Investor Presentation

FINANCIALS

TECHNOLOGY

ST

5

ENERGY EVOLUTION

NATURAL RESOURCES

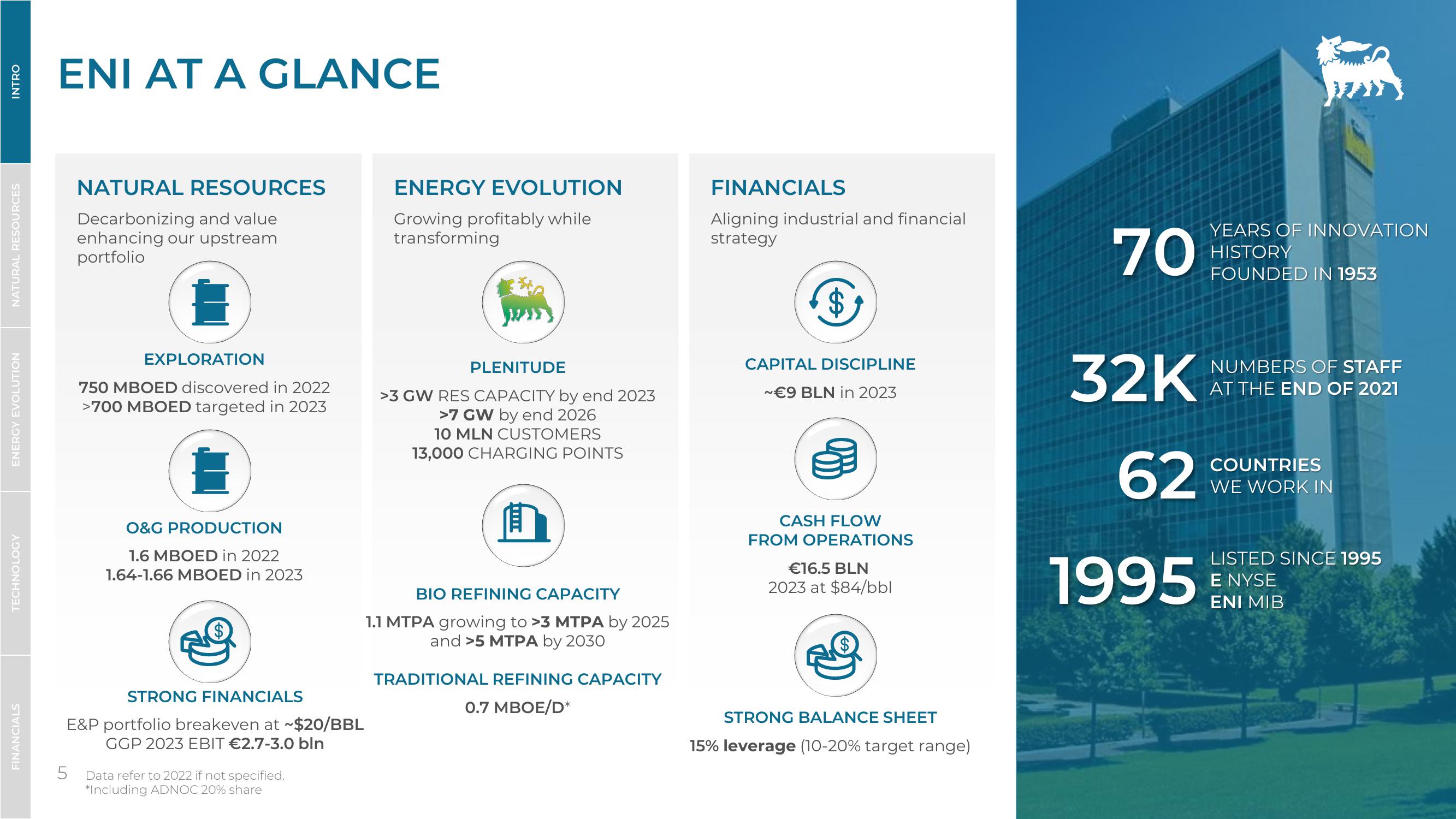

ENI AT A GLANCE

NATURAL RESOURCES

Decarbonizing and value

enhancing our upstream

portfolio

EXPLORATION

750 MBOED discovered in 2022

>700 MBOED targeted in 2023

O&G PRODUCTION

1.6 MBOED in 2022

1.64-1.66 MBOED in 2023

STRONG FINANCIALS

E&P portfolio breakeven at ~$20/BBL

GGP 2023 EBIT €2.7-3.0 bln

Data refer to 2022 if not specified.

*Including ADNOC 20% share

ENERGY EVOLUTION

Growing profitably while

transforming

PLENITUDE

>3 GW RES CAPACITY by end 2023

>7 GW by end 2026

10 MLN CUSTOMERS

13,000 CHARGING POINTS

BIO REFINING CAPACITY

1.1 MTPA growing to >3 MTPA by 2025

and >5 MTPA by 2030

TRADITIONAL REFINING CAPACITY

0.7 MBOE/D*

FINANCIALS

Aligning industrial and financial

strategy

$

CAPITAL DISCIPLINE

~€9 BLN in 2023

P

CASH FLOW

FROM OPERATIONS

€16.5 BLN

2023 at $84/bbl

STRONG BALANCE SHEET

15% leverage (10-20% target range)

70

32K

YEARS OF INNOVATION

HISTORY

FOUNDED IN 1953

NUMBERS OF STAFF

AT THE END OF 2021

COUNTRIES

WE WORK IN

62

1995 ENIMI

LISTED SINCE 1995

NYSEView entire presentation