Blackwells Capital Activist Presentation Deck

I

B

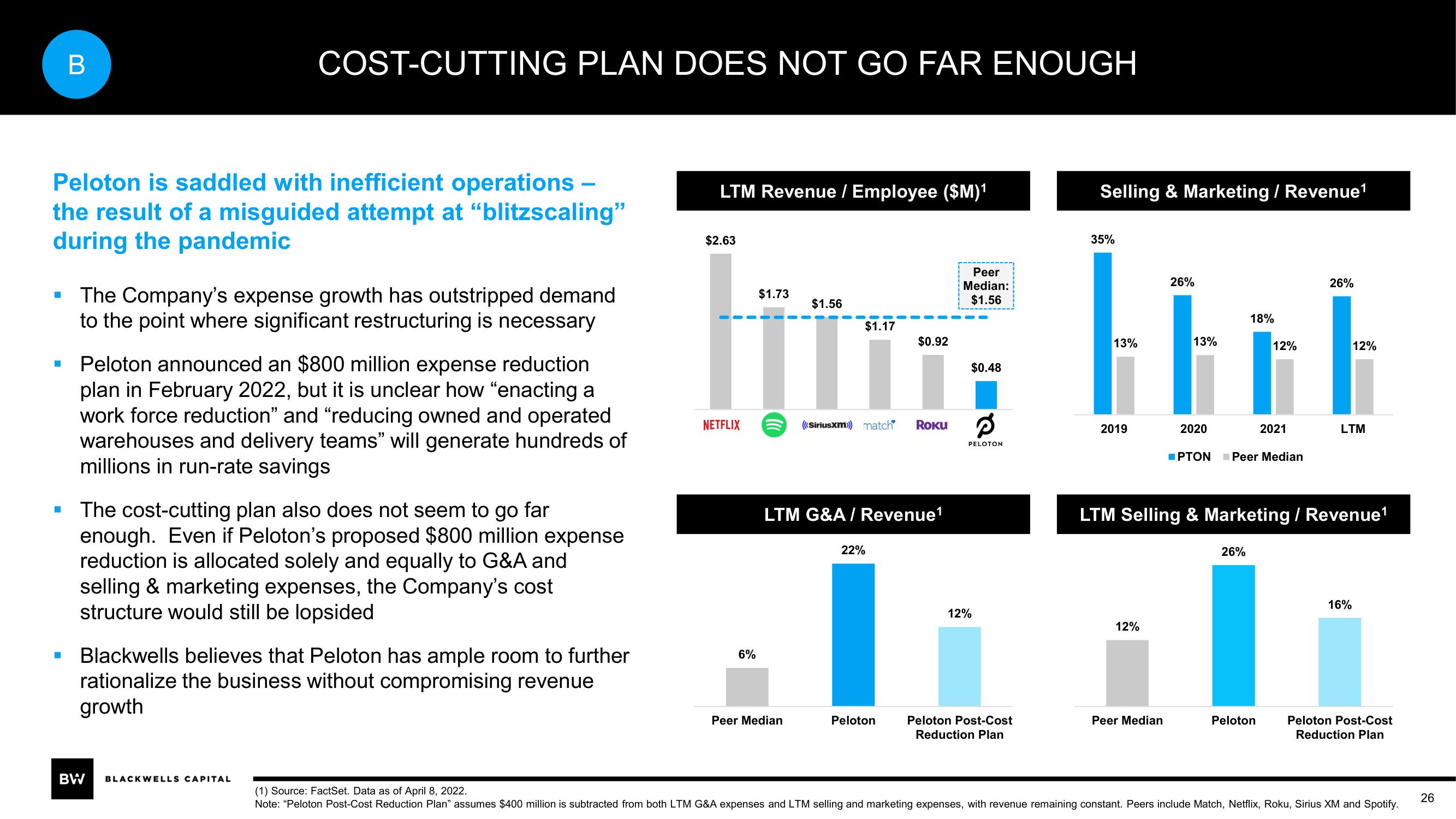

Peloton is saddled with inefficient operations -

the result of a misguided attempt at "blitzscaling"

during the pandemic

■

COST-CUTTING PLAN DOES NOT GO FAR ENOUGH

The Company's expense growth has outstripped demand

to the point where significant restructuring is necessary

Peloton announced an $800 million expense reduction

plan in February 2022, but it is unclear how "enacting a

work force reduction" and "reducing owned and operated

warehouses and delivery teams" will generate hundreds of

millions in run-rate savings

The cost-cutting plan also does not seem to go far

enough. Even if Peloton's proposed $800 million expense

reduction is allocated solely and equally to G&A and

selling & marketing expenses, the Company's cost

structure would still be lopsided

Blackwells believes that Peloton has ample room to further

rationalize the business without compromising revenue

growth

BW BLACKWELLS CAPITAL

LTM Revenue / Employee ($M)¹

$2.63

NETFLIX

$1.73

6%

$1.17

int

$1.56

Peer Median

LTM G&A / Revenue¹

$0.92

22%

((Siriusxm))) match Roku 3

Peloton

Peer

Median:

$1.56

$0.48

PELOTON

12%

Peloton Post-Cost

Reduction Plan

Selling & Marketing / Revenue¹

35%

26%

bi

13%

13%

2019

12%

2020

Peer Median

18%

26%

12%

■PTON Peer Median

2021

Peloton

LTM Selling & Marketing / Revenue¹

26%

12%

LTM

16%

Peloton Post-Cost

Reduction Plan

(1) Source: FactSet. Data as of April 8, 2022.

Note: "Peloton Post-Cost Reduction Plan" assumes $400 million is subtracted from both LTM G&A expenses and LTM selling and marketing expenses, with revenue remaining constant. Peers include Match, Netflix, Roku, Sirius XM and Spotify.

26View entire presentation