BMO Capital Markets Investment Banking Pitch Book

BMO Capital Markets

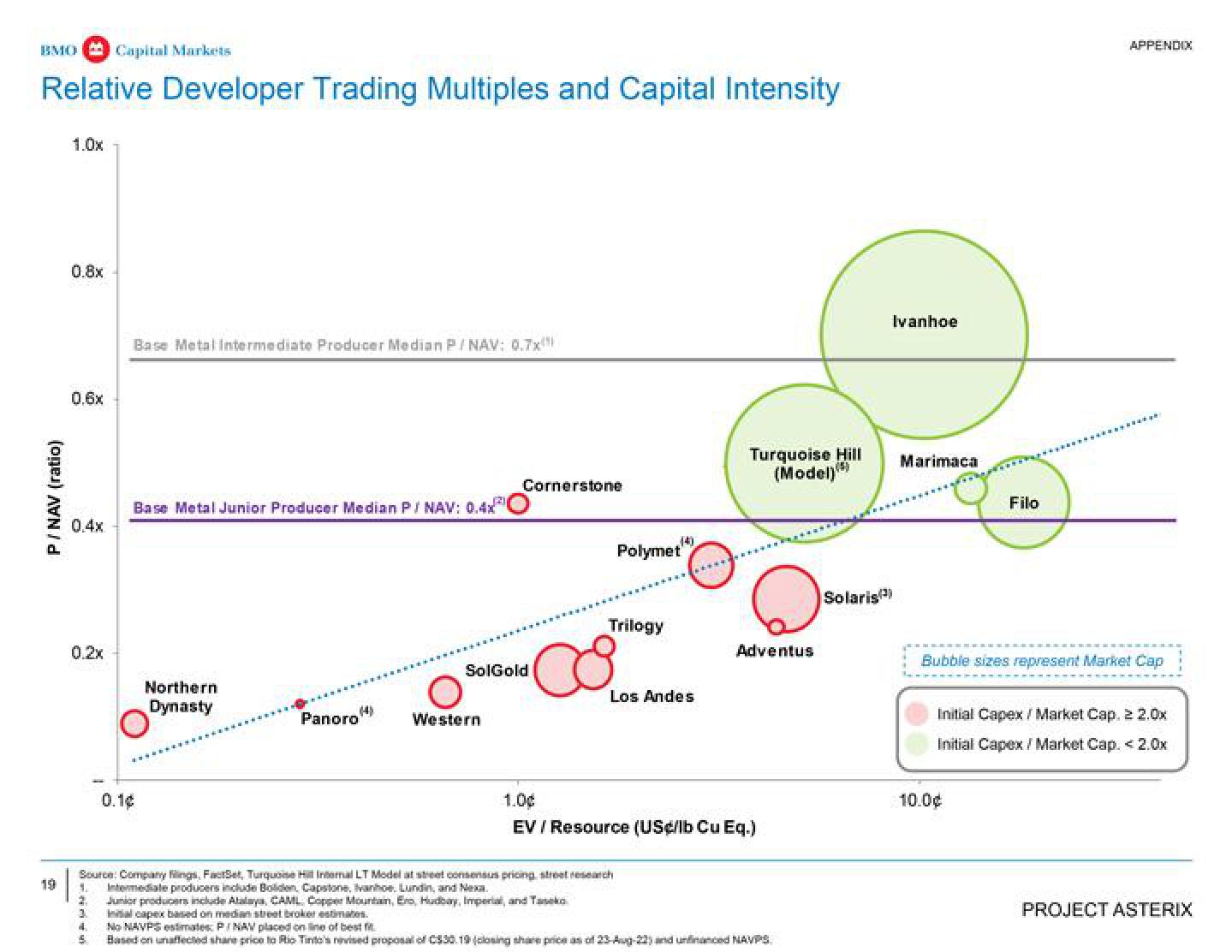

Relative Developer Trading Multiples and Capital Intensity

P/NAV (ratio)

19

1.0x

0.8x

0.6x

0.4x

0.2x

Base Metal Intermediate Producer Median P/NAV: 0.7x

Trinida

Base Metal Junior Producer Median P/ NAV: 0.4x

0.1¢

Northern

Dynasty

((4)

Panoro

Cornerstone

Western

SolGold

CO

1.0¢

Trilogy

Polymet

Source: Company Fings, FactSet, Turquoise Hill Internal LT Model at street consensus pricing, street research

Intermediate producers include Bolden, Capstone, Ivanhoe. Lundin, and Nexa

2. Junior producers include Atalaya, CAML Copper Mountan, Ero, Hudbay, Imperial, and Taseko

******

Los Andes

EV/Resource (US¢/lb Cu Eq.)

Turquoise Hill Marimaca

(Model)

Adventus

Ivanhoe

Intalcapex based on median street broker estimates.

4. No NAVPS estimates: P/NAV placed on line of best

Based on unaffected share price to Rio Tinto's revised proposal of C$30.19 (closing share price as of 23-Aug-22) and unfinanced NAVPS

Solaris)

Filo

APPENDIX

Bubble sizes represent Market Cap

10.0¢

Initial Capex / Market Cap. 22.0x

Initial Capex / Market Cap. < 2.0x

PROJECT ASTERIXView entire presentation