Liberty Global Results Presentation Deck

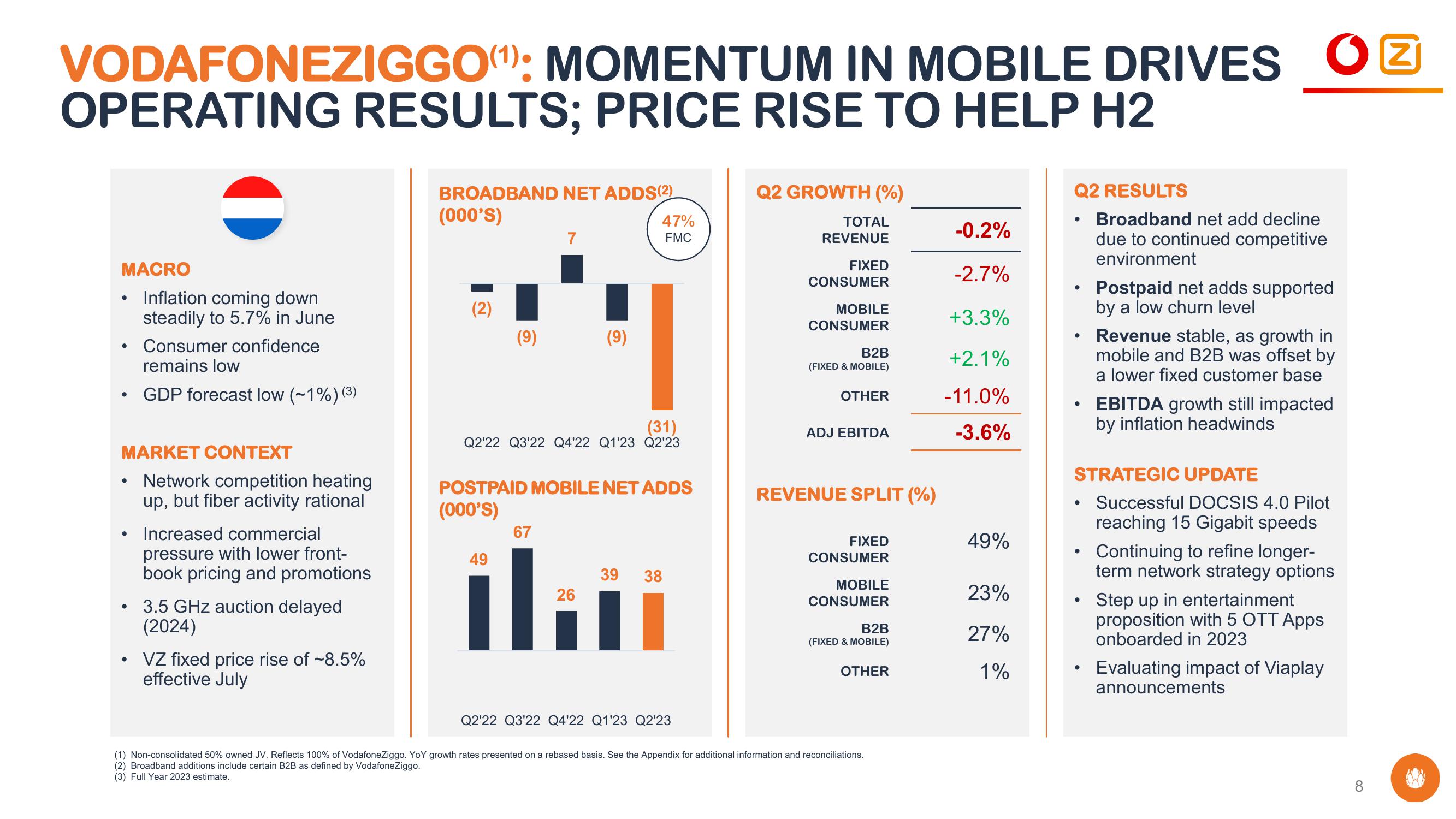

VODAFONEZIGGO(¹): MOMENTUM IN MOBILE DRIVES OZ

OPERATING RESULTS; PRICE RISE TO HELP H2

MACRO

●

●

●

●

Inflation coming down

steadily to 5.7% in June

MARKET CONTEXT

Network competition heating

up, but fiber activity rational

●

Consumer confidence

remains low

GDP forecast low (~1%) (³)

Increased commercial

pressure with lower front-

book pricing and promotions

3.5 GHz auction delayed

(2024)

VZ fixed price rise of ~8.5%

effective July

BROADBAND NET ADDS(2)

(000'S)

(2)

(9)

49

7

(31)

Q2'22 Q3'22 Q4'22 Q1'23 Q2'23

67

(9)

POSTPAID MOBILE NET ADDS

(000'S)

47%

FMC

26

39 38

Q2'22 Q3'22 Q4'22 Q1'23 Q2'23

Q2 GROWTH (%)

TOTAL

REVENUE

FIXED

CONSUMER

MOBILE

CONSUMER

B2B

(FIXED & MOBILE)

OTHER

ADJ EBITDA

REVENUE SPLIT (%)

FIXED

CONSUMER

MOBILE

CONSUMER

B2B

(FIXED & MOBILE)

OTHER

(1) Non-consolidated 50% owned JV. Reflects 100% of VodafoneZiggo. YoY growth rates presented on a rebased basis. See the Appendix for additional information and reconciliations.

(2) Broadband additions include certain B2B as defined by VodafoneZiggo.

(3) Full Year 2023 estimate.

-0.2%

-2.7%

+3.3%

+2.1%

-11.0%

-3.6%

49%

23%

27%

1%

Q2 RESULTS

Broadband net add decline

due to continued competitive

environment

●

●

●

●

Postpaid net adds supported

by a low churn level

STRATEGIC UPDATE

Successful DOCSIS 4.0 Pilot

reaching 15 Gigabit speeds

Continuing to refine longer-

term network strategy options

●

Revenue stable, as growth in

mobile and B2B was offset by

a lower fixed customer base

EBITDA growth still impacted

by inflation headwinds

Step up in entertainment

proposition with 5 OTT Apps

onboarded in 2023

Evaluating impact of Viaplay

announcements

8View entire presentation