KKR Real Estate Finance Trust Results Presentation Deck

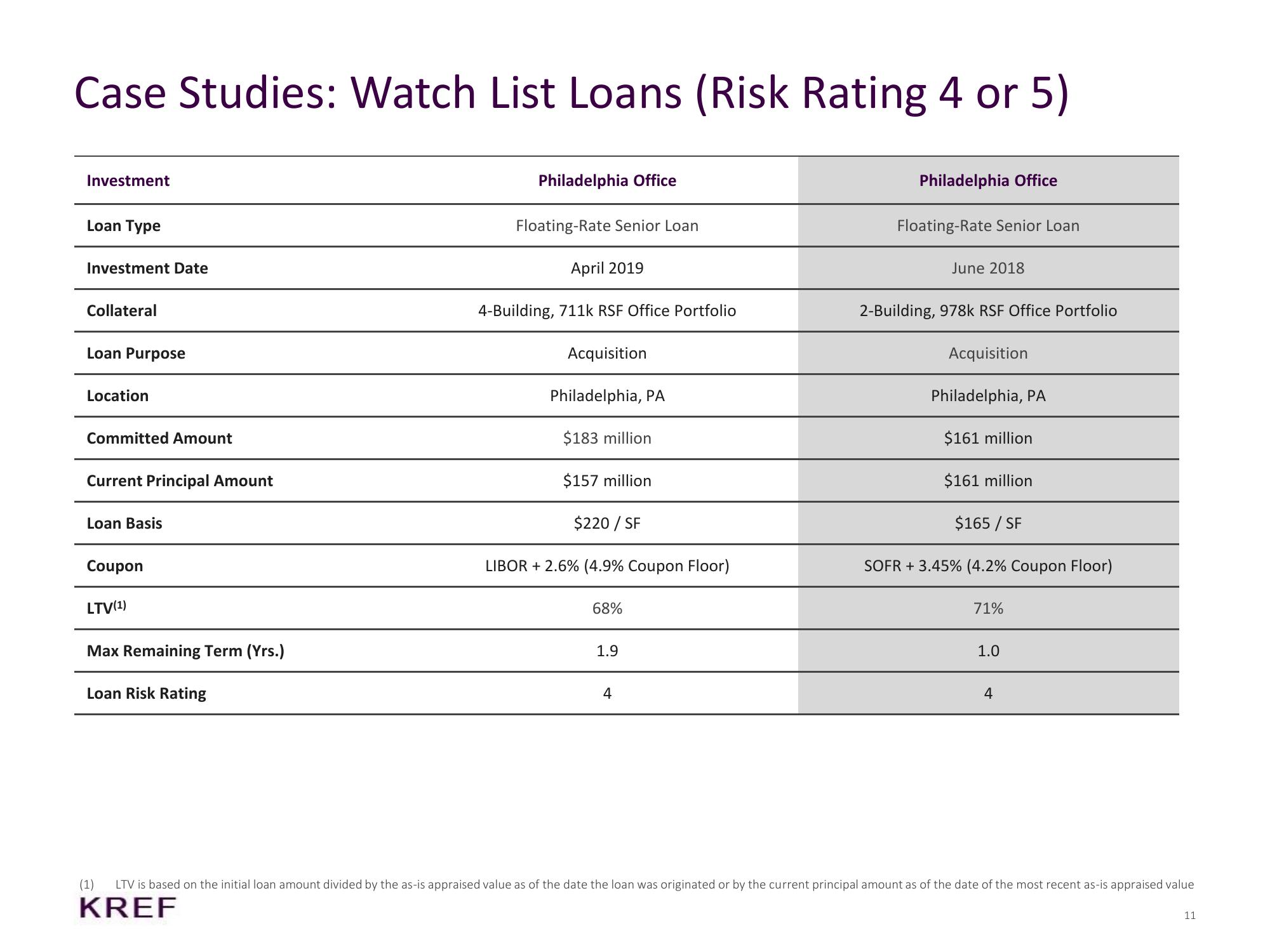

Case Studies: Watch List Loans (Risk Rating 4 or 5)

Investment

Loan Type

Investment Date

Collateral

Loan Purpose

Location

Committed Amount

Current Principal Amount

Loan Basis

Coupon

LTV(¹)

Max Remaining Term (Yrs.)

Loan Risk Rating

Philadelphia Office

Floating-Rate Senior Loan

April 2019

4-Building, 711k RSF Office Portfolio

Acquisition

Philadelphia, PA

$183 million

$157 million

$220 / SF

LIBOR + 2.6% (4.9% Coupon Floor)

68%

1.9

4

Philadelphia Office

Floating-Rate Senior Loan

June 2018

2-Building, 978k RSF Office Portfolio

Acquisition

Philadelphia, PA

$161 million

$161 million

$165 / SF

SOFR + 3.45% (4.2% Coupon Floor)

71%

1.0

4

(1) LTV is based on the initial loan amount divided by the as-is appraised value as of the date the loan was originated or by the current principal amount as of the date of the most recent as-is appraised value

KREF

11View entire presentation