Credit Suisse Investment Banking Pitch Book

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

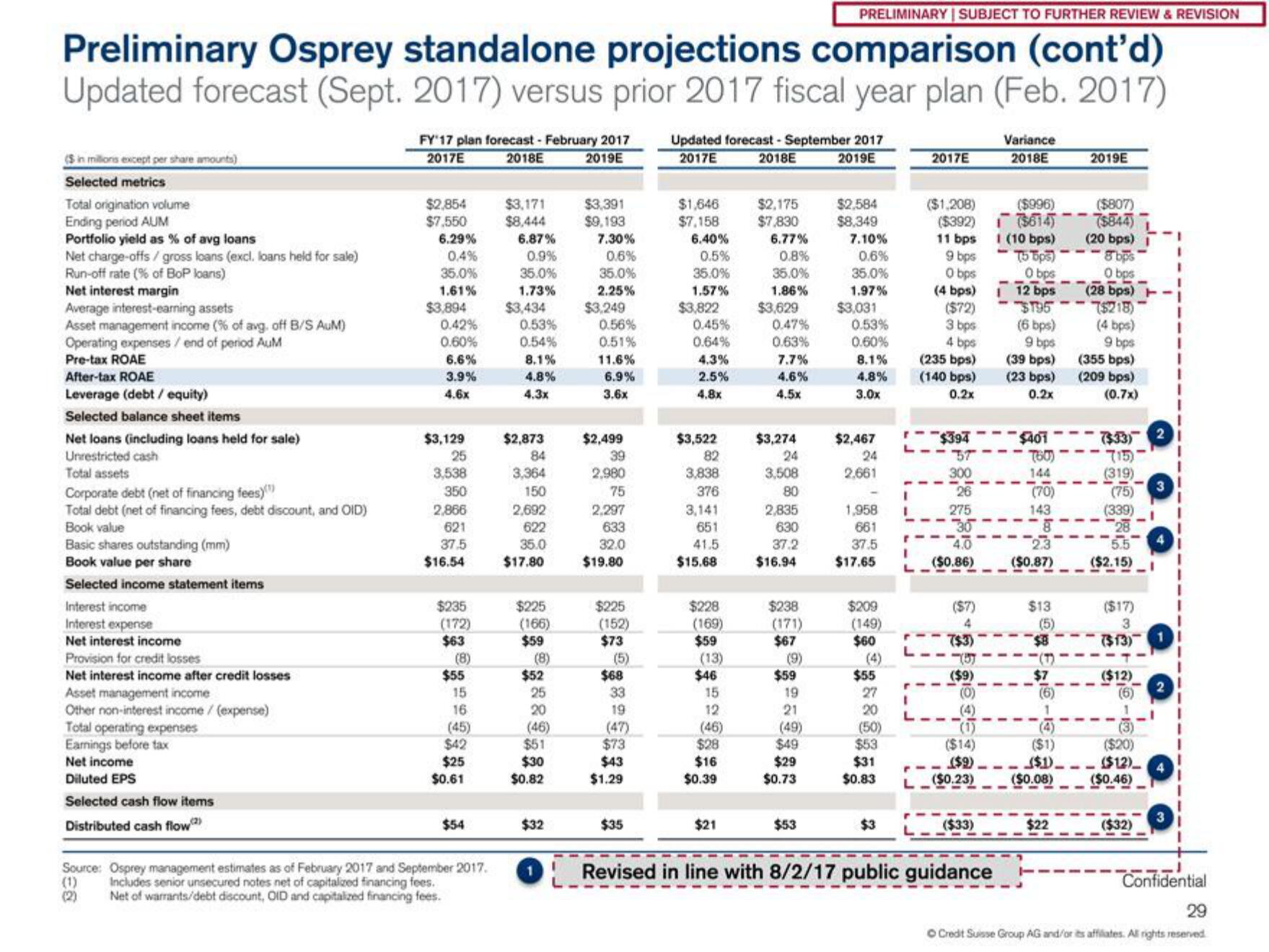

Preliminary Osprey standalone projections comparison (cont'd)

Updated forecast (Sept. 2017) versus prior 2017 fiscal year plan (Feb. 2017)

($ in millions except per share amounts)

