Adtheorent SPAC Presentation Deck

Transaction Summary

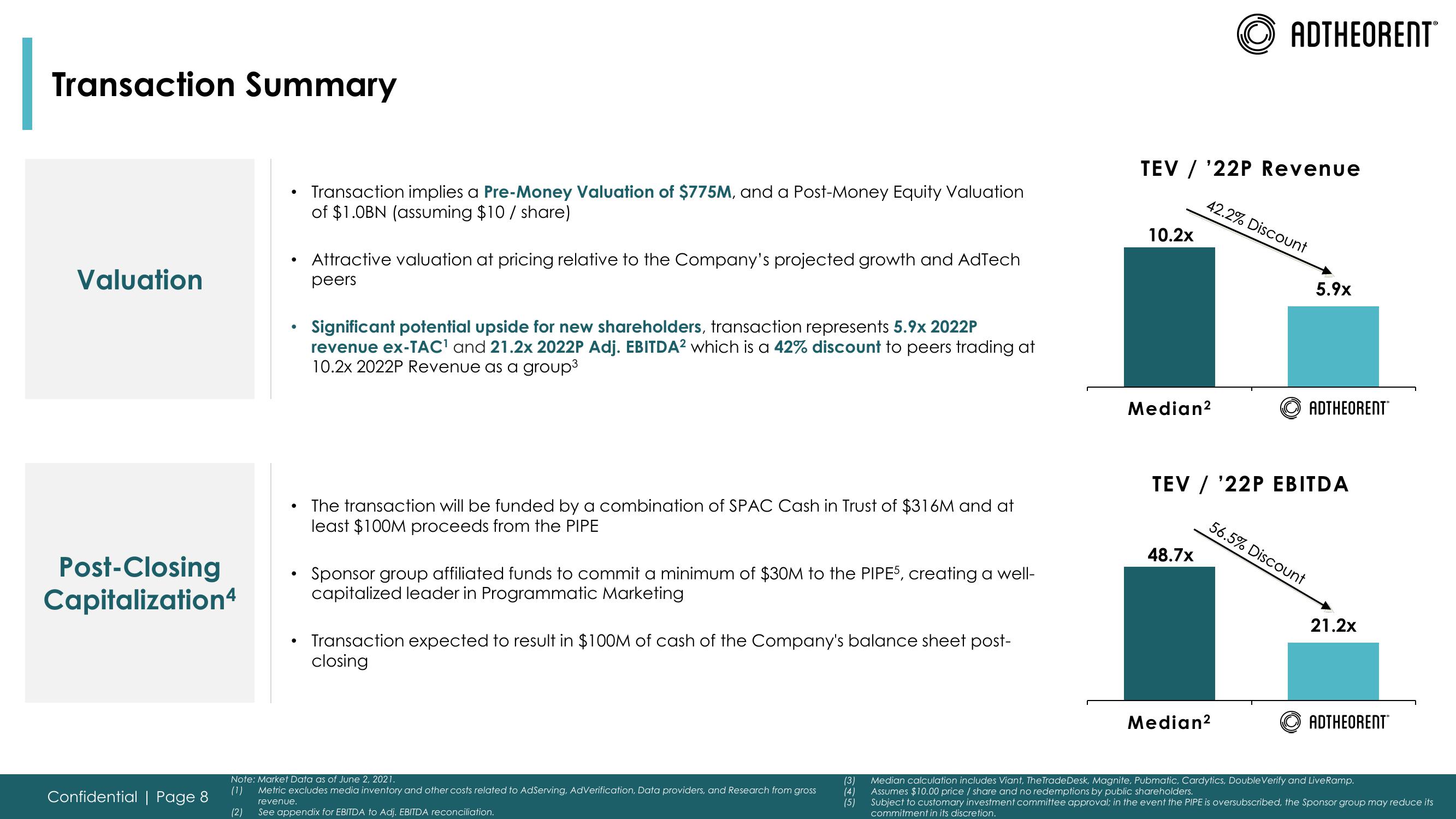

Valuation

Post-Closing

Capitalization4

Confidential | Page 8

●

●

●

●

Transaction implies a Pre-Money Valuation of $775M, and a Post-Money Equity Valuation

of $1.0BN (assuming $10/ share)

Attractive valuation at pricing relative to the Company's projected growth and AdTech

peers

Significant potential upside for new shareholders, transaction represents 5.9x 2022P

revenue ex-TAC¹ and 21.2x 2022P Adj. EBITDA² which is a 42% discount to peers trading at

10.2x 2022P Revenue as a group³

The transaction will be funded by a combination of SPAC Cash in Trust of $316M and at

least $100M proceeds from the PIPE

Sponsor group affiliated funds to commit a minimum of $30M to the PIPE5, creating a well-

capitalized leader in Programmatic Marketing

Transaction expected to result in $100M of cash of the Company's balance sheet post-

closing

Note: Market Data as of June 2, 2021.

(1) Metric excludes media inventory and other costs related to AdServing, AdVerification, Data providers, and Research from gross

revenue.

(2) See appendix for EBITDA to Adj. EBITDA reconciliation.

(3)

(4)

(5)

TEV / '22P Revenue

10.2x

Median²

ADTHEORENT

42.2% Discount

48.7x

Median²

5.9x

TEV / '22P EBITDA

ADTHEORENT

56.5% Discount

21.2x

ADTHEORENT™

Median calculation includes Viant, TheTrade Desk, Magnite, Pubmatic, Cardytics, Double Verify and Live Ramp.

Assumes $10.00 price / share and no redemptions by public shareholders.

Subject to customary investment committee approval; in the event the PIPE is oversubscribed, the Sponsor group may reduce its

commitment in its discretion.View entire presentation