MP Materials SPAC Presentation Deck

EXECUTIVE SUMMARY: PROPOSED TRANSACTION

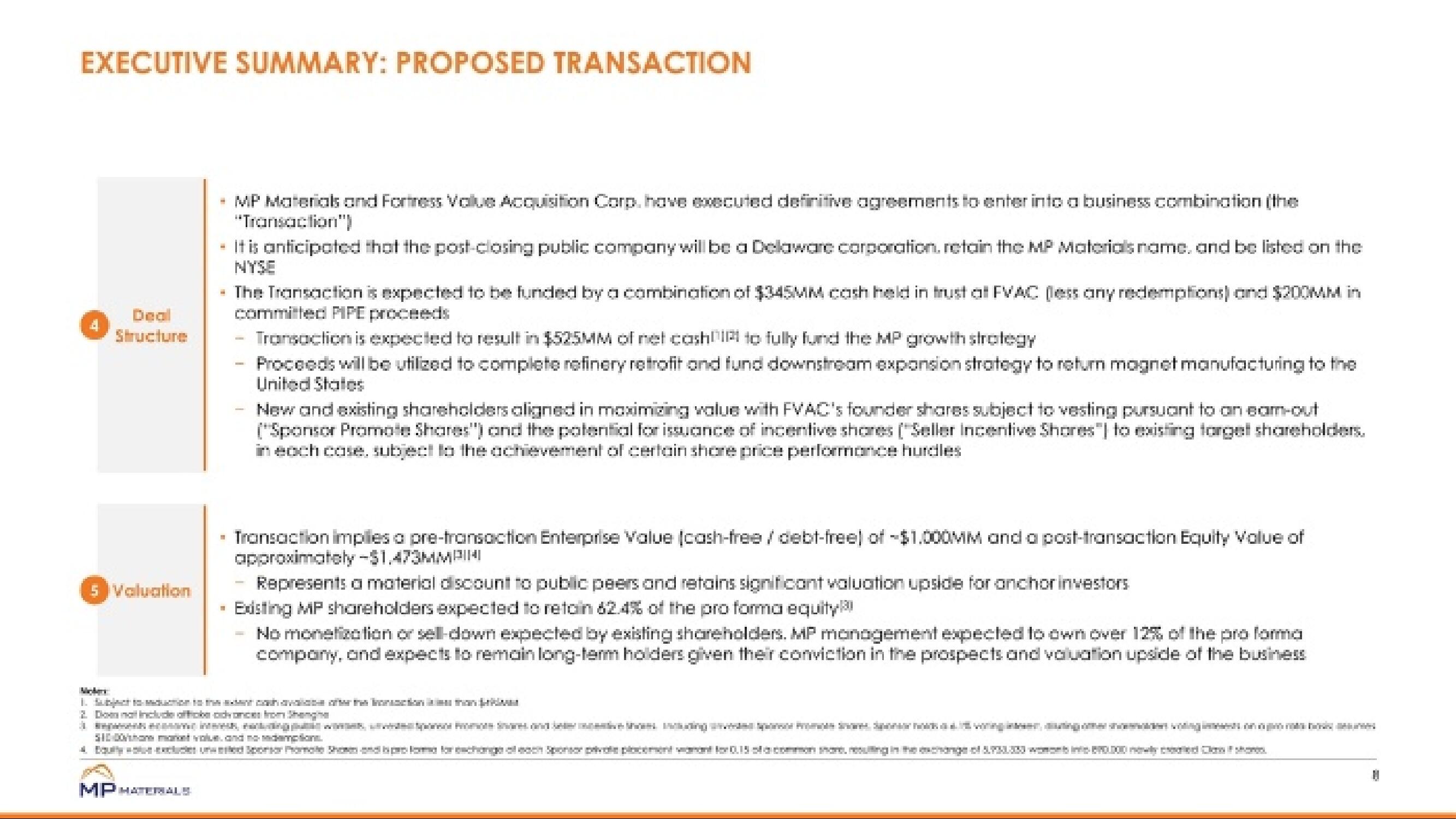

Structure

5 Valuation

+ MP Materials and Fortress Value Acquisition Corp, have executed definitive agreements to enter into a business combination (the

"Transaction")

MPHATERALS

I

It is anticipated that the post-closing public company will be a Delaware corporation, retain the MP Materials name, and be listed on the

NYSE

The Transaction is expected to be funded by a combination of $345MM cash held in trust at FVAC (less any redemptions) and $200MM in

committed PIPE proceeds

-

- Transaction is expected to result in $525MM of net cash to fully fund the MP growth strategy

Proceeds will be utilized to complete refinery retrofit and fund downstream expansion strategy to return magnet manufacturing to the

United States

New and existing shareholders aligned in maximizing value with FVAC's founder shares subject to vesting pursuant to an eam-out

("Sponsor Promote Shares") and the potential for issuance of incentive shares ("Seller Incentive Shores") to existing forget shareholders.

in each case, subject to the achievement of certain share price performance hurdles

Transaction implies a pre-transaction Enterprise Value (cash-free / debt-free) of -$1.000MM and a post-transaction Equity Value of

approximately -$1.473MMPIN

Represents a material discount to public peers and retains significant valuation upside for anchor investors.

Edsting MP shareholders expected to retain 62.4% of the pro forma equity)

No monetization or sell-down expected by existing shareholders. MP manogement expected to own over 12% of the pro forma

company, and expects to remain long-term holders given their conviction in the prospects and valuation upside of the business

2. Dommall Include afficke odvonces from Shanghe

SIC DOWhom market value and no demptionView entire presentation