Jefferies Financial Group Investor Day Presentation Deck

Jefferies Finance - Overview

H

Jefferies Finance ("JFIN") continues to operate prudently

JFIN has demonstrated growth and resilience across multiple business cycles, including the

current economic disruption

JFIN has built a highly successful franchise arranging leveraged loans for distribution to the

capital markets and has successfully arranged >1,400 transactions ($290 billion of financing)

since inception

JFIN also provides direct lending to Jefferies' clients through Jefferies Credit Partners ("JCP"),

JFIN's private credit investment team

JFIN manages CLOs through Apex Credit Partners ("Apex"), which runs 29 term loan CLOS

and revolver funding vehicles, a large share of which were arranged by Jefferies

Managed capital across all business lines exceeds $17 billion(1)

JFIN's strategy will remain focused on core U.S. and European underwriting business,

and furthering the success of our large cap and mid cap direct lending (both origination

and asset management), which represents a significant growth opportunity

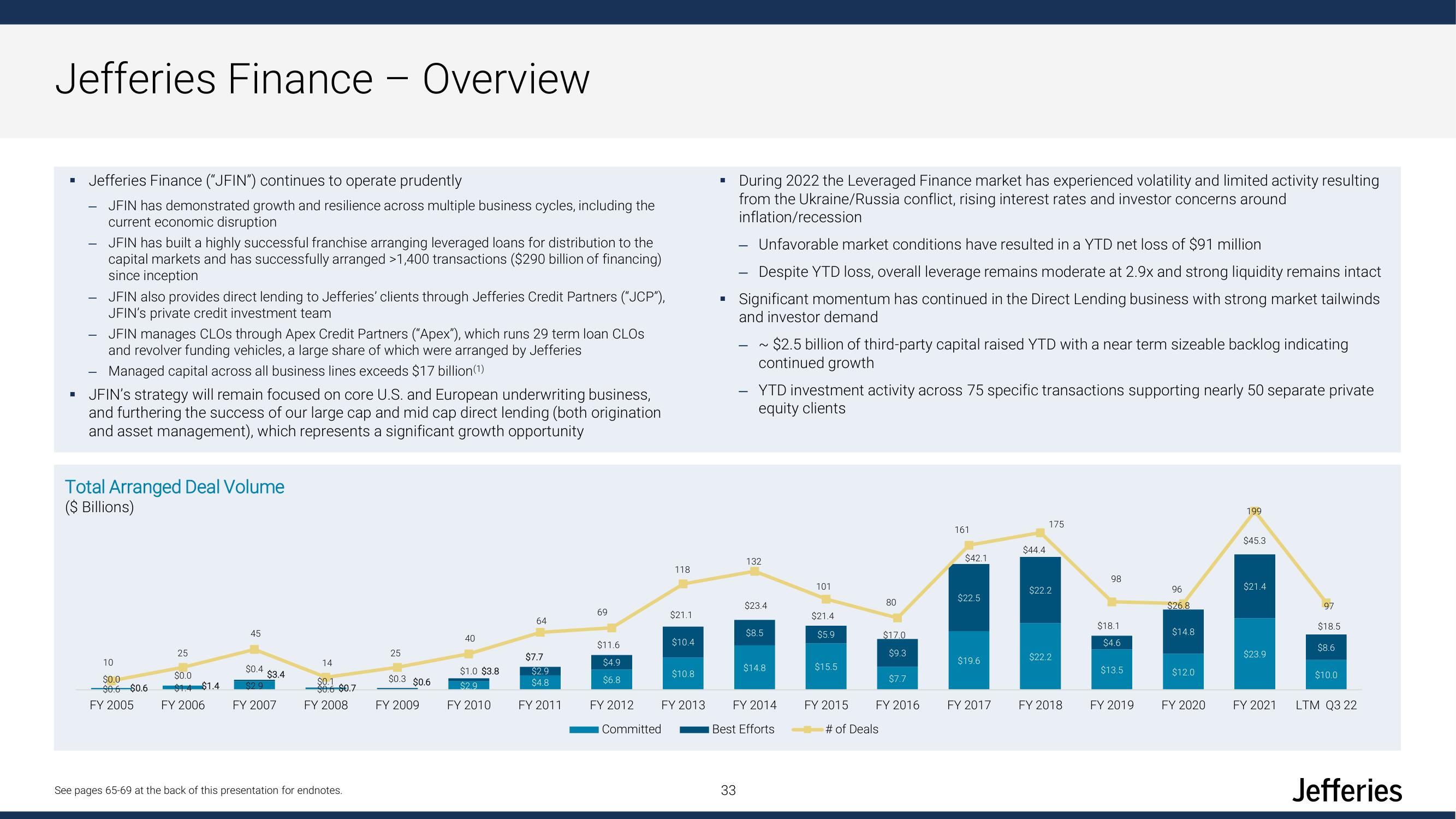

Total Arranged Deal Volume

($ Billions)

10

$0.0

$0.6 $0.6

FY 2005

25

$0.0

$14 $1.4

FY 2006

45

$0.4

$2.9

FY 2007

$3.4

14

$0.1

$0.6 $0.7

FY 2008

See pages 65-69 at the back of this presentation for endnotes.

25

$0.3 $0.6

FY 2009

40

$1.0 $3.8

$2.9

FY 2010

64

$7.7

$2.9

$4.8

FY 2011

69

$11.6

$4.9

$6.8

FY 2012

Committed

118

$21.1

$10.4

$10.8

FY 2013

■

I

During 2022 the Leveraged Finance market has experienced volatility and limited activity resulting

from the Ukraine/Russia conflict, rising interest rates and investor concerns around

inflation/recession

Unfavorable market conditions have resulted in a YTD net loss of $91 million

Despite YTD loss, overall leverage remains moderate at 2.9x and strong liquidity remains intact

Significant momentum has continued in the Direct Lending business with strong market tailwinds

and investor demand

33

~$2.5 billion of third-party capital raised YTD with a near term sizeable backlog indicating

continued growth

YTD investment activity across 75 specific transactions supporting nearly 50 separate private

equity clients

132

$23.4

$8.5

$14.8

FY 2014

Best Efforts

101

$21.4

$5.9

$15.5

FY 2015

80

# of Deals

$17.0

$9.3

$7.7

FY 2016

161

$42.1

$22.5

$19.6

FY 2017

$44.4

175

$22.2

$22.2

FY 2018

98

$18.1

$4.6

$13.5

FY 2019

96

$26.8

$14.8

$12.0

FY 2020

199

$45.3

$21.4

$23.9

FY 2021

97

$18.5

$8.6

$10.0

LTM Q3 22

JefferiesView entire presentation