J.P.Morgan Results Presentation Deck

JPMORGAN CHASE & CO.

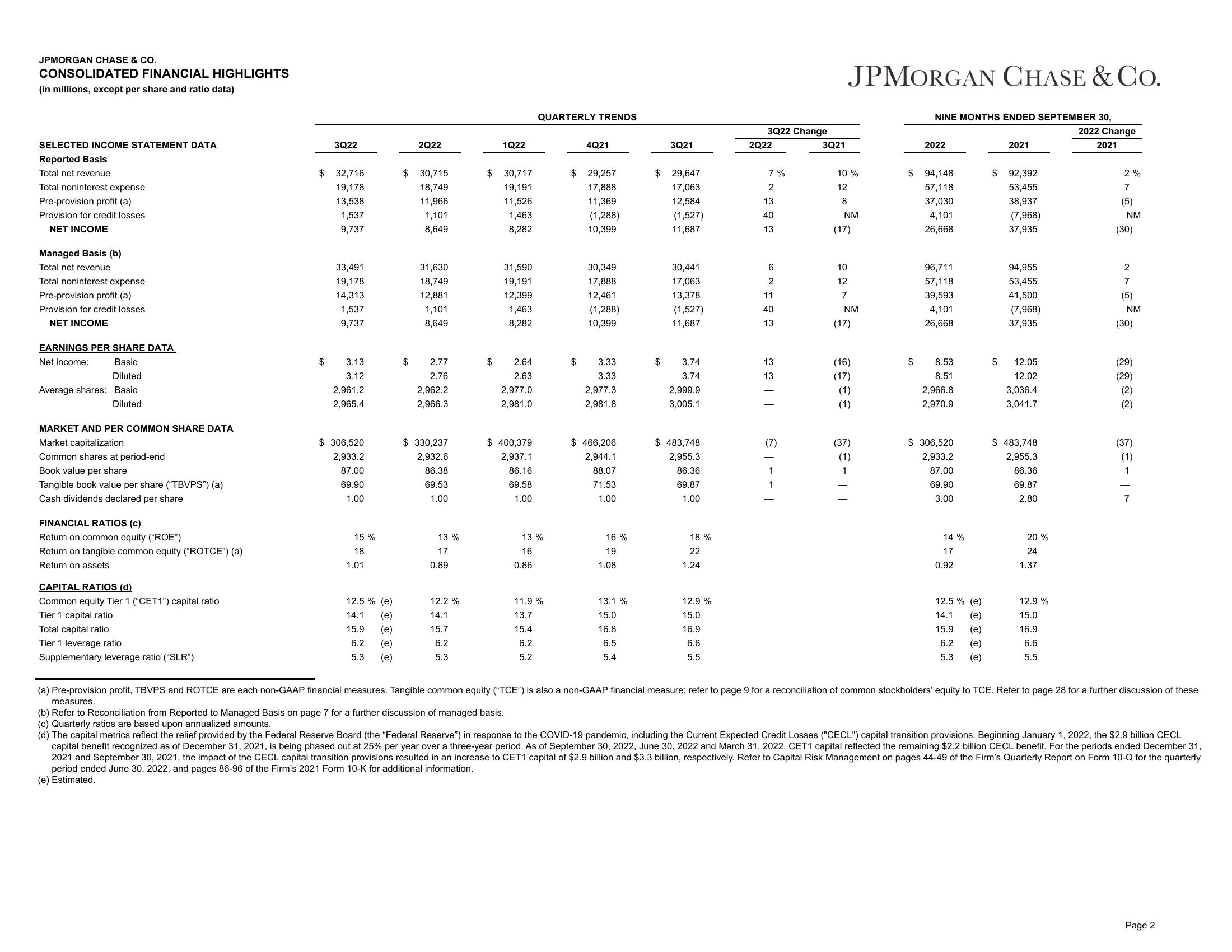

CONSOLIDATED FINANCIAL HIGHLIGHTS

(in millions, except per share and ratio data)

SELECTED INCOME STATEMENT DATA

Reported Basis

Total net revenue

Total noninterest expense

Pre-provision profit (a)

Provision for credit losses

NET INCOME

Managed Basis (b)

Total net revenue

Total noninterest expense

Pre-provision profit (a)

Provision for credit losses

NET INCOME

EARNINGS PER SHARE DATA

Net income:

Basic

Diluted

Average shares: Basic

Diluted

MARKET AND PER COMMON SHARE DATA

Market capitalization

Common shares at period-end

Book value per share

Tangible book value per share ("TBVPS") (a)

Cash dividends declared per share

FINANCIAL RATIOS (c)

