Kinnevik Results Presentation Deck

Intro

Net Asset Value

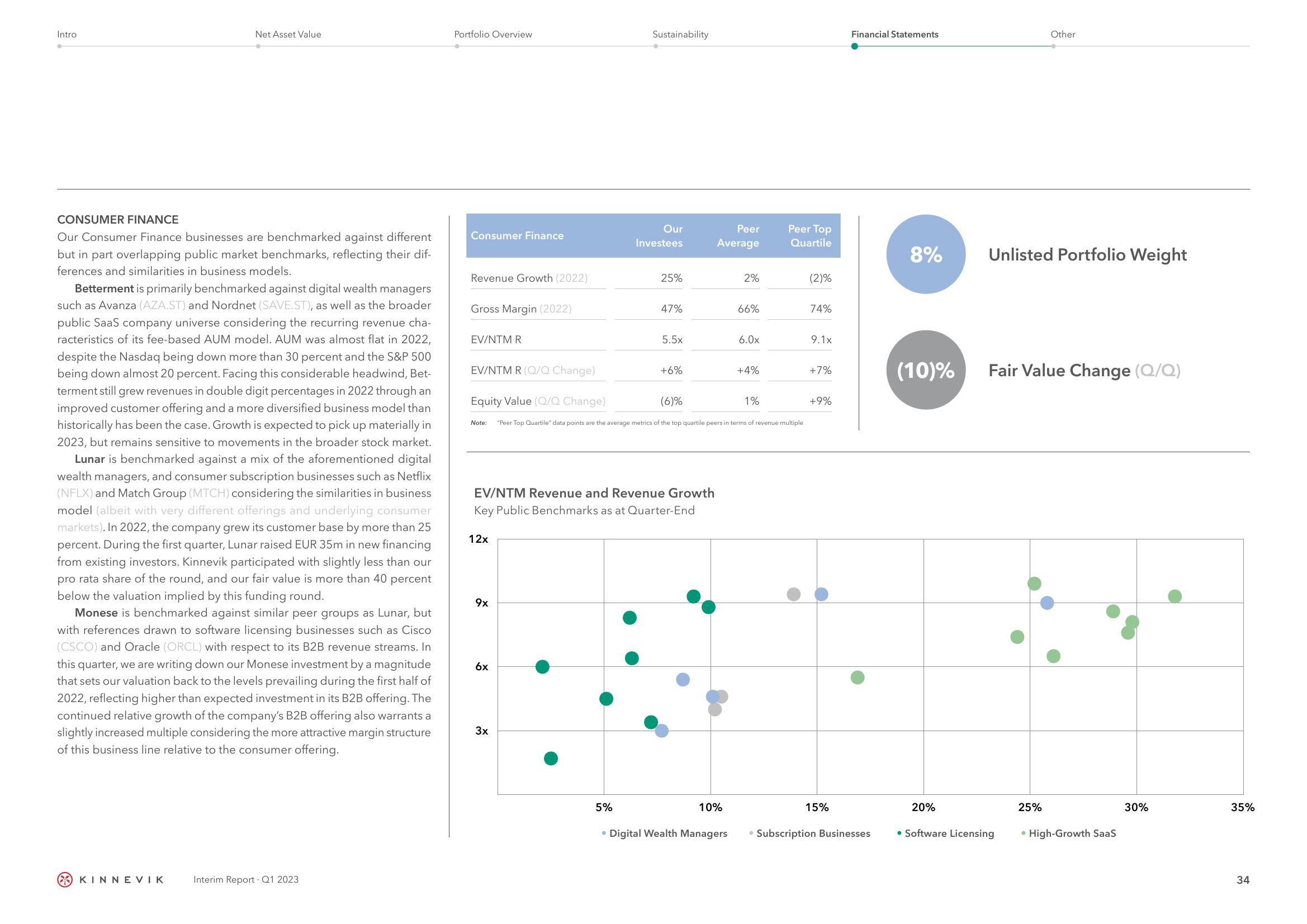

CONSUMER FINANCE

Our Consumer Finance businesses are benchmarked against different

but in part overlapping public market benchmarks, reflecting their dif-

ferences and similarities in business models.

Betterment is primarily benchmarked against digital wealth managers

such as Avanza (AZA.ST) and Nordnet (SAVE.ST), as well as the broader

public SaaS company universe considering the recurring revenue cha-

racteristics of its fee-based AUM model. AUM was almost flat in 2022,

despite the Nasdaq being down more than 30 percent and the S&P 500

being down almost 20 percent. Facing this considerable headwind, Bet-

terment still grew revenues in double digit percentages in 2022 through an

improved customer offering and a more diversified business model than

historically has been the case. Growth is expected to pick up materially in

2023, but remains sensitive to movements in the broader stock market.

Lunar is benchmarked against a mix of the aforementioned digital

wealth managers, and consumer subscription businesses such as Netflix

(NFLX) and Match Group (MTCH) considering the similarities in business

model (albeit with very different offerings and underlying consumer

markets). In 2022, the company grew its customer base by more than 25

percent. During the first quarter, Lunar raised EUR 35m in new financing

from existing investors. Kinnevik participated with slightly less than our

pro rata share of the round, and our fair value is more than 40 percent

below the valuation implied by this funding round.

Monese is benchmarked against similar peer groups as Lunar, but

with references drawn to software licensing businesses such as Cisco

(CSCO) and Oracle (ORCL) with respect to its B2B revenue streams. In

this quarter, we are writing down our Monese investment by a magnitude

that sets our valuation back to the levels prevailing during the first half of

2022, reflecting higher than expected investment in its B2B offering. The

continued relative growth of the company's B2B offering also warrants a

slightly increased multiple considering the more attractive margin structure

of this business line relative to the consumer offering.

KINNEVIK

Interim Report Q1 2023

Portfolio Overview

Consumer Finance

Revenue Growth (2022)

Gross Margin (2022)

EV/NTM R

EV/NTM R (Q/Q Change)

Equity Value (Q/Q Change)

Note:

12x

9x

6x

3x

Sustainability

Our

Investees

5%

25%

47%

EV/NTM Revenue and Revenue Growth

Key Public Benchmarks as at Quarter-End

5.5x

+6%

(6)%

Peer

Average

10%

2%

• Digital Wealth Managers

66%

6.0x

"Peer Top Quartile" data points are the average metrics of the top quartile peers in terms of revenue multiple

+4%

1%

Peer Top

Quartile

(2)%

74%

9.1x

+7%

+9%

15%

Financial Statements

• Subscription Businesses

8%

(10)%

20%

Unlisted Portfolio Weight

Other

Fair Value Change (Q/Q)

• Software Licensing

25%

• High-Growth SaaS

30%

35%

34View entire presentation