Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

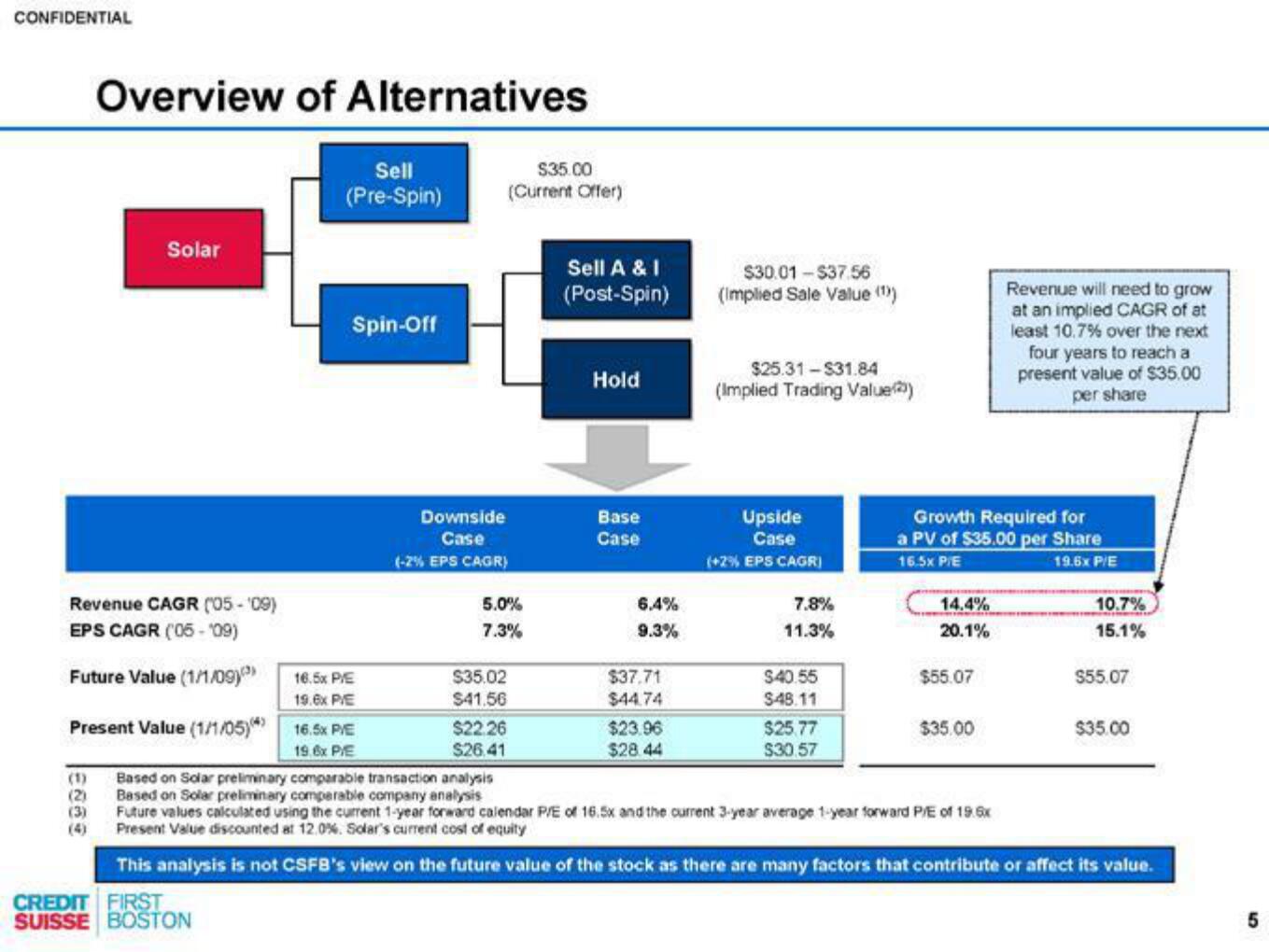

Overview of Alternatives

(2)

(3)

Solar

Revenue CAGR (05-'09)

EPS CAGR (05-'09)

Future Value (1/1/09)

Present Value (1/1/05)*

Sell

(Pre-Spin)

Spin-Off

16.5x P/E

19.6x P/E

16.5x P/E

19.6x P/E

Downside

Case

(-2% EPS CAGR)

$35.00

(Current Offer)

5.0%

7.3%

$35.02

$41.56

$22.26

$26.41

Sell A & I

(Post-Spin)

Hold

Base

Case

6.4%

9.3%

$37.71

$44.74

$23.96

$28.44

$30.01-$37.56

(Implied Sale Value (¹))

$25.31-$31.84

(Implied Trading Value)

Upside

Case

(+2% EPS CAGR)

7.8%

11.3%

$40.55

$48.11

$25.77

$30,57

Growth Required for

a PV of $35.00 per Share

16.5x P/E

19.6x P/E

14.4%

20.1%

$55.07

$35.00

Revenue will need to grow

at an implied CAGR of at

least 10.7% over the next

four years to reach a

present value of $35.00

per share

Based on Solar preliminary comparable transaction analysis

Based on Solar preliminary comparable company analysis

Future values calculated using the current 1-year forward calendar P/E of 16.5x and the current 3-year average 1-year forward P/E of 19.6x

Present Value discounted at 12.0%. Solar's current cost of equity

10.7%

15.1%

$55.07

$35.00

This analysis is not CSFB's view on the future value of the stock as there are many factors that contribute or affect its value.

CREDIT FIRST

SUISSE BOSTON

5View entire presentation