Return on common equity ("ROE")

Return on tangible common equity ("ROTCE") (a)

Return on assets

CAPITAL RATIOS (d)

Common equity Tier 1 ("CET1") capital ratio

Tier 1 capital ratio

Total capital ratio

Tier 1 leverage ratio

Supplementary leverage ratio ("SLR")

$

$

3Q22

32,716

19,178

13,538

1,537

9,737

33,491

19,178

14,313

1,537

9,737

3.13

3.12

2,961.2

2,965.4

$ 306,520

2,933.2

87.00

69.90

1.00

15%

18

1.01

12.5% (e)

14.1 (e)

15.9 (e)

6.2 (e)

5.3

(e)

2Q22

$ 30,715

18,749

11,966

1,101

8,649

$

31,630

18,749

12,881

1,101

8,649

2.77

2.76

2,962.2

2,966.3

$ 330,237

2,932.6

86.38

69.53

1.00

13 %

17

0.89

12.2 %

14.1

15.7

6.2

5.3

$

$

1Q22

30,717

19,191

11,526

1,463

8,282

31,590

19,191

12,399

1,463

8,282

2.64

2.63

2,977.0

2,981.0

$400,379

2,937.1

86.16

69.58

1.00

QUARTERLY TRENDS

13%

16

0.86

11.9%

13.7

15.4

6.2

5.2

4Q21

$ 29,257

17,888

11,369

(1,288)

10,399

30,349

17,888

12,461

(1,288)

10,399

$ 3.33

3.33

2,977.3

2,981.8

$466,206

2,944.1

88.07

71.53

1.00

16 %

19

1.08

13.1 %

15.0

16.8

6.5

5.4

3Q21

$ 29,647

17,063

12,584

(1,527)

11,687

$

30,441

17,063

13,378

(1,527)

11,687

3.74

3.74

2,999.9

3,005.1

$ 483,748

2,955.3

86.36

69.87

1.00

18 %

22

1.24

12.9%

15.0

16.9

6.6

5.5

3Q22 Change

2Q22

7%

2

N

13

40

13

6

2

11

40

13

13

13

1 - - 1 3

3Q21

10%

12

8

JPMORGAN CHASE & CO.

NM

(17)

10

12

7

NM

(17)

(16)

(17)

(1)

(1)

(37)

(1)

- 11

NINE MONTHS ENDED SEPTEMBER 30,

$

2022

$94,148

57,118

37,030

4,101

26,668

96,711

57,118

39,593

4,101

26,668

8.53

8.51

2,966.8

2,970.9

$306,520

2,933.2

87.00

69.90

3.00

14%

17

0.92

12.5% (e)

14.1 (e)

15.9 (e)

6.2 (e)

5.3 (e)

2021

$92,392

53,455

38,937

(7,968)

37,935

94,955

53,455

41,500

(7,968)

37,935

12.05

12.02

3,036.4

3,041.7

$ 483,748

2,955.3

86.36

69.87

2.80

20%

24

1.37

12.9 %

15.0

16.9

6.6

5.5

2022 Change

2021

2%

7

(5)

NM

(30)

2

7

(5)

NM

(30)

(29)

(29)

(2)

(2)

(37)

(1)

1

7

(a) Pre-provision profit, TBVPS and ROTCE are each non-GAAP financial measures. Tangible common equity ("TCE") is also a non-GAAP financial measure; refer to page 9 for a reconciliation of common stockholders' equity to TCE. Refer to page 28 for a further discussion of these

(b) Refer to Reconciliation from Reported to Managed Basis on page 7 for a further discussion of managed basis.

measures.

(c) Quarterly ratios are based upon annualized amounts.

(d) The capital metrics reflect the relief provided by the Federal Reserve Board (the "Federal Reserve") in response to the COVID-19 pandemic, including the Current Expected Credit Losses ("CECL") capital transition provisions. Beginning January 1, 2022, the $2.9 billion CECL

capital benefit recognized as of December 31, 2021, is being phased out at 25% per year over a three-year period. As of September 30, 2022, June 30, 2022 and March 31, 2022, CET1 capital reflected the remaining $2.2 billion CECL benefit. For the periods ended December 31,

2021 and September 30, 2021, the impact of the CECL capital transition provisions resulted in an increase to CET1 capital of $2.9 billion and $3.3 billion, respectively. Refer to Capital Risk Management on pages 44-49 of the Firm's Quarterly Report on Form 10-Q for the quarterly

period ended June 30, 2022, and pages 86-96 of the Firm's 2021 Form 10-K for additional information.

(e) Estimated.

Page 2View entire presentation