Engine No. 1 Activist Presentation Deck

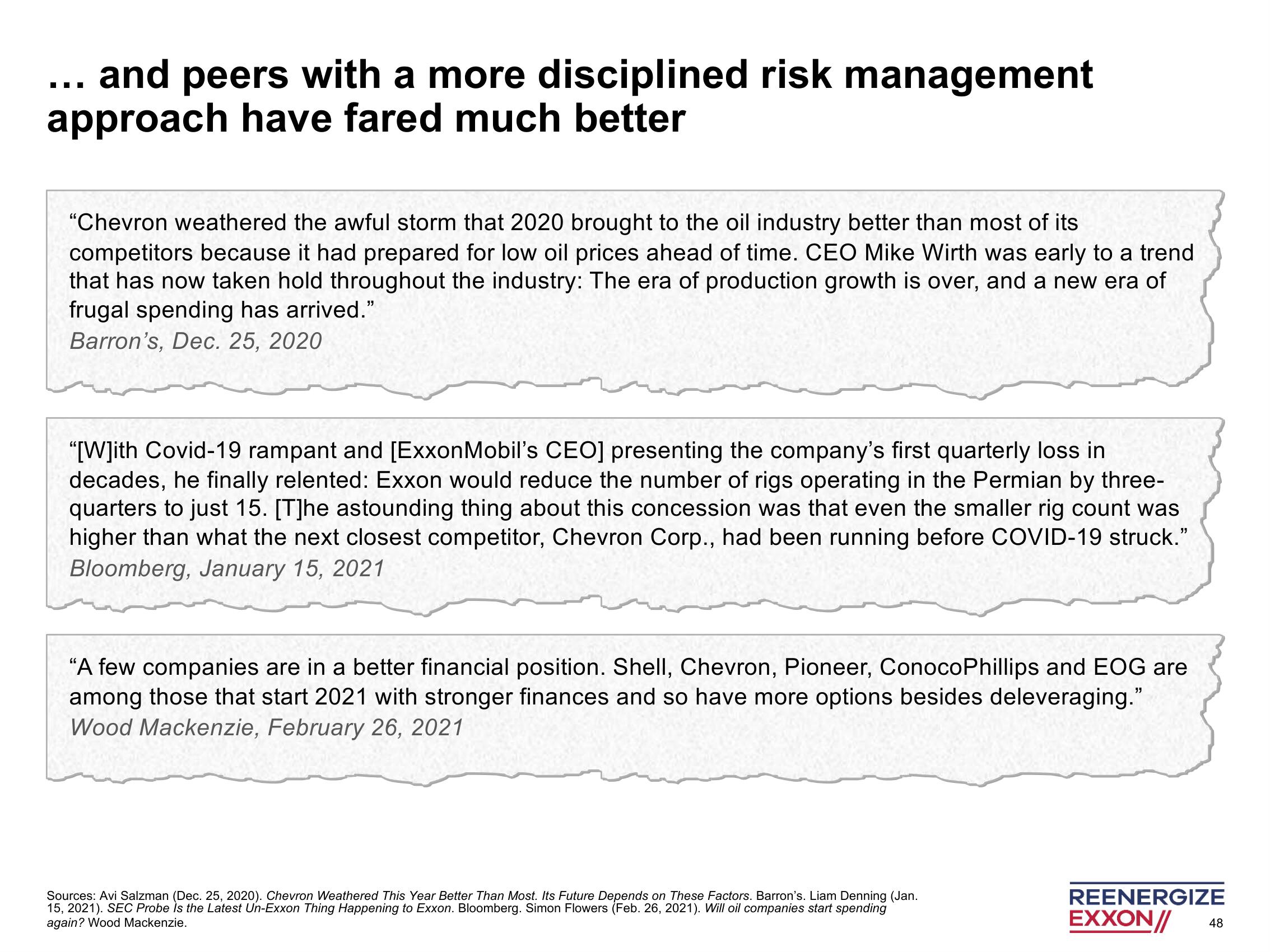

and peers with a more disciplined risk management

approach have fared much better

III

"Chevron weathered the awful storm that 2020 brought to the oil industry better than most of its

competitors because it had prepared for low oil prices ahead of time. CEO Mike Wirth was early to a trend

that has now taken hold throughout the industry: The era of production growth is over, and a new era of

frugal spending has arrived."

Barron's, Dec. 25, 2020

ww

"[W]ith Covid-19 rampant and [ExxonMobil's CEO] presenting the company's first quarterly loss in

decades, he finally relented: Exxon would reduce the number of rigs operating in the Permian by three-

quarters to just 15. [T]he astounding thing about this concession was that even the smaller rig count was

higher than what the next closest competitor, Chevron Corp., had been running before COVID-19 struck."

Bloomberg, January 15, 2021

"A few companies are in a better financial position. Shell, Chevron, Pioneer, ConocoPhillips and EOG are

among those that start 2021 with stronger finances and so have more options besides deleveraging."

Wood Mackenzie, February 26, 2021

Sources: Avi Salzman (Dec. 25, 2020). Chevron Weathered This Year Better Than Most. Its Future Depends on These Factors. Barron's. Liam Denning (Jan.

15, 2021). SEC Probe is the Latest Un-Exxon Thing Happening to Exxon. Bloomberg. Simon Flowers (Feb. 26, 2021). Will oil companies start spending

again? Wood Mackenzie.

REENERGIZE

EXXON//

48View entire presentation