Credit Suisse Investor Event Presentation Deck

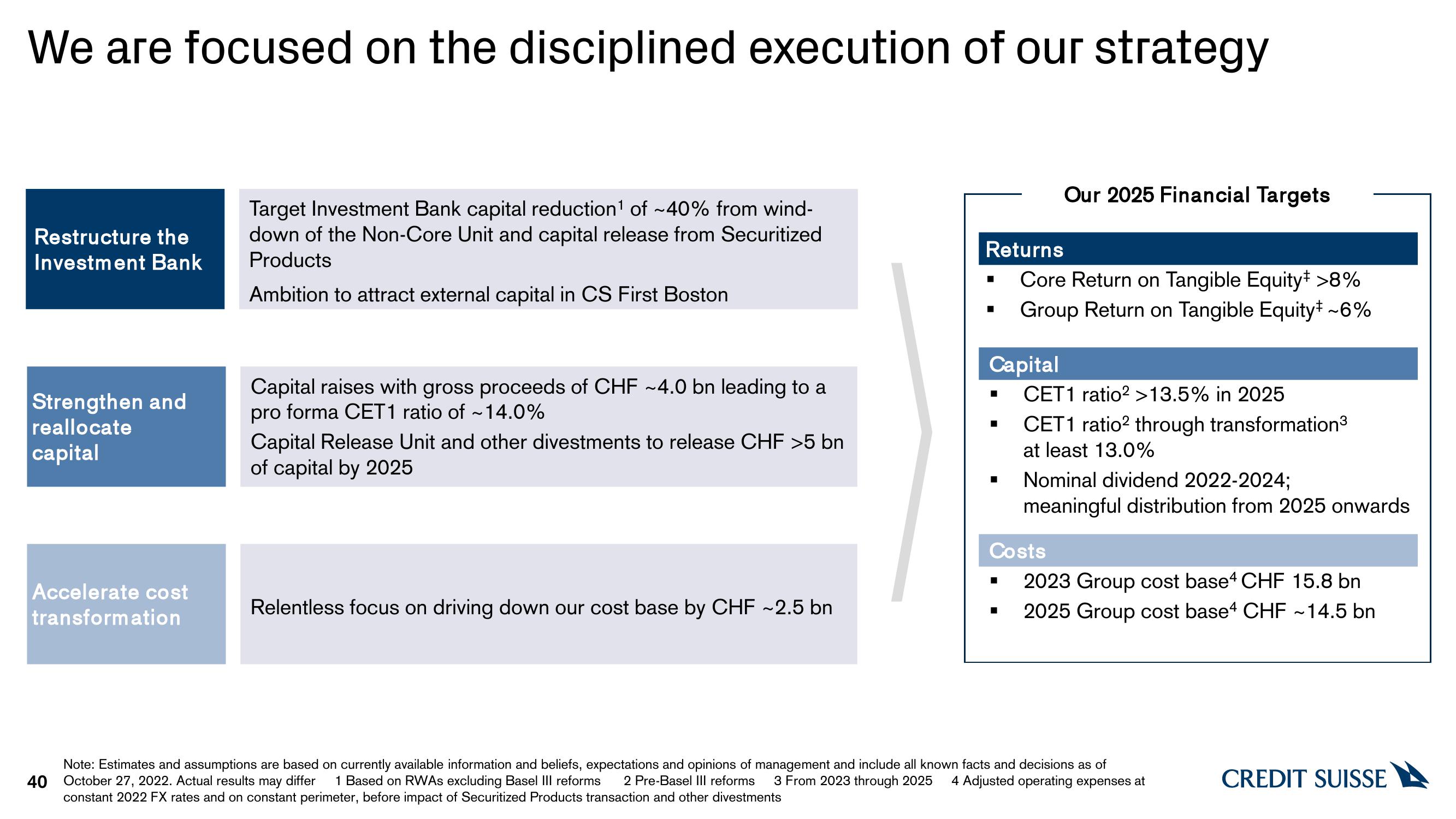

We are focused on the disciplined execution of our strategy

Restructure the

Investment Bank

Strengthen and

reallocate

capital

Accelerate cost

transformation

Target Investment Bank capital reduction¹ of ~40% from wind-

down of the Non-Core Unit and capital release from Securitized

Products

Ambition to attract external capital in CS First Boston

Capital raises with gross proceeds of CHF ~4.0 bn leading to a

pro forma CET1 ratio of ~14.0%

Capital Release Unit and other divestments to release CHF >5 bn

of capital by 2025

Relentless focus on driving down our cost base by CHF ~2.5 bn

Returns

■

■

Our 2025 Financial Targets

Capital

■

Core Return on Tangible Equity >8%

Group Return on Tangible Equity* ~6%

CET1 ratio² >13.5% in 2025

CET1 ratio² through transformation³

at least 13.0%

Nominal dividend 2022-2024;

meaningful distribution from 2025 onwards

Costs

2023 Group cost base4 CHF 15.8 bn

2025 Group cost base4 CHF ~14.5 bn

Note: Estimates and assumptions are based on currently available information and beliefs, expectations and opinions of management and include all known facts and decisions as of

40 October 27, 2022. Actual results differ

may

1 Based on RWAs excluding Basel III reforms 2 Pre-Basel III reforms 3 From 2023 through 2025 4 Adjusted operating expenses at

constant 2022 FX rates and on constant perimeter, before impact of Securitized Products transaction and other divestments

CREDIT SUISSEView entire presentation