LionTree Investment Banking Pitch Book

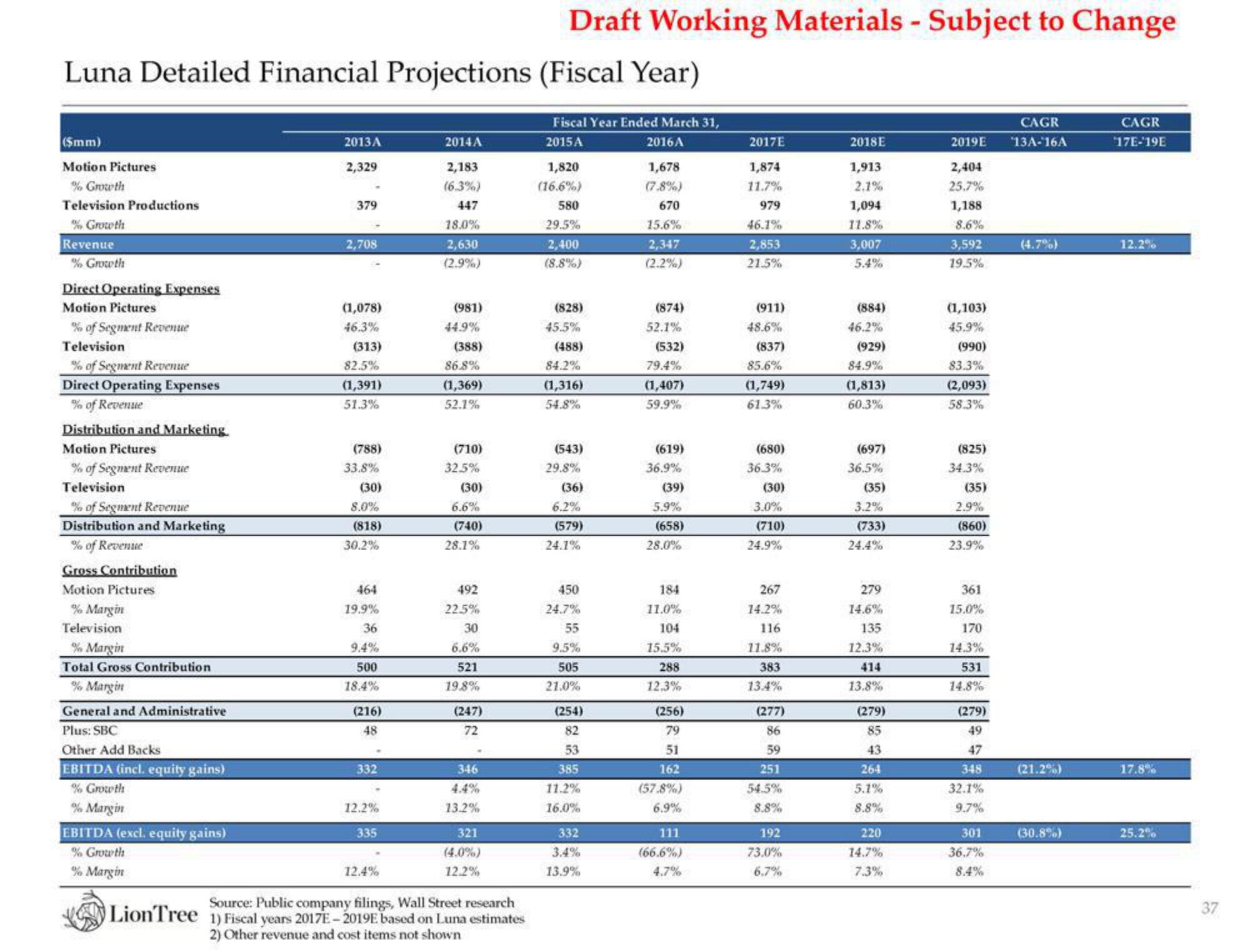

Luna Detailed Financial Projections (Fiscal Year)

Fiscal Year Ended March 31,

2016A

2015A

($mm)

Motion Pictures

% Growth

Television Productions

% Growth

Revenue

% Growth

Direct Operating Expenses

Motion Pictures

% of Segment Revenue

Television

% of Segment Revenue

Direct Operating Expenses

% of Revenue

Distribution and Marketing.

Motion Pictures

% of Segment Revenue

Television

% of Segment Revenue

Distribution and Marketing

% of Revenue

Gross Contribution

Motion Pictures

% Margin

Television

% Margin

Total Gross Contribution

% Margin

General and Administrative

Plus: SBC

Other Add Backs

EBITDA (incl. equity gains)

% Growth

% Margin

EBITDA (excl. equity gains)

% Growth

% Margin

2013A

2,329

379

2,708

(1,078)

46.3%

(313)

82.5%

(1,391)

51.3%

(788)

33.8%

(30)

8.0%

(818)

30.2%

464

19.9%

36

9.4%

500

18.4%

(216)

48

332

12.2%

335

12.4%

2014A

2,183

(6.3%)

447

18.0%

2,630

(2.9%)

(981)

44.9%

(388)

86.8%

(1,369)

52.1%

(710)

32.5%

(30)

6.6%

(740)

28.1%

492

22.5%

30

6.6%

521

19.8%

(247)

72

346

13.2%

321

(4.0%)

12.2%

Draft Working Materials - Subject to Change

Source: Public company filings, Wall Street research

LionTree 1) Fiscal years 2017E-2019E based on Luna estimates

2) Other revenue and cost items not shown

1,820

(16.6%)

580

29.5%

2,400

(8.8%)

(828)

45.5%

(488)

84.2%

(1,316)

54.8%

(543)

29.8%

(36)

6.2%

(579)

24.1%

450

24.7%

55

9.5%

505

21.0%

(254)

82

53

385

11.2%

16.0%

332

3.4%

13.9%

1,678

(7.8%)

670

15.6%

2,347

(2.2%)

(874)

52.1%

(532)

79.4%

(1,407)

59.9%

(619)

36.9%

(39)

5.9%

(658)

28.0%

184

11.0%

104

15.5%

288

12.3%

(256)

79

51

162

(57.8%)

6.9%

111

(66.6%)

4.7%

2017E

1,874

11.7%

979

46.1%

2,853

21.5%

(911)

48.6%

(837)

85.6%

(1,749)

61.3%

(680)

36.3%

(30)

3.0%

(710)

24.9%

267

14.2%

116

11.8%

383

13.4%

(277)

86

59

251

54.5%

8.8%

192

73.0%

6.7%

2018E

1,913

2.1%

1,094

11.8%

3,007

5.4%

(884)

46.2%

(929)

84.9%

(1,813)

60.3%

(697)

36.5%

(35)

3.2%

(733)

24.4%

279

14.6%

135

12.3%

13.8%

(279)

85

43

264

5.1%

8.8%

220

14.7%

7.3%

CAGR

2019E $13A-16A

2,404

25.7%

1,188

8.6%

3,592

19.5%

(1,103)

45.9%

(990)

83.3%

(2,093)

58.3%

(825)

34.3%

(35)

2.9%

(860)

23.9%

361

15.0%

170

14.3%

531

14.8%

(279)

49

47

348

32.1%

9.7%

301

36.7%

8.4%

(4.7%)

(21.2%)

(30.8%)

CAGR

17E-19E

12.2%

17.8%

25.2%

37View entire presentation