Spirit Mergers and Acquisitions Presentation Deck

》》》

ta

Inn$

R 7

ку

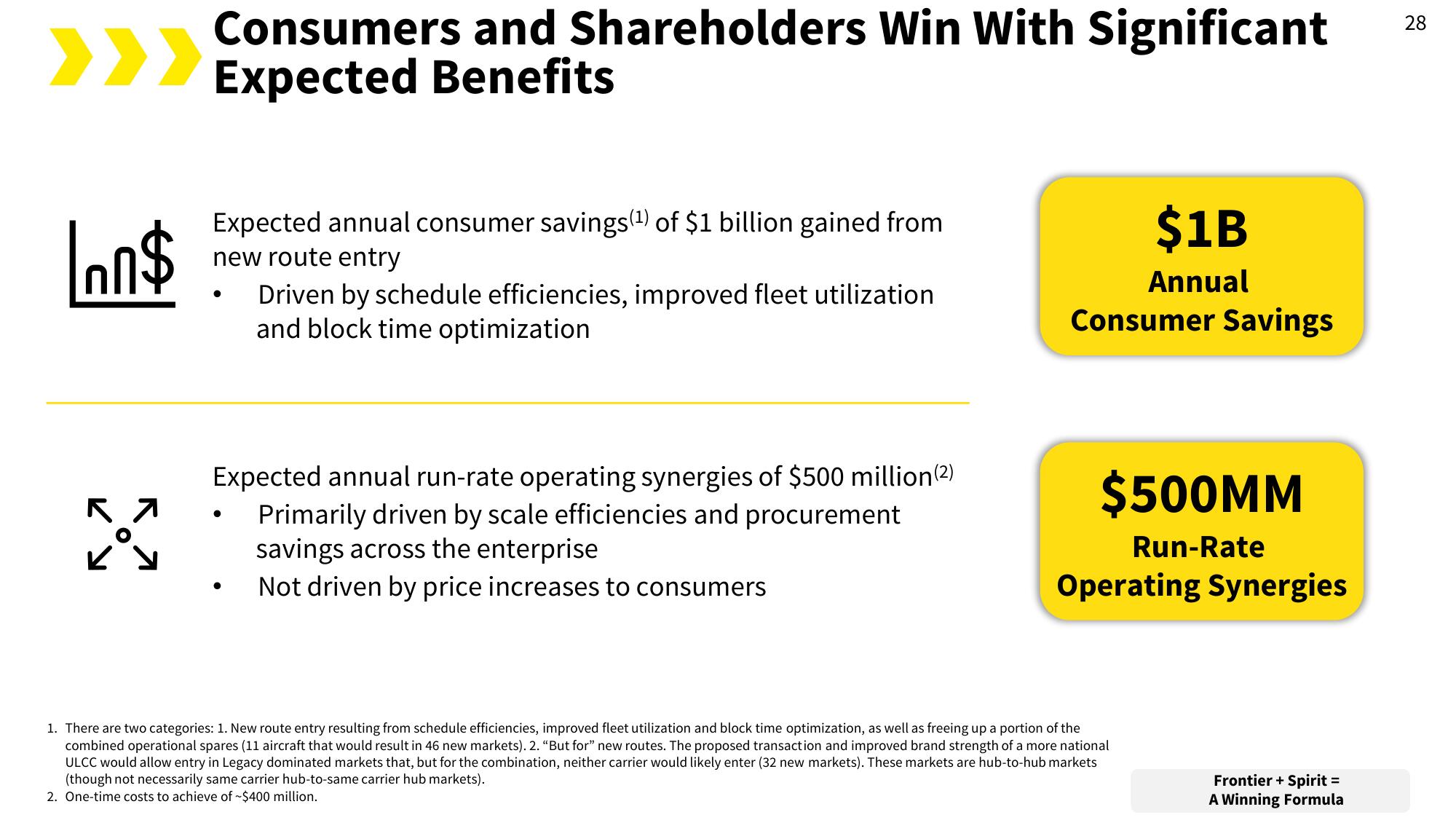

Consumers and Shareholders Win With Significant

Expected Benefits

Expected annual consumer savings(¹) of $1 billion gained from

new route entry

Expected annual run-rate operating synergies of $500 million (²)

Primarily driven by scale efficiencies and procurement

savings across the enterprise

Not driven by price increases to consumers

●

Driven by schedule efficiencies, improved fleet utilization

and block time optimization

●

$1B

Annual

Consumer Savings

$500MM

Run-Rate

Operating Synergies

1. There are two categories: 1. New route entry resulting from schedule efficiencies, improved fleet utilization and block time optimization, as well as freeing up a portion of the

combined operational spares (11 aircraft that would result in 46 new markets). 2. "But for" new routes. The proposed transaction and improved brand strength of a more national

ULCC would allow entry in Legacy dominated markets that, but for the combination, neither carrier would likely enter (32 new markets). These markets are hub-to-hub markets

(though not necessarily same carrier hub-to-same carrier hub markets).

2. One-time costs to achieve of ~$400 million.

Frontier + Spirit =

A Winning Formula

28View entire presentation