Engine No. 1 Activist Presentation Deck

This strategy has contributed to a decade of value

destruction

...

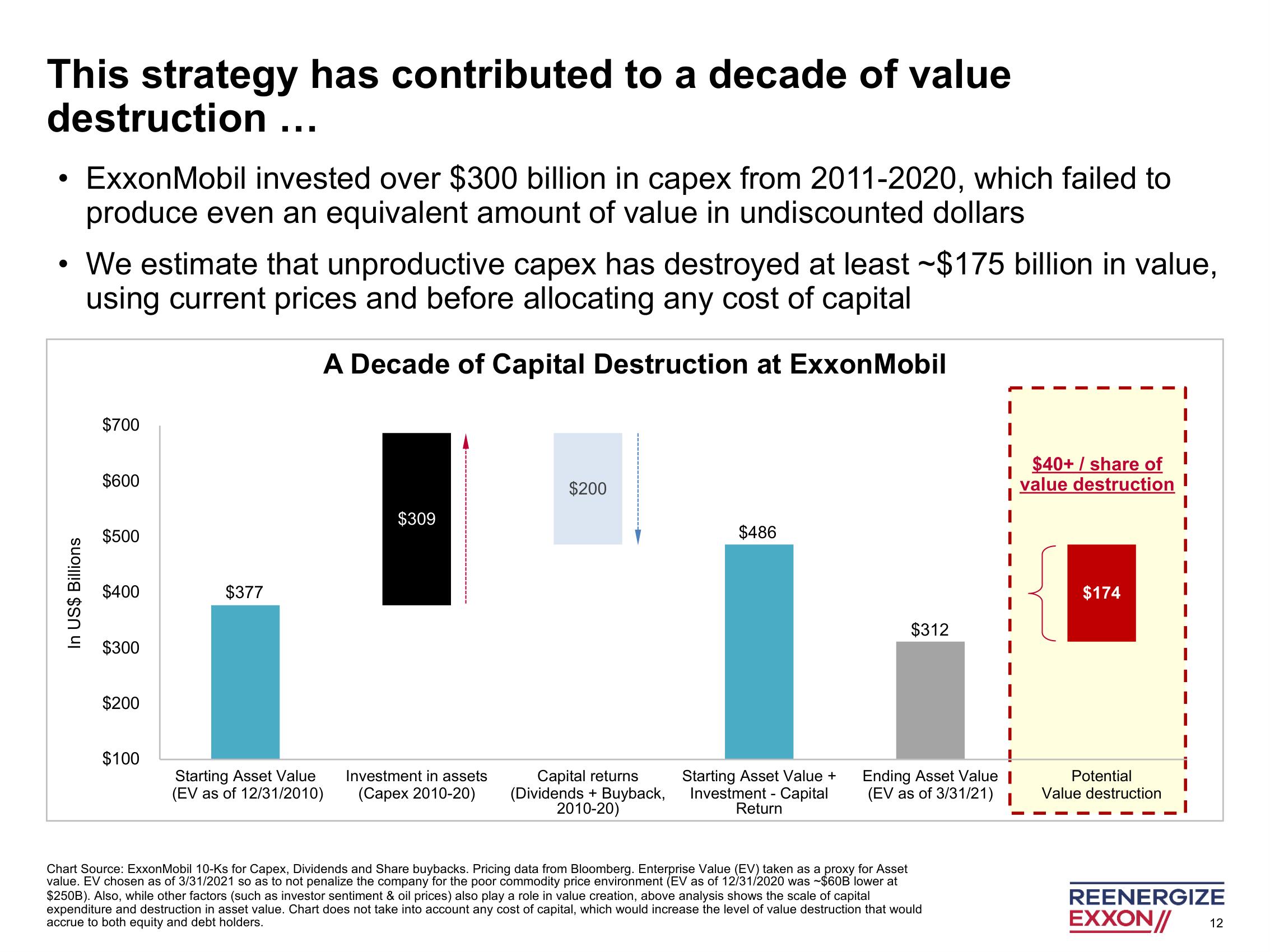

ExxonMobil invested over $300 billion in capex from 2011-2020, which failed to

produce even an equivalent amount of value in undiscounted dollars

●

●

In US$ Billions

We estimate that unproductive capex has destroyed at least ~$175 billion in value,

using current prices and before allocating any cost of capital

A Decade of Capital Destruction at ExxonMobil

$700

$600

$500

$400

$300

$200

$100

$377

Starting Asset Value

(EV as of 12/31/2010)

$309

Investment in assets

(Capex 2010-20)

$200

Capital returns

(Dividends + Buyback,

2010-20)

$486

Starting Asset Value +

Investment - Capital

Return

$312

Ending Asset Value I

(EV as of 3/31/21)

Chart Source: ExxonMobil 10-Ks for Capex, Dividends and Share buybacks. Pricing data from Bloomberg. Enterprise Value (EV) taken as a proxy for Asset

value. EV chosen as of 3/31/2021 so as to not penalize the company for the poor commodity price environment (EV as of 12/31/2020 was ~$60B lower at

$250B). Also, while other factors (such as investor sentiment & oil prices) also play a role in value creation, above analysis shows the scale of capital

expenditure and destruction in asset value. Chart does not take into account any cost of capital, which would increase the level of value destruction that would

accrue to both equity and debt holders.

$40+ share of

value destruction

$174

Potential

Value destruction

REENERGIZE

EXXON//

12View entire presentation