TPG Results Presentation Deck

Non-GAAP Balance Sheet

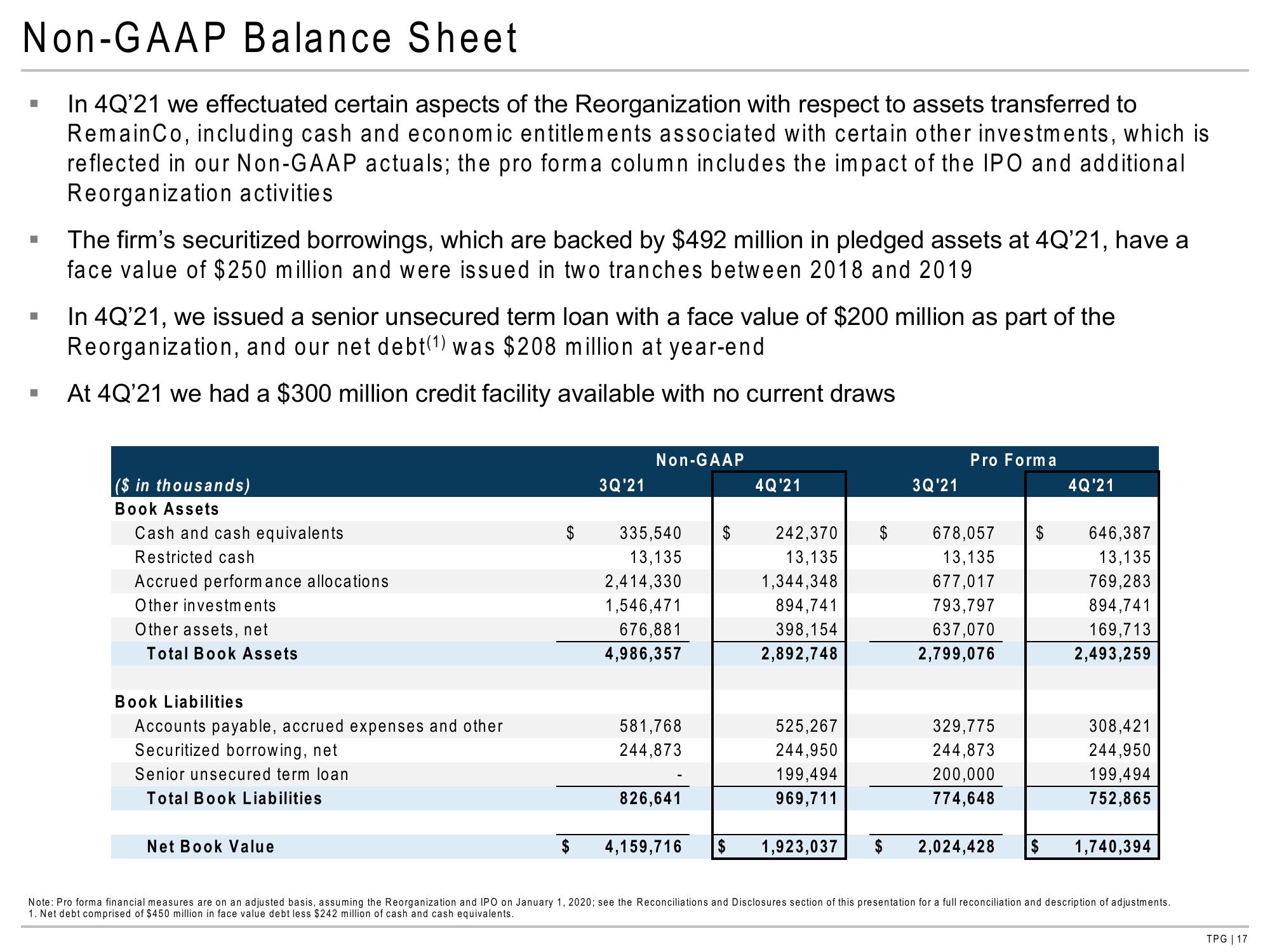

In 4Q'21 we effectuated certain aspects of the Reorganization with respect to assets transferred to

RemainCo, including cash and economic entitlements associated with certain other investments, which is

reflected in our Non-GAAP actuals; the pro forma column includes the impact of the IPO and additional

Reorganization activities

■

■

■

The firm's securitized borrowings, which are backed by $492 million in pledged assets at 4Q'21, have a

face value of $250 million and were issued in two tranches between 2018 and 2019

In 4Q'21, we issued a senior unsecured term loan with a face value of $200 million as part of the

Reorganization, and our net debt(1) was $208 million at year-end

At 4Q'21 we had a $300 million credit facility available with no current draws

($ in thousands)

Book Assets

Cash and cash equivalents

Restricted cash

Accrued performance allocations

Other investments

Other assets, net

Total Book Assets

Book Liabilities

Accounts payable, accrued expenses and other

Securitized borrowing, net

Senior unsecured term loan

Total Book Liabilities

Net Book Value

3Q'21

Non-GAAP

335,540

13,135

2,414,330

1,546,471

676,881

4,986,357

581,768

244,873

826,641

4Q'21

242,370 $

13,135

1,344,348

894,741

398,154

2,892,748

525,267

244,950

199,494

969,711

3Q'21

Pro Forma

678,057

13,135

677,017

793,797

637,070

2,799,076

329,775

244,873

200,000

774,648

$ 4,159,716 $ 1,923,037 $ 2,024,428

$

4Q'21

646,387

13,135

769,283

894,741

169,713

2,493,259

308,421

244,950

199,494

752,865

1,740,394

Note: Pro forma financial measures are on an adjusted basis, assuming the Reorganization and IPO on January 1, 2020; see the Reconciliations and Disclosures section of this presentation for a full reconciliation and description of adjustments.

1. Net debt comprised of $450 million in face value debt less $242 million of cash and cash equivalents.

TPG | 17View entire presentation