J.P.Morgan Results Presentation Deck

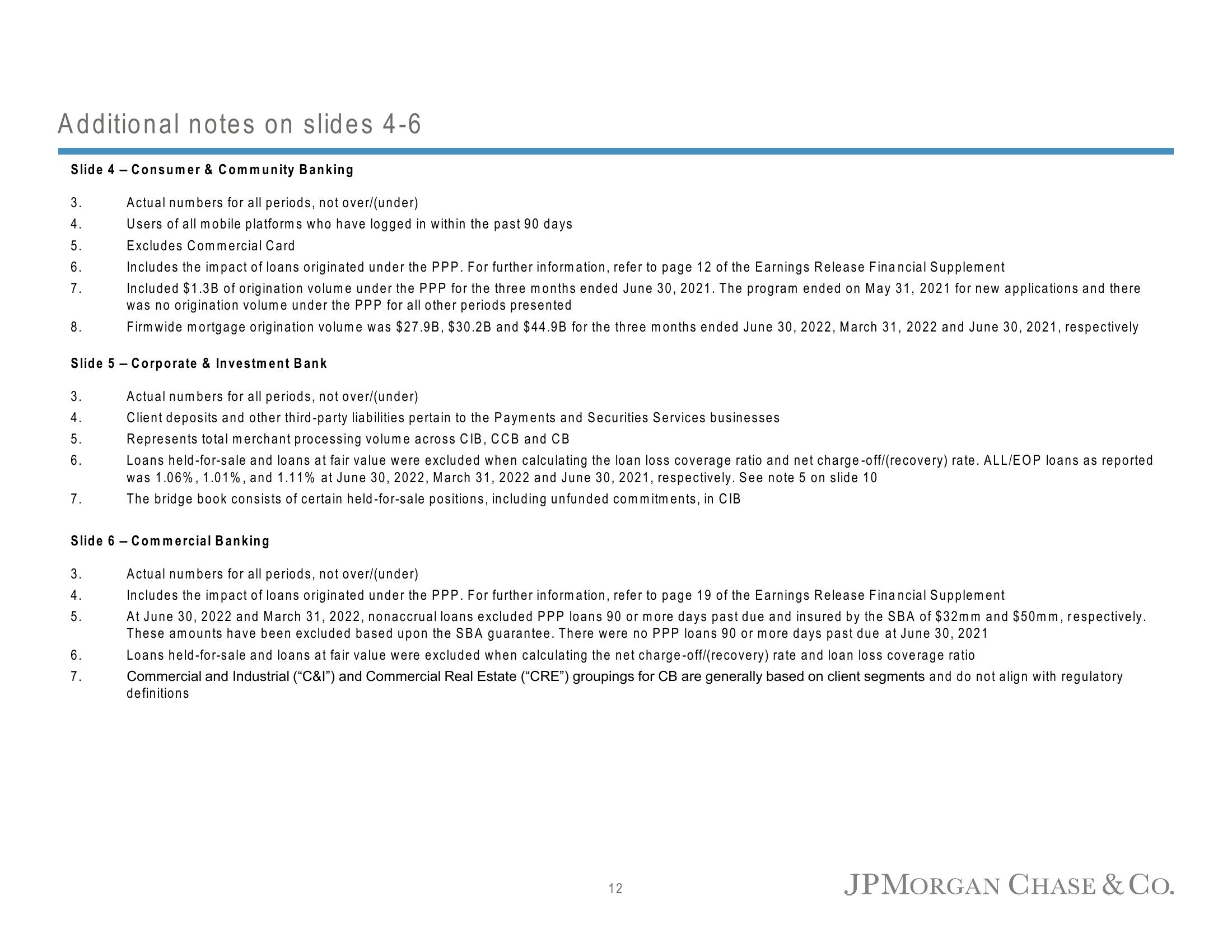

Additional notes on slides 4-6

Slide 4 Consumer & Community Banking

3.

4.

5.

6.

7.

Includes the impact of loans originated under the PPP. For further information, refer to page 12 of the Earnings Release Financial Supplement

Included $1.3B of origination volume under the PPP for the three months ended June 30, 2021. The program ended on May 31, 2021 for new applications and there

was no origination volume under the PPP for all other periods presented

Firmwide mortgage origination volume was $27.9B, $30.2B and $44.9B for the three months ended June 30, 2022, March 31, 2022 and June 30, 2021, respectively

Slide 5 Corporate & Investment Bank

Actual numbers for all periods, not over/(under)

Client deposits and other third-party liabilities pertain to the Payments and Securities Services businesses

Represents total merchant processing volume across CIB, CCB and CB

Loans held-for-sale and loans at fair value were excluded when calculating the loan loss coverage ratio and net charge-off/(recovery) rate. ALL/EOP loans as reported

was 1.06%, 1.01%, and 1.11% at June 30, 2022, March 31, 2022 and June 30, 2021, respectively. See note 5 on slide 10

The bridge book consists of certain held-for-sale positions, including unfunded commitments, in CIB

8.

3.

4.

5.

6.

7.

Actual numbers for all periods, not over/(under)

Users of all mobile platforms who have logged in within the past 90 days

Excludes Commercial Card

Slide 6 Commercial Banking

3.

4.

5.

6.

7.

Actual numbers for all periods, not over/(under)

Includes the impact of loans originated under the PPP. For further information, refer to page 19 of the Earnings Release Financial Supplement

At June 30, 2022 and March 31, 2022, nonaccrual loans excluded PPP loans 90 or more days past due and insured by the SBA of $32mm and $50mm, respectively.

These amounts have been excluded based upon the SBA guarantee. There were no PPP loans 90 or more days past due at June 30, 2021

Loans held-for-sale and loans at fair value were excluded when calculating the net charge-off/(recovery) rate and loan loss coverage ratio

Commercial and Industrial ("C&I") and Commercial Real Estate ("CRE") groupings for CB are generally based on client segments and do not align with regulatory

definitions

12

JPMORGAN CHASE & Co.View entire presentation