Q2 Quarter 2023

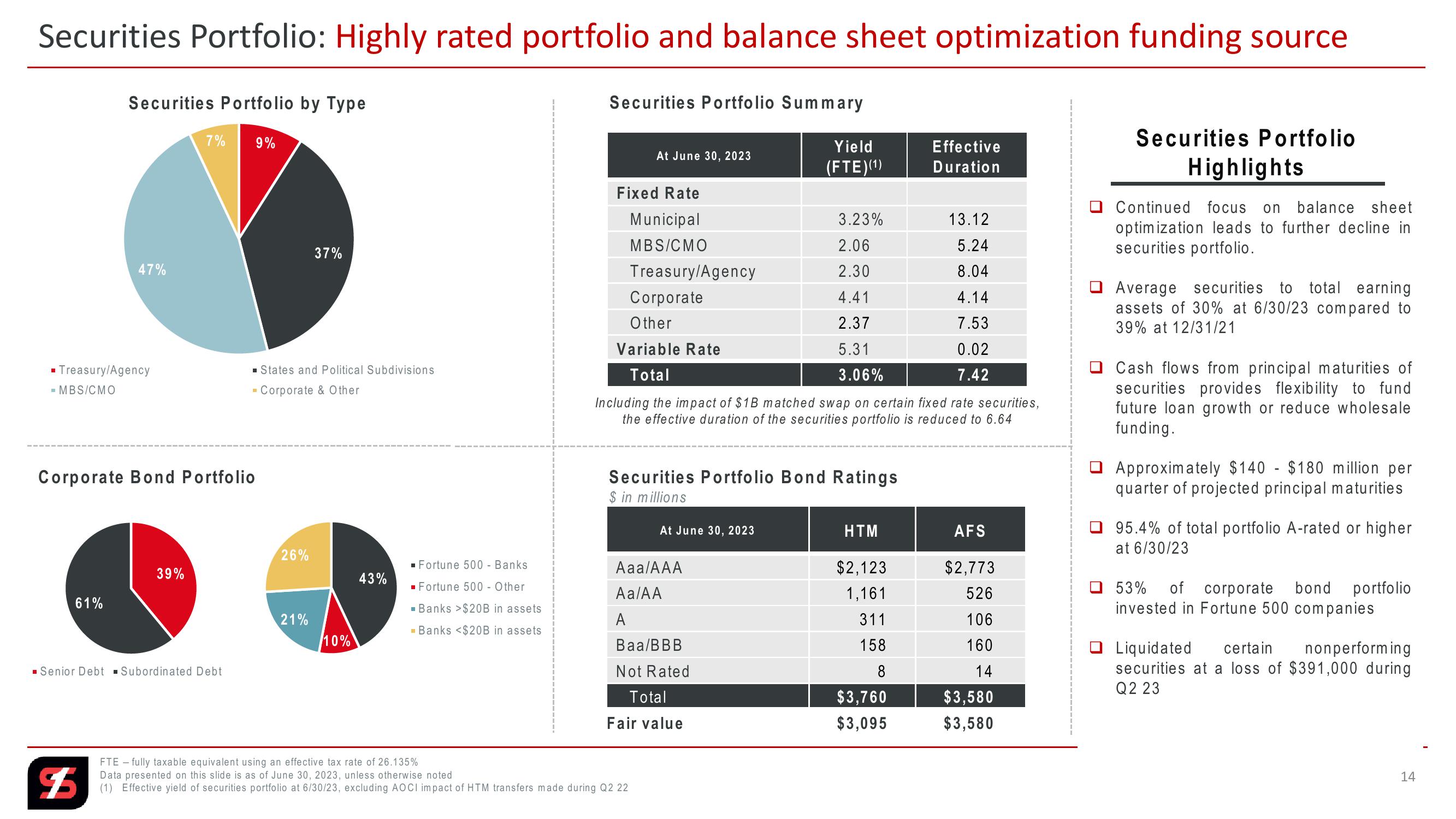

Securities Portfolio: Highly rated portfolio and balance sheet optimization funding source

Securities Portfolio by Type

Securities Portfolio Summary

47%

■Treasury/Agency

■ MBS/CMO

7%

9%

Corporate Bond Portfolio

37%

■States and Political Subdivisions

Corporate & Other

At June 30, 2023

Yield

(FTE)(1)

Effective

Duration

Fixed Rate

Municipal

3.23%

13.12

MBS/CMO

2.06

5.24

Treasury/Agency

2.30

8.04

Corporate

4.41

4.14

Other

2.37

7.53

Variable Rate

5.31

0.02

Total

3.06%

7.42

Including the impact of $1B matched swap on certain fixed rate securities,

the effective duration of the securities portfolio is reduced to 6.64

Securities Portfolio Bond Ratings

$ in millions

At June 30, 2023

HTM

AFS

26%

■ Fortune 500 - Banks

39%

Aaa/AAA

$2,123

$2,773

43%

61%

21%

Fortune 500 - Other

■Banks >$20B in assets

■Banks <$20B in assets

Aa/AA

1,161

526

A

311

106

10%

Baa/BBB

158

160

■Senior Debt Subordinated Debt

Not Rated

8

14

Total

$3,760

$3,580

Fair value

$3,095

$3,580

Securities Portfolio

Highlights

Continued focus on balance sheet

optimization leads to further decline in

securities portfolio.

Average securities to total earning

assets of 30% at 6/30/23 compared to

39% at 12/31/21

Cash flows from principal maturities of

securities provides flexibility to fund

future loan growth or reduce wholesale

funding.

Approximately $140 $180 million per

quarter of projected principal maturities

95.4% of total portfolio A-rated or higher

at 6/30/23

53% of corporate

bond portfolio

invested in Fortune 500 companies

Liquidated certain nonperforming

securities at a loss of $391,000 during

Q2 23

FTE - fully taxable equivalent using an effective tax rate of 26.135%

$

Data presented on this slide is as of June 30, 2023, unless otherwise noted

(1) Effective yield of securities portfolio at 6/30/23, excluding AOCI impact of HTM transfers made during Q2 22

14View entire presentation