Bluejay IPO Presentation Deck

Offering Overview

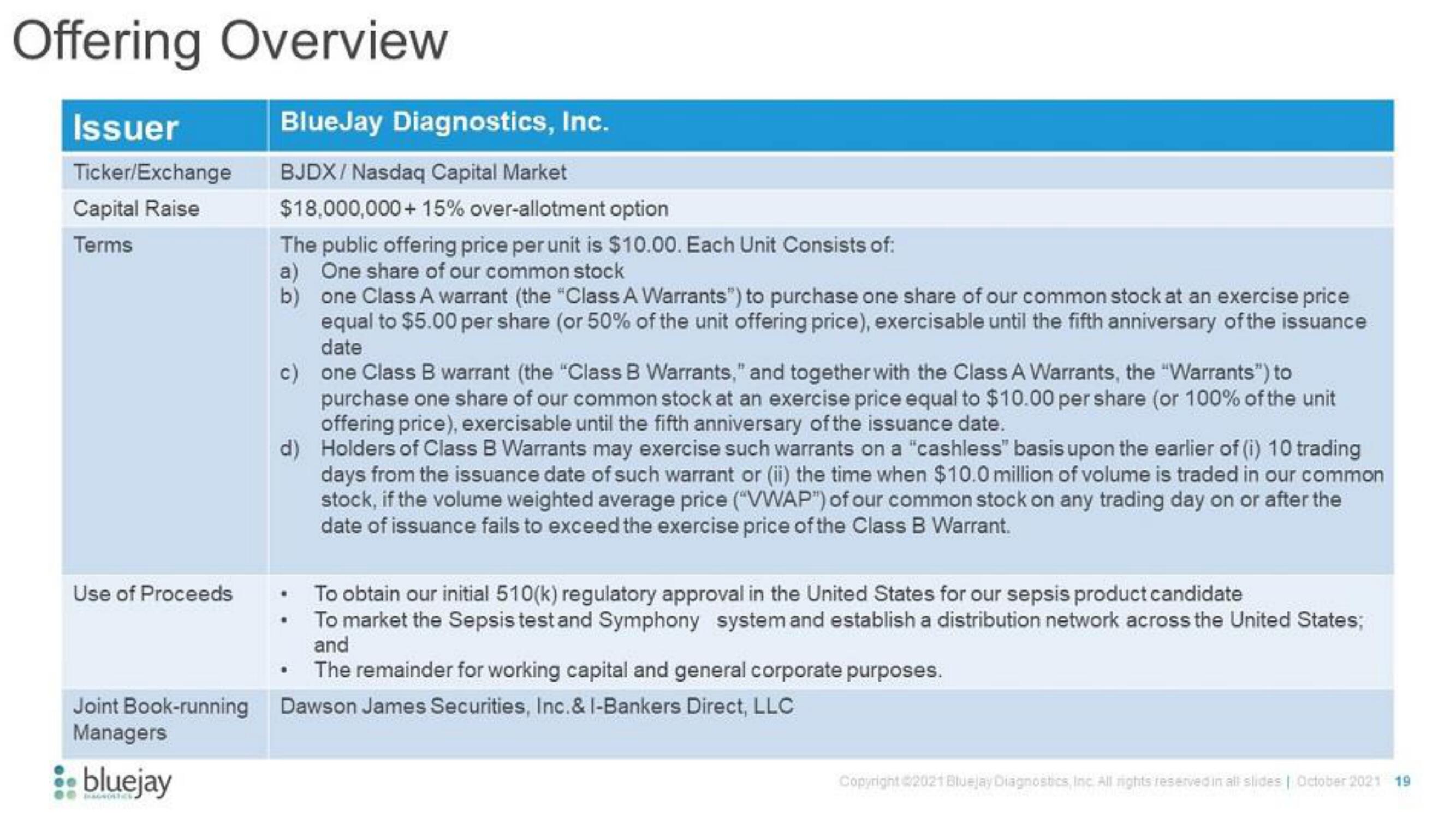

Issuer

Ticker/Exchange

Capital Raise

Terms

Use of Proceeds

Joint Book-running

Managers

bluejay

BlueJay Diagnostics, Inc.

BJDX/Nasdaq Capital Market

$18,000,000+ 15% over-allotment option

The public offering price per unit is $10.00. Each Unit Consists of:

a) One share of our common stock

b)

one Class A warrant (the "Class A Warrants") to purchase one share of our common stock at an exercise price

equal to $5.00 per share (or 50% of the unit offering price), exercisable until the fifth anniversary of the issuance

date

c) one Class B warrant (the "Class B Warrants," and together with the Class A Warrants, the "Warrants") to

purchase one share of our common stock at an exercise price equal to $10.00 per share (or 100% of the unit

offering price), exercisable until the fifth anniversary of the issuance date.

d) Holders of Class B Warrants may exercise such warrants on a "cashless" basis upon the earlier of (i) 10 trading

days from the issuance date of such warrant or (ii) the time when $10.0 million of volume is traded in our common

stock, if the volume weighted average price ("VWAP") of our common stock on any trading day on or after the

date of issuance fails to exceed the exercise price of the Class B Warrant.

To obtain our initial 510(k) regulatory approval in the United States for our sepsis product candidate

To market the Sepsis test and Symphony system and establish a distribution network across the United States;

and

The remainder for working capital and general corporate purposes.

Dawson James Securities, Inc.& l-Bankers Direct, LLC

Copyright 2021 Bluejay Diagnostics, Inc. All rights reserved in all slides | October 2021 19View entire presentation