Blackwells Capital Activist Presentation Deck

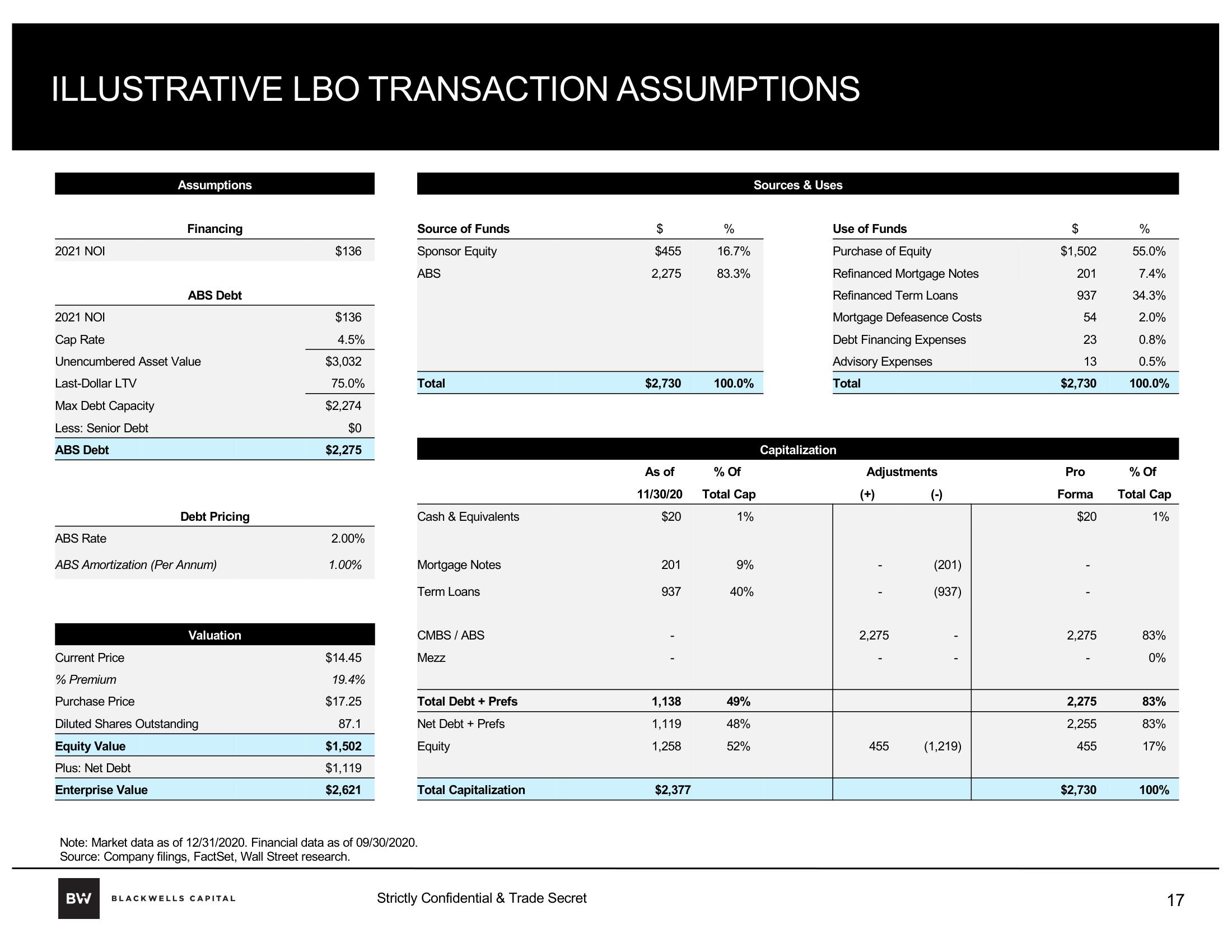

ILLUSTRATIVE LBO TRANSACTION ASSUMPTIONS

2021 NOI

Assumptions

Financing

ABS Debt

2021 NOI

Cap Rate

Unencumbered Asset Value

Last-Dollar LTV

Max Debt Capacity

Less: Senior Debt

ABS Debt

Debt Pricing

ABS Rate

ABS Amortization (Per Annum)

Valuation

Current Price

% Premium

Purchase Price

Diluted Shares Outstanding

Equity Value

Plus: Net Debt

Enterprise Value

$136

BW BLACKWELLS CAPITAL

$136

4.5%

$3,032

75.0%

$2,274

$0

$2,275

2.00%

1.00%

$14.45

19.4%

$17.25

87.1

$1,502

$1,119

$2,621

Source of Funds

Sponsor Equity

ABS

Total

Cash & Equivalents

Mortgage Notes

Term Loans

CMBS / ABS

Mezz

Total Debt + Prefs

Net Debt + Prefs

Equity

Total Capitalization

Note: Market data as of 12/31/2020. Financial data as of 09/30/2020.

Source: Company filings, FactSet, Wall Street research.

Strictly Confidential & Trade Secret

$

$455

2,275

$2,730

As of

11/30/20

$20

201

937

1,138

1,119

1,258

$2,377

%

16.7%

83.3%

100.0%

% Of

Total Cap

1%

9%

40%

Sources & Uses

49%

48%

52%

Use of Funds

Purchase of Equity

Refinanced Mortgage Notes

Refinanced Term Loans

Mortgage Defeasence Costs

Debt Financing Expenses

Advisory Expenses

Total

Capitalization

Adjustments

(+)

2,275

455

(-)

(201)

(937)

(1,219)

$

$1,502

201

937

54

23

13

$2,730

Pro

Forma

$20

2,275

2,275

2,255

455

$2,730

%

55.0%

7.4%

34.3%

2.0%

0.8%

0.5%

100.0%

% Of

Total Cap

1%

83%

0%

83%

83%

17%

100%

17View entire presentation