Summer 2023 Solar Industry Update

Domestic Content Bonus Guidance

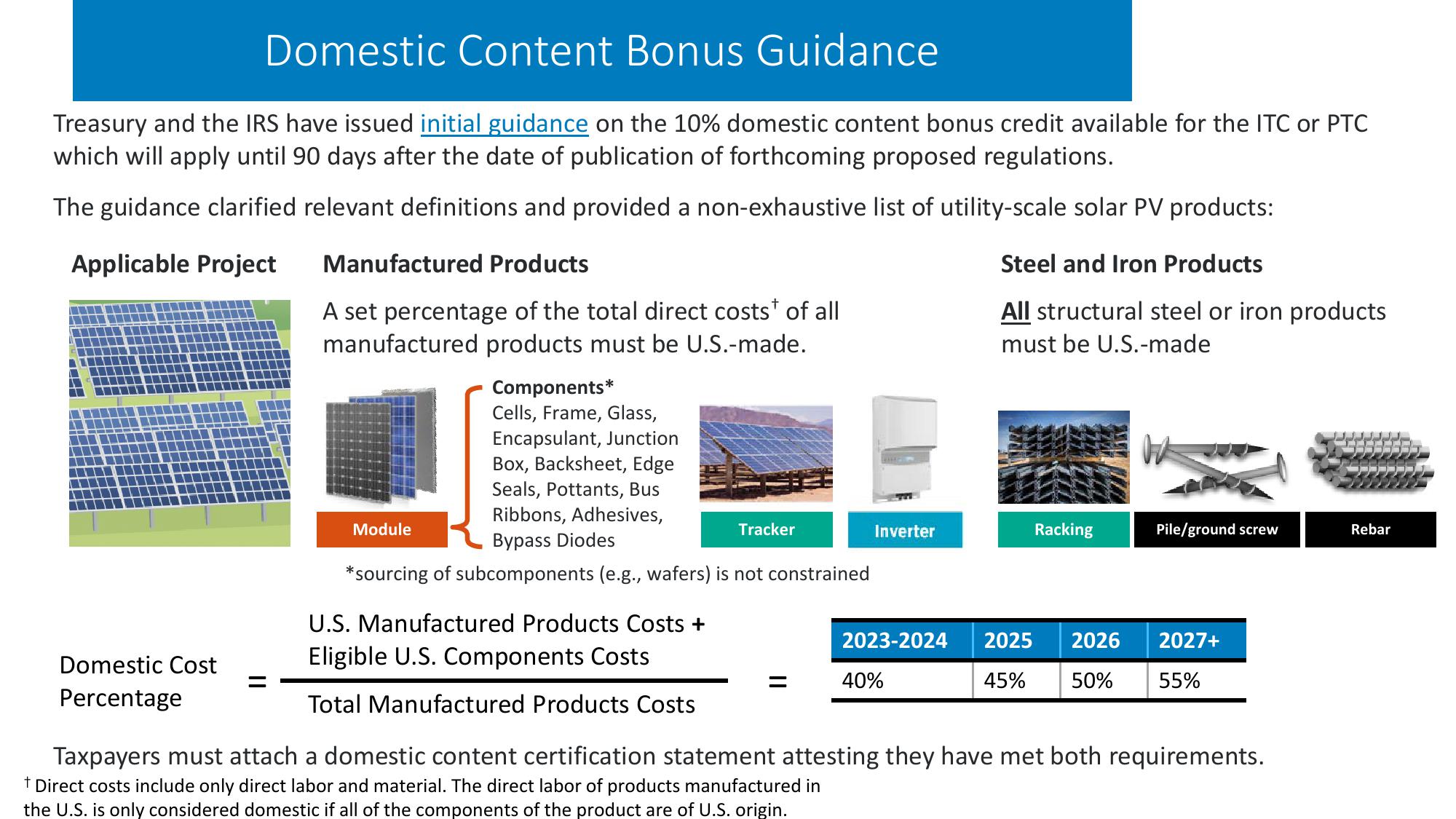

Treasury and the IRS have issued initial guidance on the 10% domestic content bonus credit available for the ITC or PTC

which will apply until 90 days after the date of publication of forthcoming proposed regulations.

The guidance clarified relevant definitions and provided a non-exhaustive list of utility-scale solar PV products:

Applicable Project

Manufactured Products

A set percentage of the total direct costs of all

manufactured products must be U.S.-made.

Steel and Iron Products

All structural steel or iron products

must be U.S.-made

Module

Components*

Cells, Frame, Glass,

Encapsulant, Junction

Box, Backsheet, Edge

Seals, Pottants, Bus

Ribbons, Adhesives,

Bypass Diodes

Tracker

*sourcing of subcomponents (e.g., wafers) is not constrained

Inverter

Racking

Pile/ground screw

Rebar

Domestic Cost

Percentage

U.S. Manufactured Products Costs +

Eligible U.S. Components Costs

=

40%

2023-2024 2025 2026

45% 50%

2027+

55%

Total Manufactured Products Costs

Taxpayers must attach a domestic content certification statement attesting they have met both requirements.

+ Direct costs include only direct labor and material. The direct labor of products manufactured in

the U.S. is only considered domestic if all of the components of the product are of U.S. origin.View entire presentation