HSBC Investor Day Presentation Deck

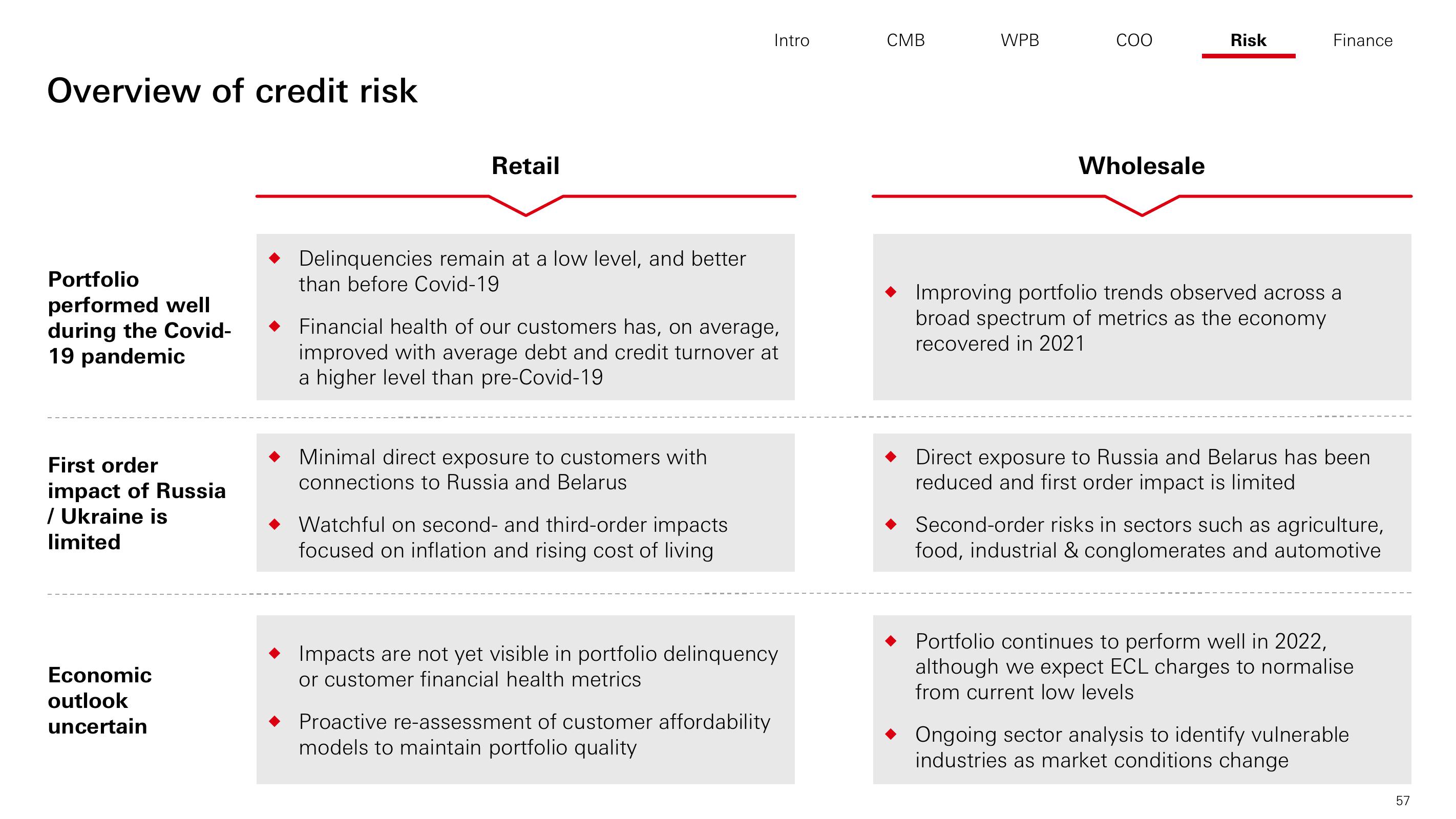

Overview of credit risk

Portfolio

performed well

during the Covid-

19 pandemic

First order

impact of Russia

/ Ukraine is

limited

Economic

outlook

uncertain

Retail

Delinquencies remain at a low level, and better

than before Covid-19

Financial health of our customers has, on average,

improved with average debt and credit turnover at

a higher level than pre-Covid-19

Minimal direct exposure to customers with

connections to Russia and Belarus

Watchful on second- and third-order impacts

focused on inflation and rising cost of living

Intro

◆ Impacts are not yet visible in portfolio delinquency

or customer financial health metrics

Proactive re-assessment of customer affordability

models to maintain portfolio quality

CMB

WPB

COO

Wholesale

Risk

Finance

Improving portfolio trends observed across a

broad spectrum of metrics as the economy

recovered in 2021

Direct exposure to Russia and Belarus has been

reduced and first order impact is limited

Second-order risks in sectors such as agriculture,

food, industrial & conglomerates and automotive

Portfolio continues to perform well in 2022,

although we expect ECL charges to normalise

from current low levels

◆ Ongoing sector analysis to identify vulnerable.

industries as market conditions change

57View entire presentation