Coppersmith Presentation to Alere Inc Stockholders

PAGE 40 |

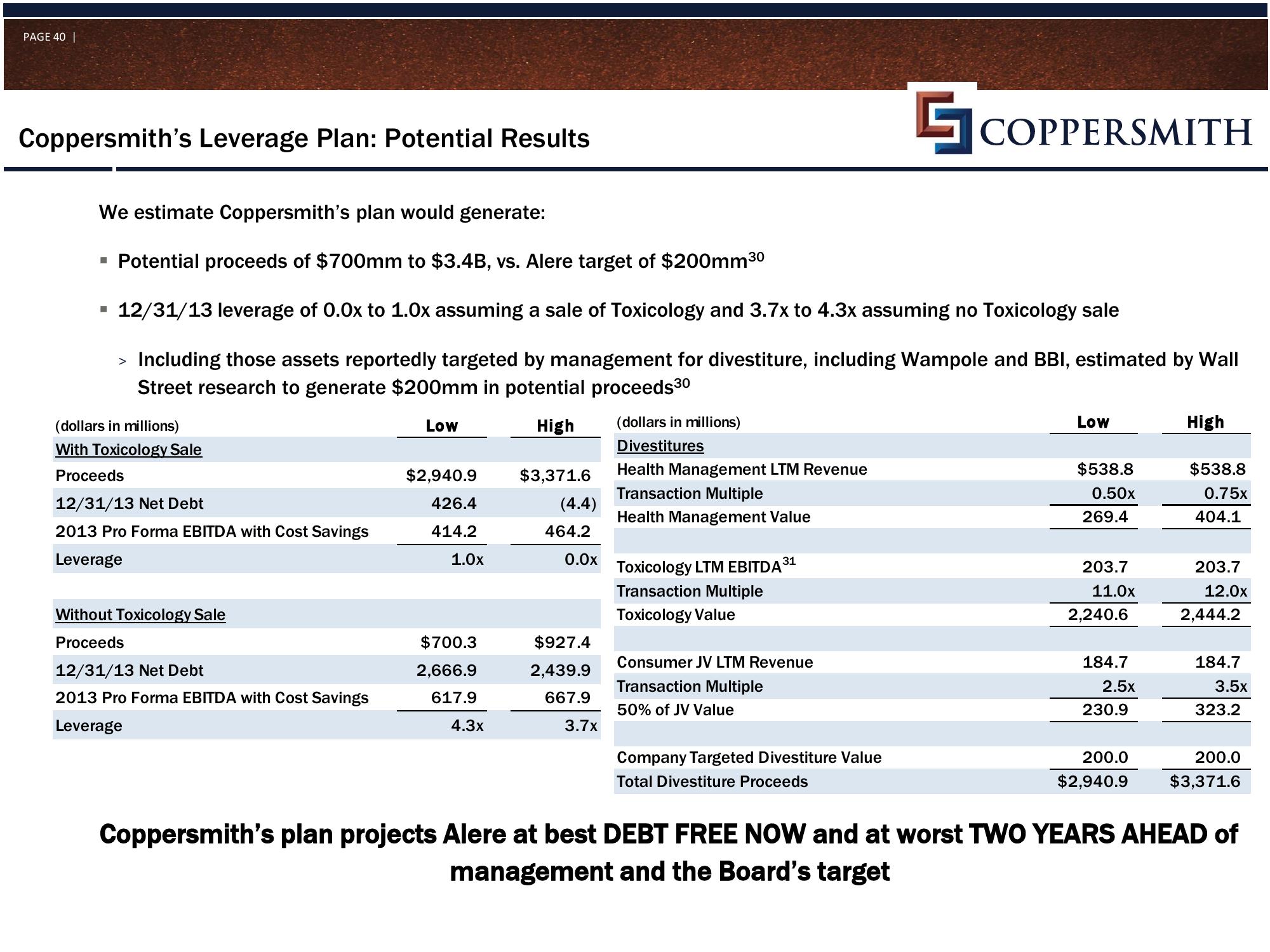

Coppersmith's Leverage Plan: Potential Results

We estimate Coppersmith's plan would generate:

▪ Potential proceeds of $700mm to $3.4B, vs. Alere target of $200mm30

12/31/13 leverage of 0.0x to 1.0x assuming a sale of Toxicology and 3.7x to 4.3x assuming no Toxicology sale

> Including those assets reportedly targeted by management for divestiture, including Wampole and BBI, estimated by Wall

Street research to generate $200mm in potential proceeds30

Low

High

■

(dollars in millions)

With Toxicology Sale

Proceeds

12/31/13 Net Debt

2013 Pro Forma EBITDA with Cost Savings

Leverage

Without Toxicology Sale

Proceeds

12/31/13 Net Debt

2013 Pro Forma EBITDA with Cost Savings

Leverage

$2,940.9

426.4

414.2

1.0x

$700.3

2,666.9

617.9

4.3x

$3,371.6

(4.4)

464.2

0.0x

$927.4

2,439.9

667.9

3.7x

(dollars in millions)

Divestitures

Health Management LTM Revenue

Transaction Multiple

Health Management Value

Toxicology LTM EBITDA

Transaction Multiple

Toxicology Value

31

Consumer JV LTM Revenue

Transaction Multiple

50% of JV Value

COPPERSMITH

Company Targeted Divestiture Value

Total Divestiture Proceeds

Low

$538.8

0.50x

269.4

203.7

11.0x

2,240.6

184.7

2.5x

230.9

200.0

$2,940.9

High

$538.8

0.75x

404.1

203.7

12.0x

2,444.2

184.7

3.5x

323.2

200.0

$3,371.6

Coppersmith's plan projects Alere at best DEBT FREE NOW and at worst TWO YEARS AHEAD of

management and the Board's targetView entire presentation