Credit Suisse Results Presentation Deck

Successful start to NCU's de-risking process

22

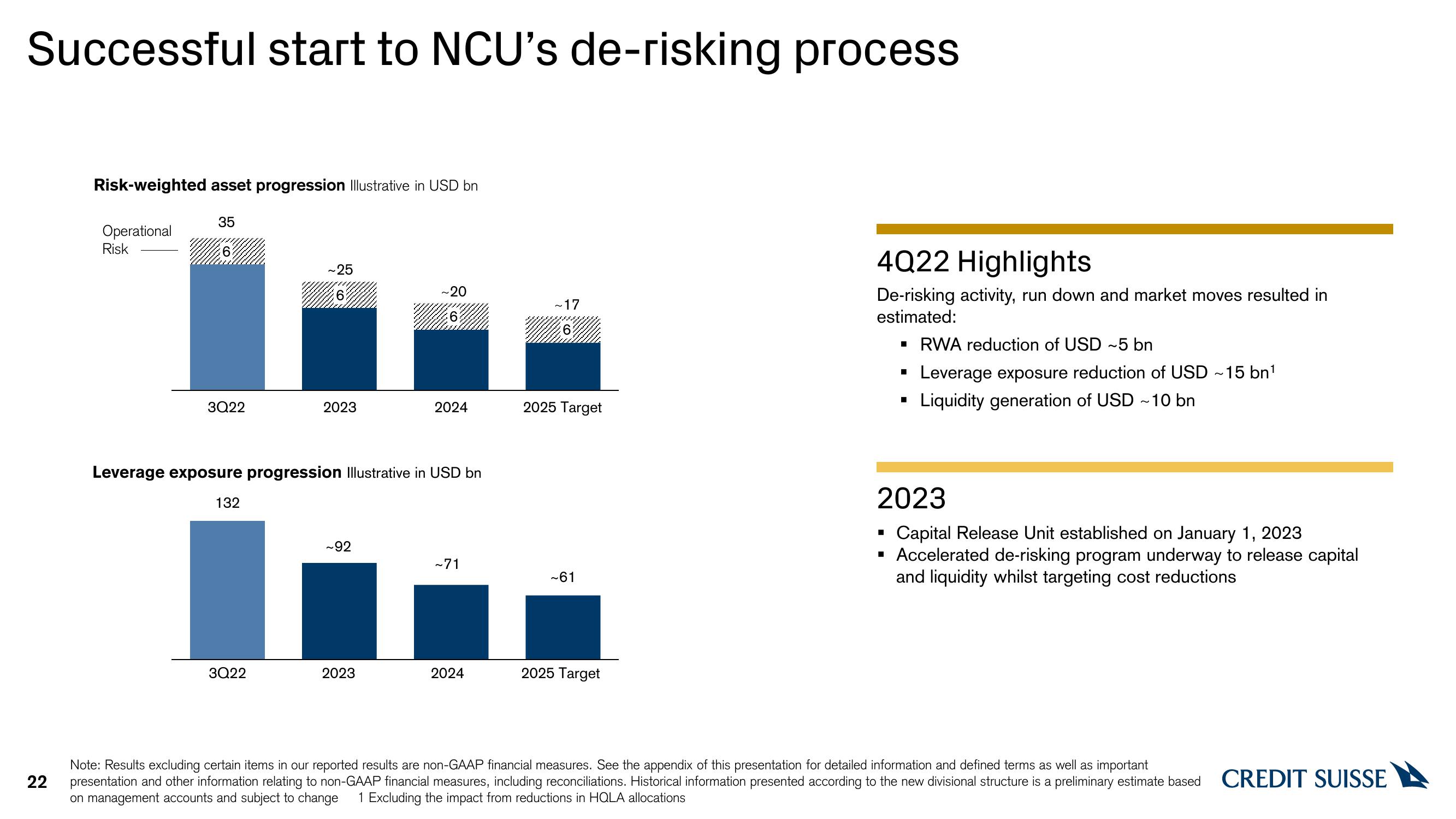

Risk-weighted asset progression Illustrative in USD bn

Operational

Risk

35

6

3Q22

132

~25

6

3Q22

2023

Leverage exposure progression Illustrative in USD bn

~92

~20

6

2023

2024

~71

2024

~17

6

2025 Target

~61

2025 Target

4022 Highlights

De-risking activity, run down and market moves resulted in

estimated:

▪ RWA reduction of USD ~5 bn

Leverage exposure reduction of USD ~ 15 bn¹

Liquidity generation of USD ~10 bn

2023

Capital Release Unit established on January 1, 2023

▪ Accelerated de-risking program underway to release capital

and liquidity whilst targeting cost reductions

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. Historical information presented according to the new divisional structure is a preliminary estimate based CREDIT SUISSE

on management accounts and subject to change 1 Excluding the impact from reductions in HQLA allocationsView entire presentation