Selected metrics

Total origination volume

Ending period AUM

Portfolio yield as % of avg loans

Net charge-offs / gross loans (excl. loans held for sale)

Run-off rate (% of BoP loans)

Net interest margin

Average interest-earning assets

Asset management income (% of avg. off B/S AuM)

Operating expenses / end of period AuM

Pre-tax ROAE

After-tax ROAE

Leverage (debt / equity)

Selected balance sheet items

Net loans (including loans held for sale)

Unrestricted cash

Total assets

Corporate debt (net of financing fees)

Total debt (net of financing fees, debt discount, and OID)

Book value

Basic shares outstanding (mm)

Book value per share

Selected income statement items

Interest income

Interest expense

Net interest income

Provision for credit losses

Net interest income after credit losses

Asset management income

Other non-interest income / (expense)

Total operating expenses

Earnings before tax

Net income

Diluted EPS

Selected cash flow items

Distributed cash flow (2)

FY'17 plan forecast - February 2017

2017E

2018E

2019E

$2,854

$7,550

6.29%

0.4%

35.0%

1.61%

$3.894

0.42%

0.60%

6.6%

3.9%

4.6x

$3,129

25

3,538

350

2,866

621

37.5

$16.54

$235

(172)

$63

(8)

$55

15

16

(45)

$42

$25

$0.61

$54

Source: Osprey management estimates as of February 2017 and September 2017.

(1)

Includes senior unsecured notes net of capitalized financing fees.

(2)

Net of warrants/debt discount, OID and capitalized financing fees.

$3,171

$8,444

6.87%

0.9%

35.0%

1.73%

$3,434

0.53%

0.54%

8.1%

4.8%

4.3x

$2,873

84

3,364

150

2,692

622

35.0

$17.80

$225

(166)

$59

(8)

$52

25

20

(46)

$51

$30

$0.82

$32

$3,391

$9,193

7.30%

0.6%

35.0%

2.25%

$3,249

0.56%

0.51%

11.6%

6.9%

3.6x

$2,499

39

2,980

75

2,297

633

32.0

$19.80

$225

(152)

$73

(5)

$68

33

19

(47)

$73

$43

$1.29

$35

Updated forecast - September 2017

2017E

2018E 2019E

$1,646

$7,158

6.40%

0.5%

35.0%

1.57%

$3,822

0.45%

0.64%

4.3%

2.5%

4.8x

$3,522

82

3,838

376

3,141

651

41.5

$15.68

$228

(169)

$59

(13)

$46

15

12

(46)

$28

$16

$0.39

$21

$2,175

$7,830

6.77%

0.8%

35.0%

1.86%

$3,629

0.47%

0.63%

7.7%

4.6%

4.5x

$3,274

24

3,508

80

2,835

630

37.2

$16.94

$238

(171)

$67

(9)

$59

19

21

(49)

$49

$29

$0.73

$53

$2,584

$8,349

7.10%

0.6%

35.0%

1.97%

$3,031

0.53%

0.60%

8.1%

4.8%

3.0x

$2,467

24

2.661

1,958

661

37.5

$17.65

$209

(149)

$60

$55

27

20

(50)

$53

$31

$0.83

$3

L

I

2017E

($1,208)

($392)

11 bps

9 bps

0 bps

(4 bps)

($72)

3 bps

4 bps

(235 bps)

(140 bps)

0.2x

--$394

57

300

275

30

4.0

($0.86)

($7)

4

(57

($9)

($14)

($9)

($0.23)

($33)

1 Revised in line with 8/2/17 public guidance

Variance

2018E

($996)

($614)

1 (10 bps)

T5 Tops)

0 bps

12 bps

ST95

(6 bps)

9 bps

(39 bps)

(23 bps)

0.2x

$401

760)

144

(70)

143

-8

2.3

($0.87)

$13

(5)

($1)

($0.08)

2019E

$22

($807)

($844)

(20 bps)

8bps

0 bps

(28 bps)

-7$218)

(4 bps)

9 bps

(355 bps)

(209 bps)

(0.7x)

($33)

715)

(319)

(75)

(339)

28

($2.15)

($17)

3

($13) 1

($12)

($1)__($12)__

($0.46)

($20)

($32)

J

Confidential

29

Ⓒ Credit Suisse Group AG and/or its affiliates. All rights reservedView entire presentation