Fiverr Investor Presentation Deck

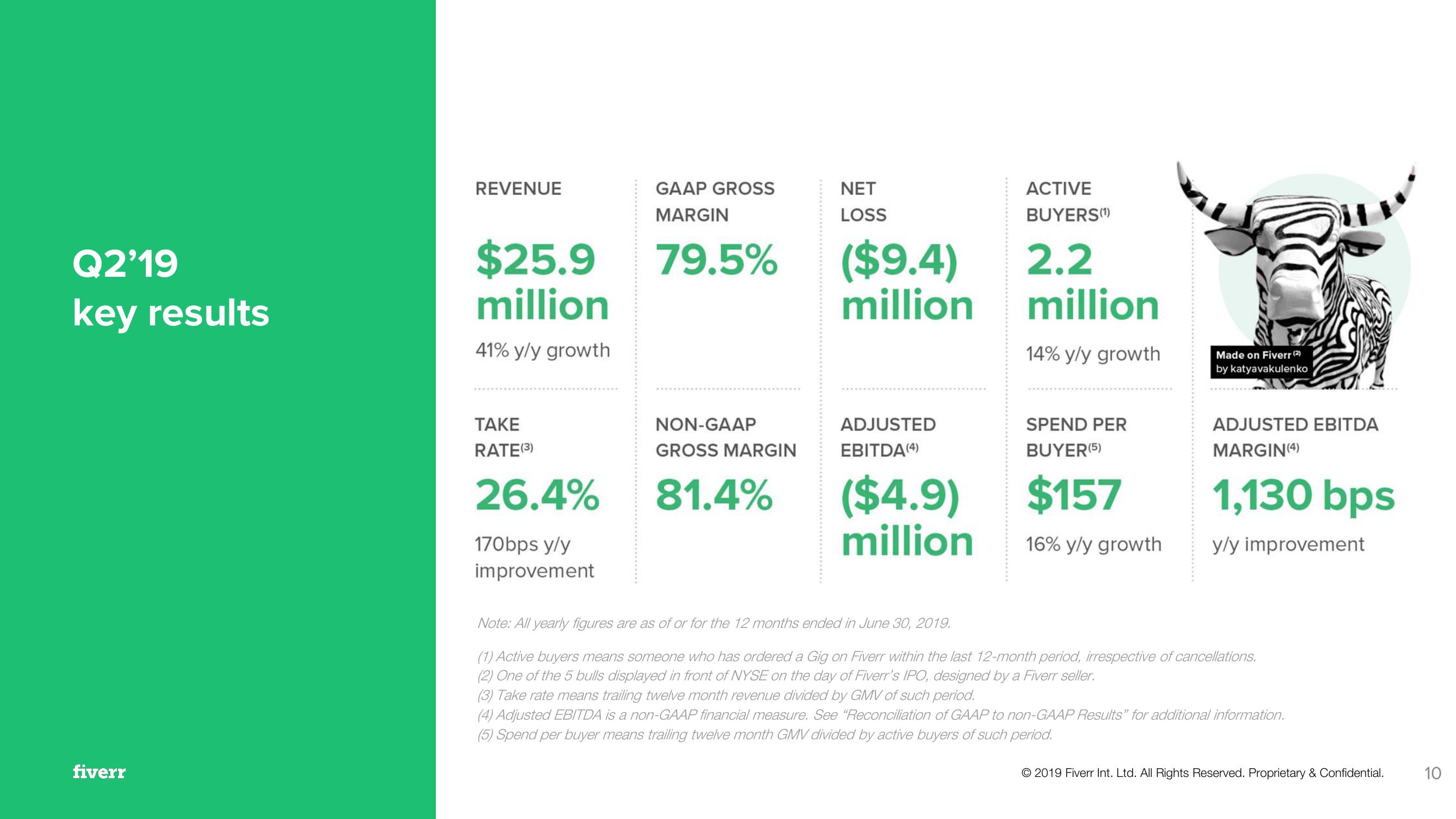

Q2'19

key results

fiverr

REVENUE

$25.9

million

41% y/y growth

TAKE

RATE (3)

26.4%

170bps y/y

improvement

GAAP GROSS

MARGIN

79.5%

NON-GAAP

GROSS MARGIN

81.4%

NET

LOSS

($9.4)

million

ADJUSTED

EBITDA (4)

($4.9)

million

ACTIVE

BUYERS(¹)

2.2

million

14% y/y growth

SPEND PER

BUYER (5)

$157

16% y/y growth

Made on Fiverr (2)

by katyavakulenko

ADJUSTED EBITDA

MARGIN (4)

1,130 bps

y/y improvement

Note: All yearly figures are as of or for the 12 months ended in June 30, 2019.

(1) Active buyers means someone who has ordered a Gig on Fiverr within the last 12-month period, irrespective of cancellations.

(2) One of the 5 bulls displayed in front of NYSE on the day of Fiverr's IPO, designed by a Fiverr seller.

(3) Take rate means trailing twelve month revenue divided by GMV of such period.

(4) Adjusted EBITDA is a non-GAAP financial measure. See "Reconciliation of GAAP to non-GAAP Results" for additional information.

(5) Spend per buyer means trailing twelve month GMV divided by active buyers of such period.

© 2019 Fiverr Int. Ltd. All Rights Reserved. Proprietary & Confidential.

10View entire presentation