FiscalNote SPAC Presentation Deck

5

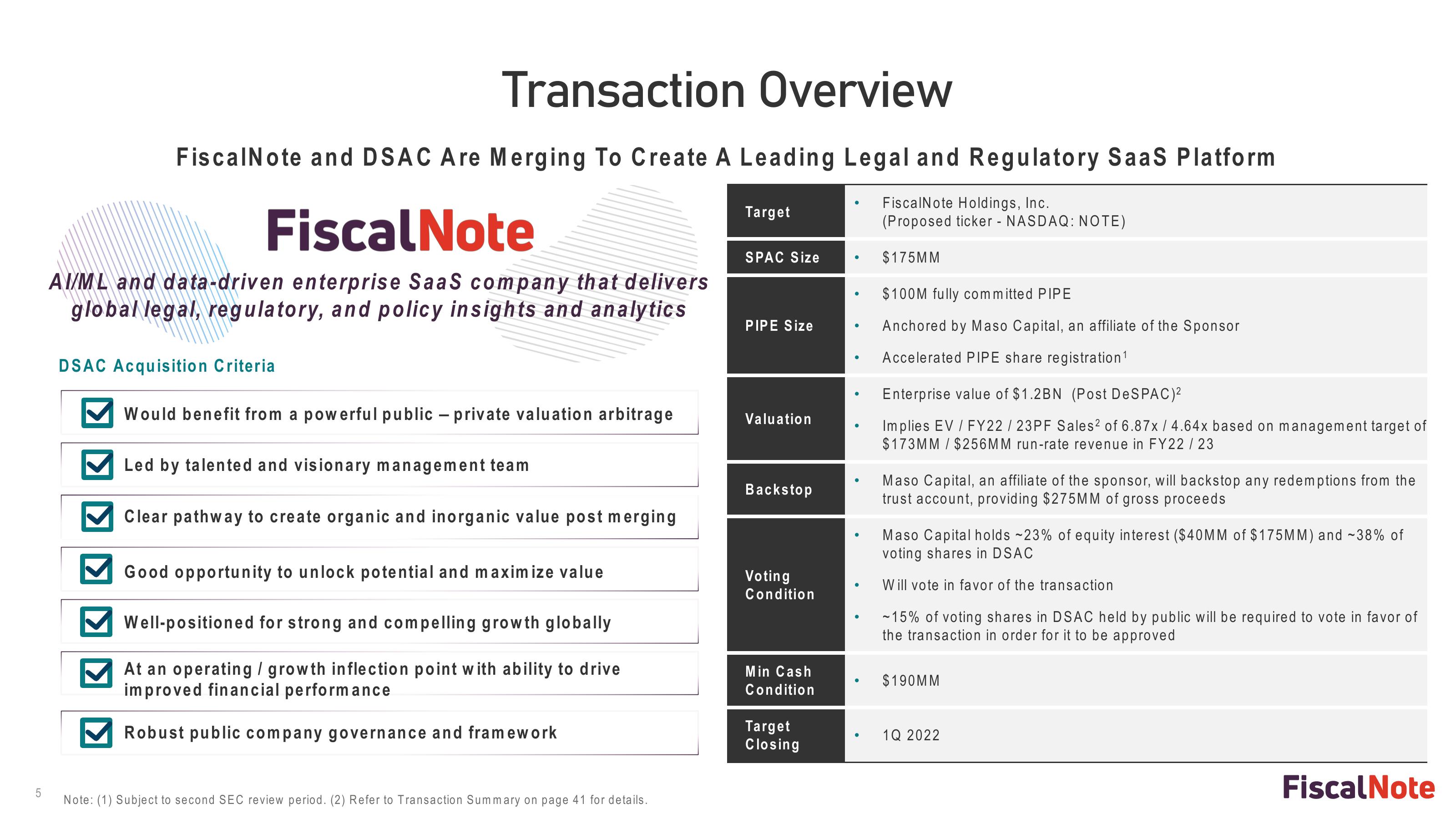

Transaction Overview

FiscalNote and DSAC Are Merging To Create A Leading Legal and Regulatory SaaS Platform

FiscalNote Holdings, Inc.

(Proposed ticker - NASDAQ: NOTE)

$175MM

Fiscal Note

AI/ML and data-driven enterprise SaaS company that delivers

global legal, regulatory, and policy insights and analytics

DSAC Acquisition Criteria

Would benefit from a powerful public - private valuation arbitrage

Led by talented and visionary management team

Clear pathway to create organic and inorganic value post merging

Good opportunity to unlock potential and maximize value

Well-positioned for strong and compelling growth globally

At an operating / growth inflection point with ability to drive

improved financial performance

Robust public company governance and framework

Note: (1) Subject to second SEC review period. (2) Refer to Transaction Summary on page 41 for details.

Target

SPAC Size

PIPE Size

Valuation

Backstop

Voting

Condition

Min Cash

Condition

Target

Closing

●

●

●

$100M fully committed PIPE

Anchored by Maso Capital, an affiliate of the Sponsor

Accelerated PIPE share registration ¹

Enterprise value of $1.2BN (Post DeSPAC)²

Implies EV / FY22/23PF Sales² of 6.87x / 4.64x based on management target of

$173MM / $256MM run-rate revenue in FY22 / 23

Maso Capital, an affiliate of the sponsor, will backstop any redemptions from the

trust account, providing $275MM of gross proceeds

Maso Capital holds -23% of equity interest ($40MM of $175MM) and -38% of

voting shares in DSAC

Will vote in favor of the transaction

~15% of voting shares in DSAC held by public will be required to vote in favor of

the transaction in order for it to be approved

$190MM

1Q 2022

Fiscal NoteView entire presentation