WeWork Investor Presentation Deck

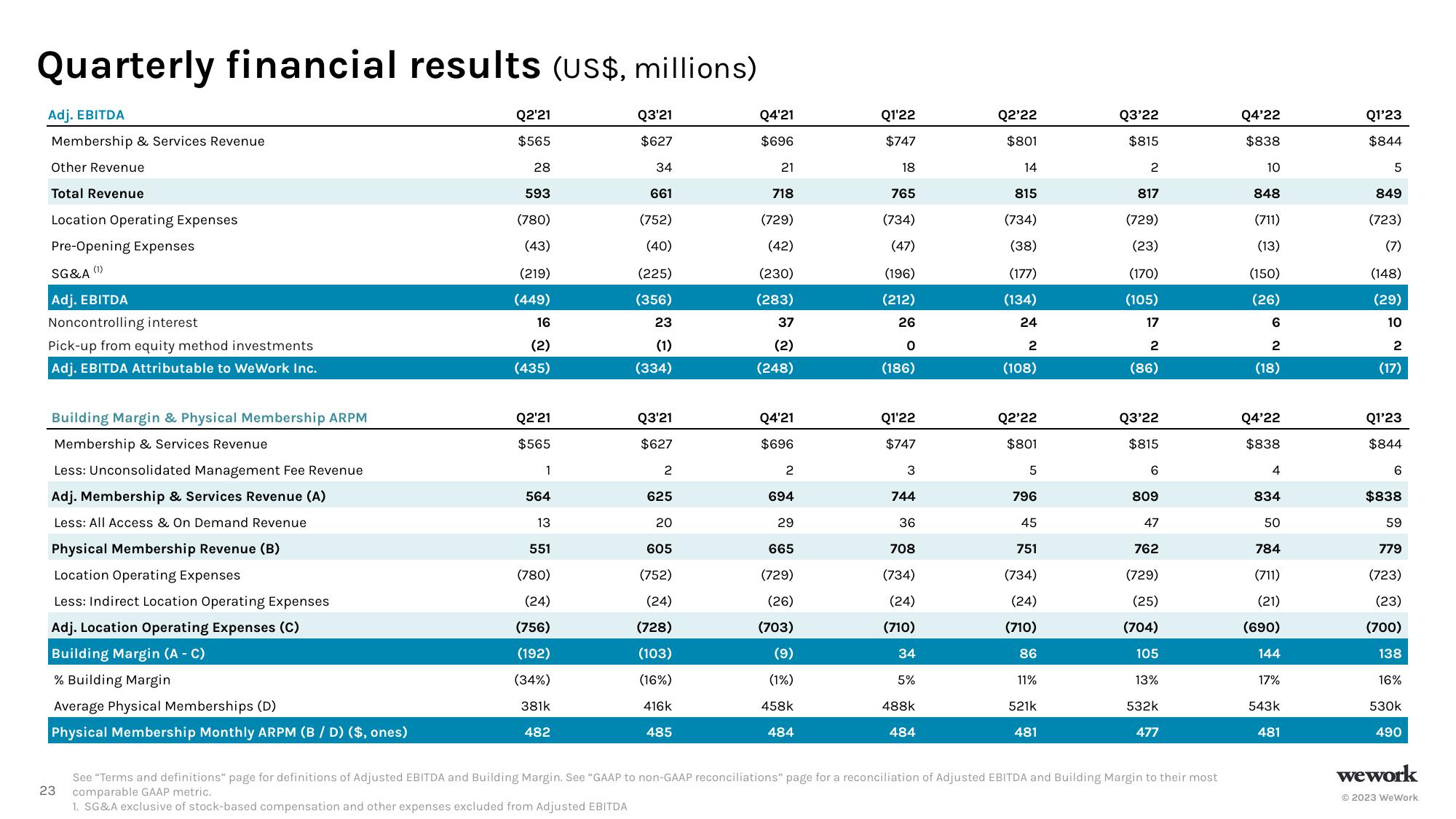

Quarterly financial results (US$, millions)

Adj. EBITDA

Membership & Services Revenue

Other Revenue

Total Revenue

Location Operating Expenses

Pre-Opening Expenses

(1)

SG&A

Adj. EBITDA

Noncontrolling interest

Pick-up from equity method investments

Adj. EBITDA Attributable to WeWork Inc.

Building Margin & Physical Membership ARPM

Membership & Services Revenue

Less: Unconsolidated Management Fee Revenue

Adj. Membership & Services Revenue (A)

Less: All Access & On Demand Revenue

Physical Membership Revenue (B)

Location Operating Expenses

Less: Indirect Location Operating Expenses

Adj. Location Operating Expenses (C)

Building Margin (A - C)

% Building Margin

Average Physical Memberships (D)

Physical Membership Monthly ARPM (B / D) ($, ones)

23

Q2'21

$565

28

593

(780)

(43)

(219)

(449)

16

(2)

(435)

Q2'21

$565

1

564

13

551

(780)

(24)

(756)

(192)

(34%)

381k

482

Q3'21

$627

34

661

(752)

(40)

(225)

(356)

23

(1)

(334)

Q3'21

$627

2

625

20

605

(752)

(24)

(728)

(103)

(16%)

416k

485

Q4'21

$696

21

718

(729)

(42)

(230)

(283)

37

(2)

(248)

Q4'21

$696

2

694

29

665

(729)

(26)

(703)

(9)

(1%)

458k

484

Q1'22

$747

18

765

(734)

(47)

(196)

(212)

26

0

(186)

Q1'22

$747

3

744

36

708

(734)

(24)

(710)

34

5%

488k

484

Q2'22

$801

14

815

(734)

(38)

(177)

(134)

24

2

(108)

Q2'22

$801

5

796

45

751

(734)

(24)

(710)

86

11%

521k

481

Q3'22

$815

2

817

(729)

(23)

(170)

(105)

17

2

(86)

Q3'22

$815

6

809

47

762

(729)

(25)

(704)

105

13%

532k

477

See "Terms and definitions" page for definitions of Adjusted EBITDA and Building Margin. See "GAAP to non-GAAP reconciliations" page for a reconciliation of Adjusted EBITDA and Building Margin to their most

comparable GAAP metric.

1. SG&A exclusive of stock-based compensation and other expenses excluded from Adjusted EBITDA

Q4'22

$838

10

848

(711)

(13)

(150)

(26)

6

2

(18)

Q4'22

$838

4

834

50

784

(711)

(21)

(690)

144

17%

543k

481

Q1'23

$844

5

849

(723)

(7)

(148)

(29)

10

2

(17)

Q1'23

$844

6

$838

59

779

(723)

(23)

(700)

138

16%

530k

490

wework

Ⓒ2023 WeWorkView entire presentation