Enact IPO Presentation Deck

Enact | Investor Presentation

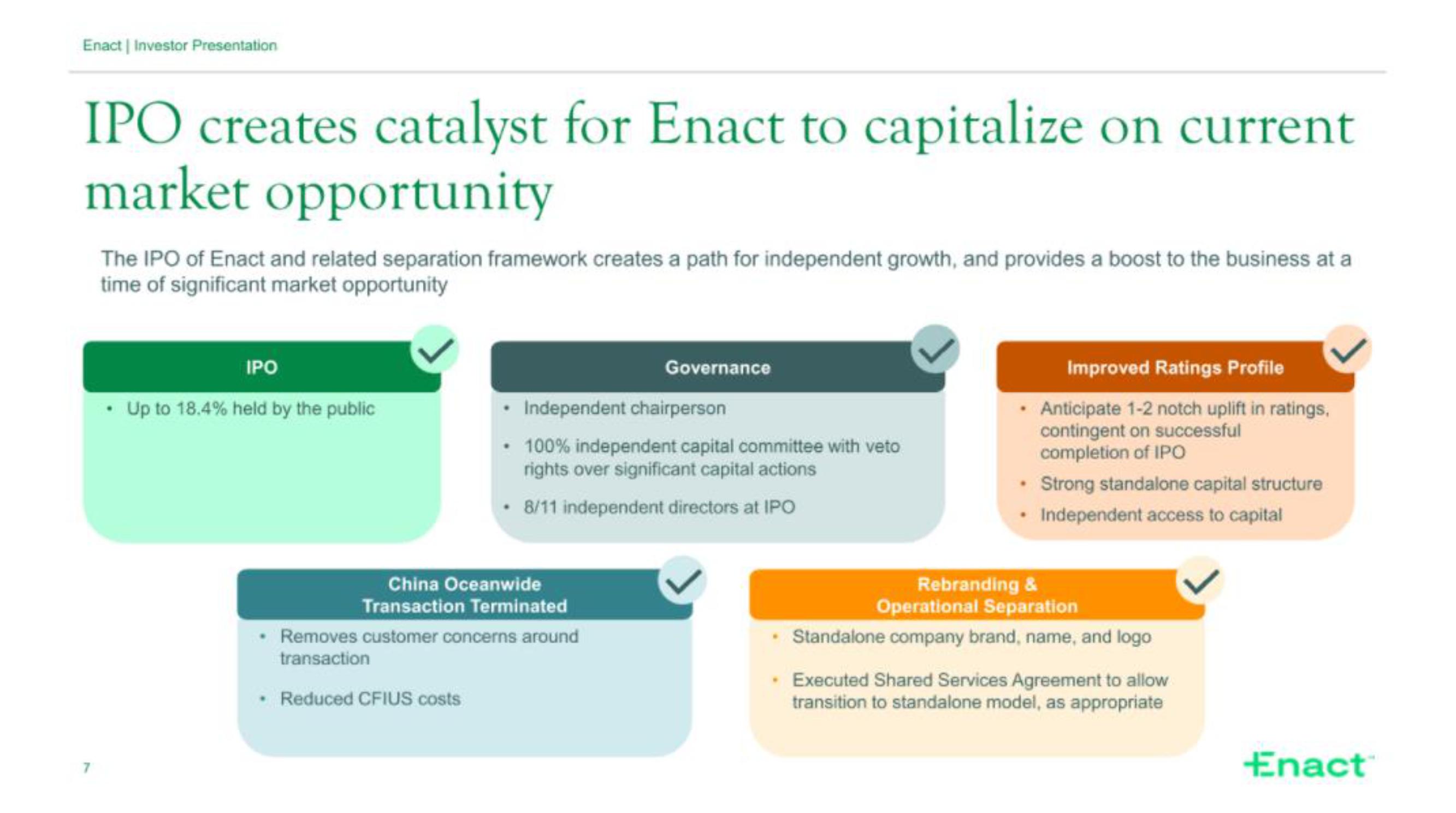

IPO creates catalyst for Enact to capitalize on current

market opportunity

The IPO of Enact and related separation framework creates a path for independent growth, and provides a boost to the business at a

time of significant market opportunity

IPO

Up to 18.4% held by the public

Independent chairperson

100% independent capital committee with veto

rights over significant capital actions

8/11 independent directors at IPO

China Oceanwide

Transaction Terminated

Governance

Removes customer concerns around

transaction

• Reduced CFIUS costs

Improved Ratings Profile

. Anticipate 1-2 notch uplift in ratings,

contingent on successful

completion of IPO

. Strong standalone capital structure

• Independent access to capital

Rebranding &

Operational Separation

• Standalone company brand, name, and logo

• Executed Shared Services Agreement to allow

transition to standalone model, as appropriate

EnactView entire presentation