Getty SPAC Presentation Deck

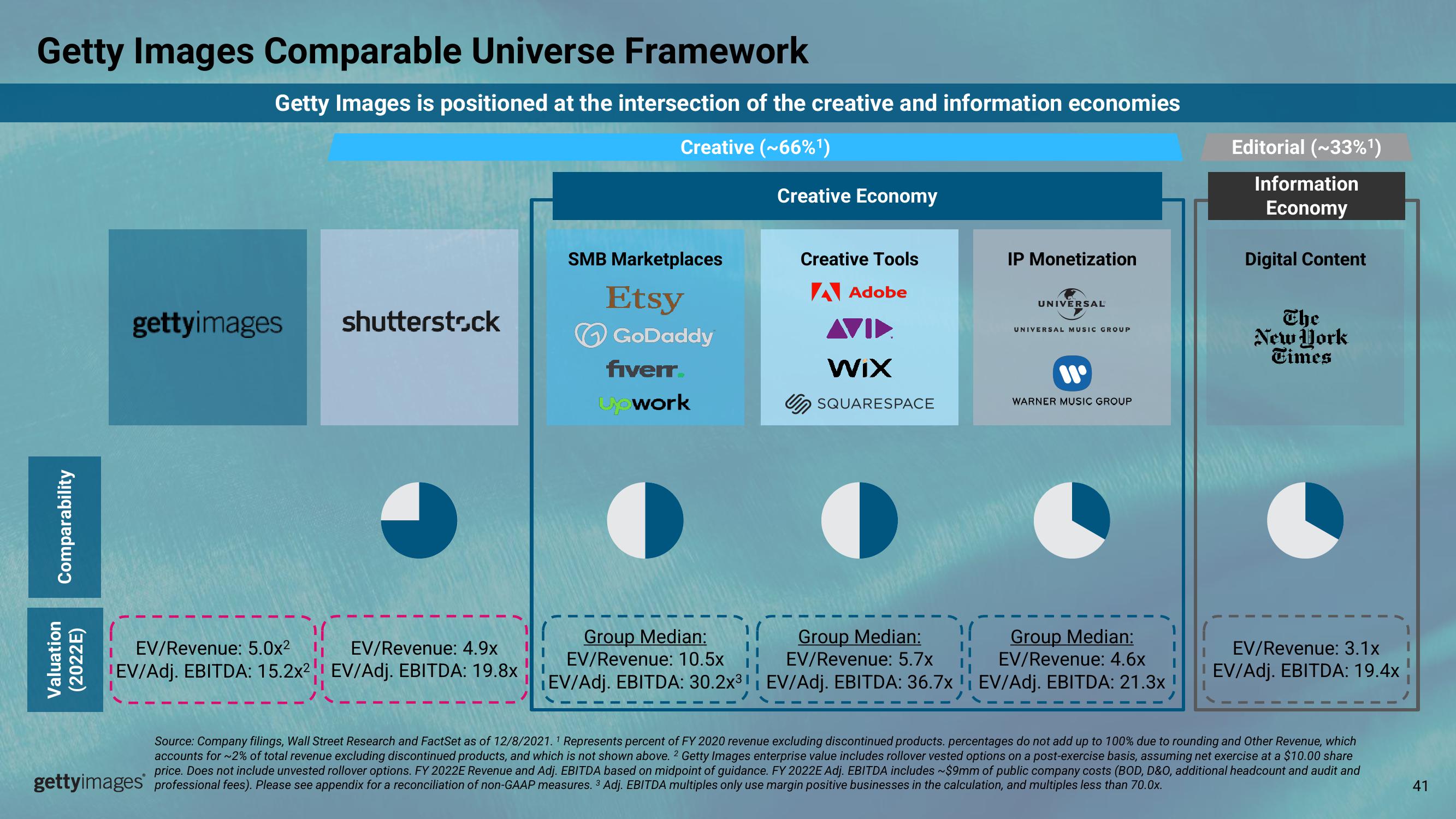

Getty Images Comparable Universe Framework

Comparability

Valuation

(2022E)

Getty Images is positioned at the intersection of the creative and information economies

Creative (~66%¹)

gettyimages

EV/Revenue: 5.0x²

EV/Adj. EBITDA: 15.2x²

shutterstock

EV/Revenue: 4.9x

EV/Adj. EBITDA: 19.8x

SMB Marketplaces

Etsy

GoDaddy

fiverr

Upwork

Group Median:

EV/Revenue: 10.5x

Creative Economy

Creative Tools

A Adobe

AVI▶

WIX

U SQUARESPACE

IP Monetization

UNIVERSAL

UNIVERSAL MUSIC GROUP

WARNER MUSIC GROUP

Group Median:

EV/Revenue: 5.7x

Group Median:

EV/Revenue: 4.6x

¡EV/Adj. EBITDA: 30.2x³1 | EV/Adj. EBITDA: 36.7x !| EV/Adj. EBITDA: 21.3x

Editorial (~33%¹)

Information

Economy

gettyimages professional fees). Please see appendix for a reconciliation of non-GAAP measures. 3 Adj. EBITDA multiples only use margin positive businesses in the calculation, and multiples less than 70.0x.

Digital Content

The

New York

Times

EV/Revenue: 3.1x

EV/Adj. EBITDA: 19.4x

Source: Company filings, Wall Street Research and FactSet as of 12/8/2021.1 Represents percent of FY 2020 revenue excluding discontinued products. percentages do not add up to 100% due to rounding and Other Revenue, which

accounts for ~2% of total revenue excluding discontinued products, and which is not shown above. 2 Getty Images enterprise value includes rollover vested options on a post-exercise basis, assuming net exercise at a $10.00 share

price. Does not include unvested rollover options. FY 2022E Revenue and Adj. EBITDA based on midpoint of guidance. FY 2022E Adj. EBITDA includes ~$9mm of public company costs (BOD, D&O, additional headcount and audit and

41View entire presentation