Allwyn Investor Presentation Deck

Positive Tailwinds

Allwyn is one of the

largest multi-market

lottery operator

●

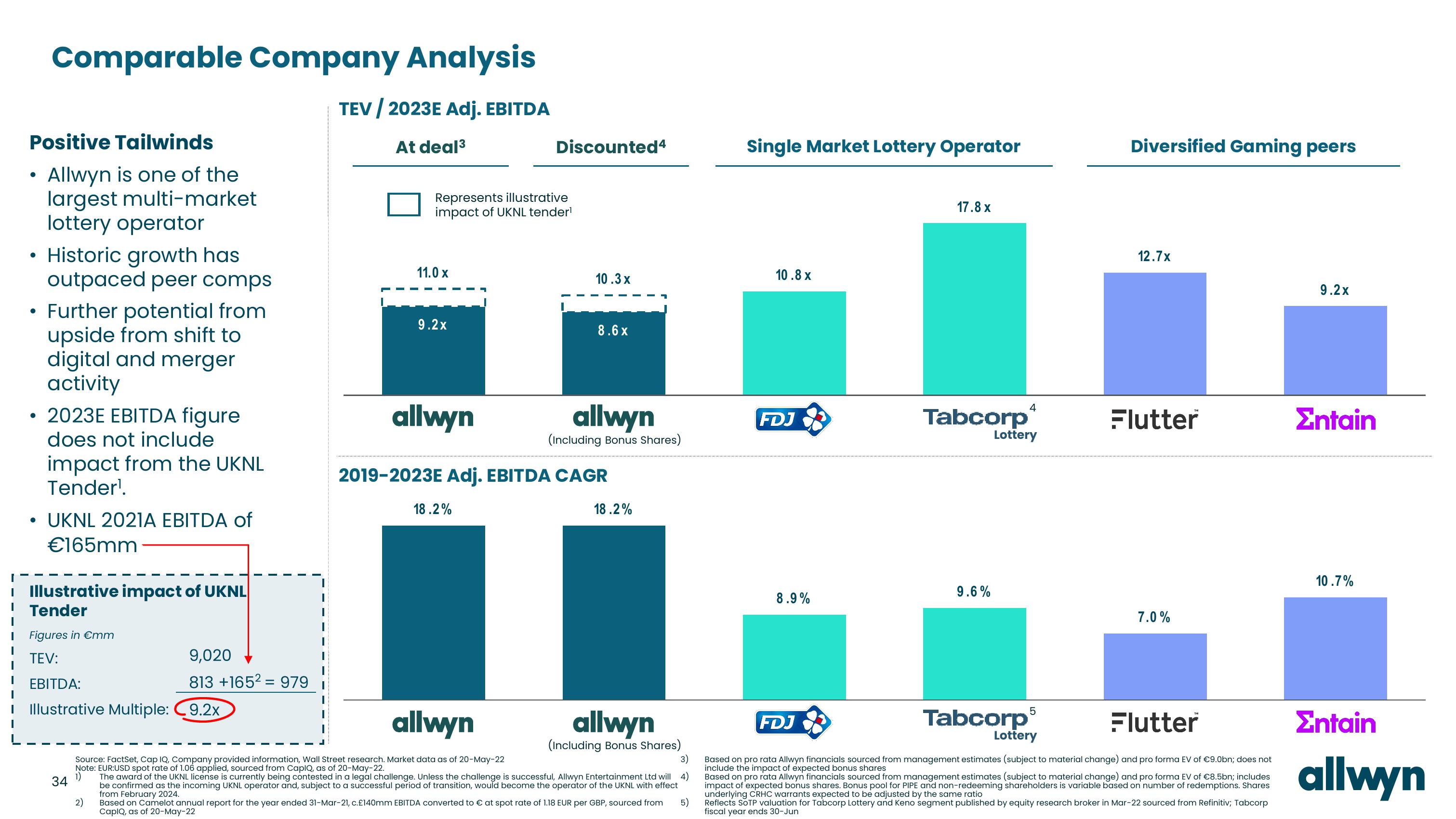

Comparable Company Analysis

TEV / 2023E Adj. EBITDA

At deal³

• Historic growth has

●

outpaced peer comps

• Further potential from

upside from shift to

digital and merger

activity

• 2023E EBITDA figure

does not include

impact from the UKNL

Tender¹.

●

UKNL 2021A EBITDA of

€165mm

Illustrative impact of UKNL

Tender

Figures in €mm

TEV:

EBITDA:

Illustrative Multiple: C9.2x

34

9,020

813 +165² 979

2)

Represents illustrative

impact of UKNL tender¹

11.0 x

9.2x

allwyn

Discounted 4

18.2%

10.3 x

8.6 x

allwyn

(Including Bonus Shares)

2019-2023E Adj. EBITDA CAGR

18.2%

allwyn

3)

Source: FactSet, Cap IQ, Company provided information, Wall Street research. Market data as of 20-May-22

Note: EUR:USD spot rate of 1.06 applied, sourced from CapIQ, as of 20-May-22.

1)

The award of the UKNL license is currently being contested in a legal challenge. Unless the challenge is successful, Allwyn Entertainment Ltd will 4)

be confirmed as the incoming UKNL operator and, subject to a successful period of transition, would become the operator of the UKNL with effect

from February 2024.

allwyn

(Including Bonus Shares)

Based on Camelot annual report for the year ended 31-Mar-21, c.£140mm EBITDA converted to € at spot rate of 1.18 EUR per GBP, sourced from 5)

CapIQ, as of 20-May-22

Single Market Lottery Operator

10.8 x

FDJ

8.9%

17.8 x

FDJ

Tabcorp

9.6%

4

Lottery

5

Diversified Gaming peers

12.7x

Flutter

Tabcorp

Flutter

Lottery

Based on pro rata Allwyn financials sourced from management estimates (subject to material change) and pro forma EV of €9.0bn; does not

include the impact of expected bonus shares

Based on pro rata Allwyn financials sourced from management estimates (subject to material change) and pro forma EV of €8.5bn; includes

impact of expected bonus shares. Bonus pool for PIPE and non-redeeming shareholders is variable based on number of redemptions. Shares

underlying CRHC warrants expected to be adjusted by the same ratio

Reflects SOTP valuation for Tabcorp Lottery and Keno segment published by equity research broker in Mar-22 sourced from Refinitiv; Tabcorp

fiscal year ends 30-Jun

7.0%

9.2x

Entain

10.7%

Σntain

allwynView entire presentation