Goldman Sachs Results Presentation Deck

Financial Overview

$ in millions,

except per share amounts

Global Banking & Markets

Asset & Wealth Management

Platform Solutions

Net revenues

Provision for credit losses

Operating expenses

Pre-tax earnings $

Net earnings

Net earnings to common $

Diluted EPS $

ROE¹

ROTE¹

Efficiency Ratio³

Financial Results

2Q23

7,189

3,047

659

10,895

615

8,544

1,736

1,216

1,071

3.08

4.0%

4.4%

78.4%

VS.

1Q23

(15)%

(5)%

17%

(11)%

N.M.

2%

(57)%

(62)%

(65)%

(65)%

(7.6)pp

(8.2)pp

9.7pp

VS.

2Q22

(14)%$

(4)%

92%

(8)%

(8)%

12%

(58)%$

2Q23

YTD

15,633

13.9pp

6,263

1,223

23,119

444

(51) % $ 5,729

16,946

4,450

(62)% $ 4,158

(60)% $ 11.91

(6.6)pp

(7.0)pp

7.8%

8.5%

73.3%

VS.

2Q22

YTD

(15)%

8%

100%

(7)%

(64)%

10%

(30)%

(35)%

(37)%

(36)%

(5.0)pp

(5.1)pp

11.3pp

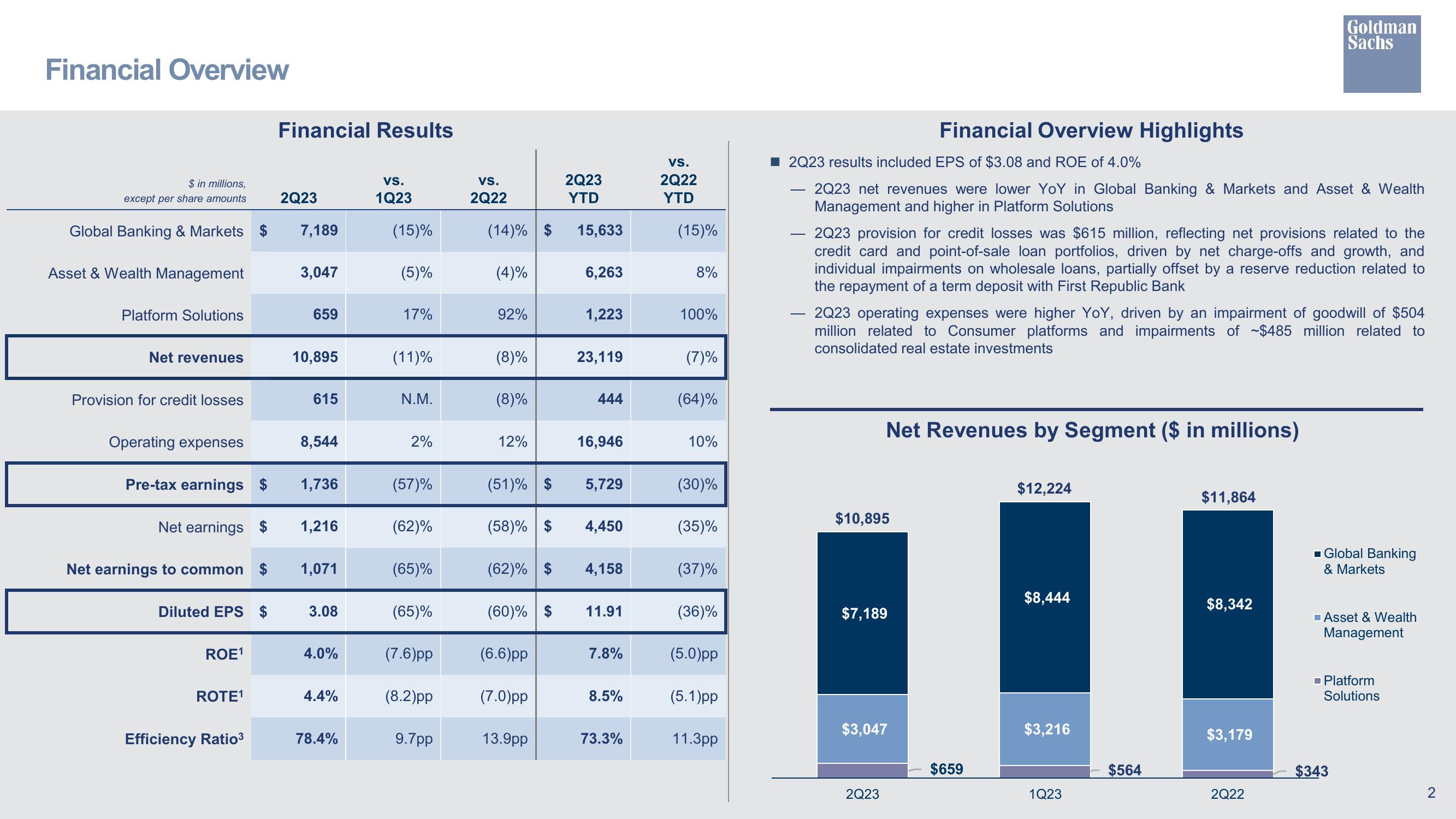

■2Q23 results included EPS of $3.08 and ROE of 4.0%

2Q23 net revenues were lower YoY in Global Banking & Markets and Asset & Wealth

Management and higher in Platform Solutions

2Q23 provision for credit losses was $615 million, reflecting net provisions related to the

credit card and point-of-sale loan portfolios, driven by net charge-offs and growth, and

individual impairments on wholesale loans, partially offset by a reserve reduction related to

the repayment of a term deposit with First Republic Bank

Financial Overview Highlights

2Q23 operating expenses were higher YoY, driven by an impairment of goodwill of $504

million related to Consumer platforms and impairments of $485 million related to

consolidated real estate investments

$10,895

Net Revenues by Segment ($ in millions)

$7,189

$3,047

2Q23

$659

$12,224

$8,444

$3,216

1Q23

$564

$11,864

$8,342

Goldman

Sachs

$3,179

2Q22

■ Global Banking

& Markets

Asset & Wealth

Management

■Platform

Solutions

$343

2View entire presentation