Barclays Investment Banking Pitch Book

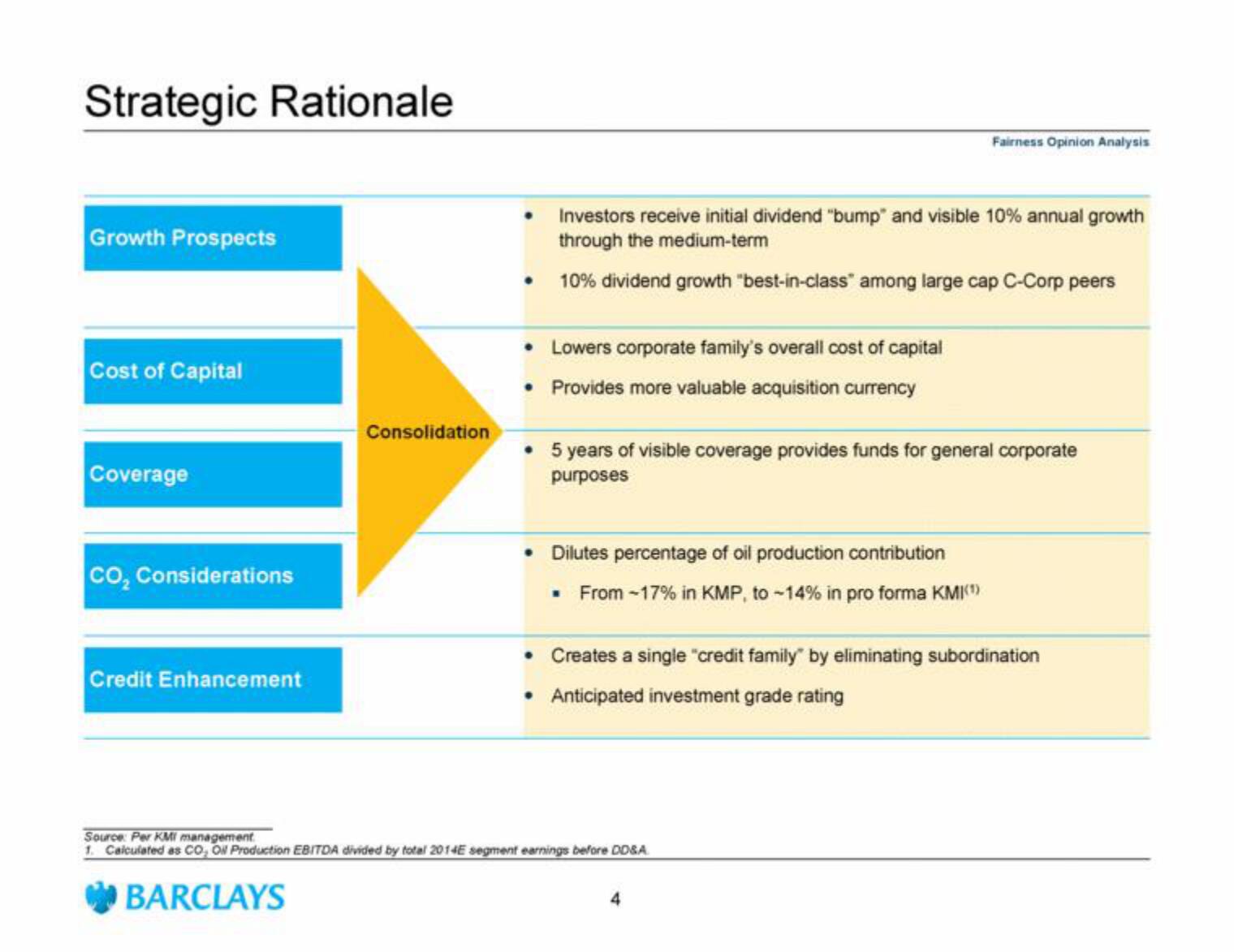

Strategic Rationale

Growth Prospects

Cost of Capital

Coverage

CO₂ Considerations

Credit Enhancement

Consolidation

BARCLAYS

Investors receive initial dividend "bump" and visible 10% annual growth

through the medium-term

• 10% dividend growth "best-in-class" among large cap C-Corp peers

• Lowers corporate family's overall cost of capital

Provides more valuable acquisition currency

Fairness Opinion Analysis

5 years of visible coverage provides funds for general corporate

purposes

• Dilutes percentage of oil production contribution

From -17% in KMP, to -14% in pro forma KMI(¹)

Source: Per KMI management

1. Calculated as CO₂ Oil Production EBITDA divided by total 2014E segment earnings before DD&A.

• Creates a single "credit family" by eliminating subordination

• Anticipated investment grade ratingView entire presentation