Affirm Investor Day Presentation Deck

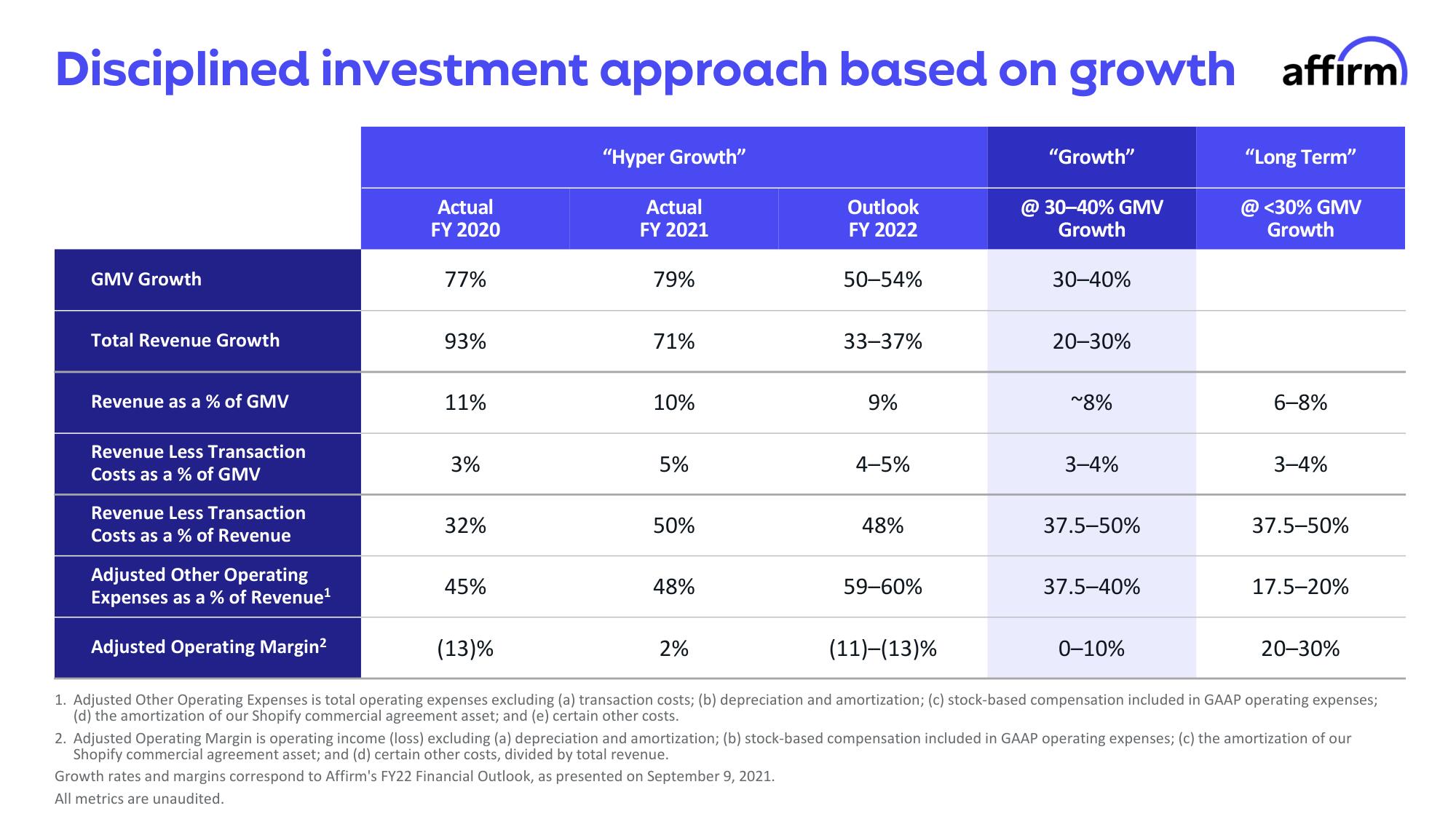

Disciplined investment approach based on growth

GMV Growth

Total Revenue Growth

Revenue as a % of GMV

Revenue Less Transaction

Costs as a % of GMV

Revenue Less Transaction

Costs as a % of Revenue

Adjusted Other Operating

Expenses as a % of Revenue¹

Adjusted Operating Margin²

Actual

FY 2020

77%

93%

11%

3%

32%

45%

"Hyper Growth"

Actual

FY 2021

79%

71%

10%

5%

50%

48%

Outlook

FY 2022

2%

50-54%

33-37%

9%

4-5%

48%

59-60%

"Growth"

@ 30-40% GMV

Growth

30-40%

20-30%

~8%

3-4%

37.5-50%

37.5-40%

affirm

0-10%

"Long Term"

<30% GMV

Growth

6-8%

3-4%

37.5-50%

(13)%

(11)-(13) %

1. Adjusted Other Operating Expenses is total operating expenses excluding (a) transaction costs; (b) depreciation and amortization; (c) stock-based compensation included in GAAP operating expenses;

(d) the amortization of our Shopify commercial agreement asset; and (e) certain other costs.

17.5-20%

20-30%

2. Adjusted Operating Margin is operating income (loss) excluding (a) depreciation and amortization; (b) stock-based compensation included in GAAP operating expenses; (c) the amortization of our

Shopify commercial agreement asset; and (d) certain other costs, divided by total revenue.

Growth rates and margins correspond to Affirm's FY22 Financial Outlook, as presented on September 9, 2021.

All metrics are unaudited.View entire presentation