Rent The Runway Results Presentation Deck

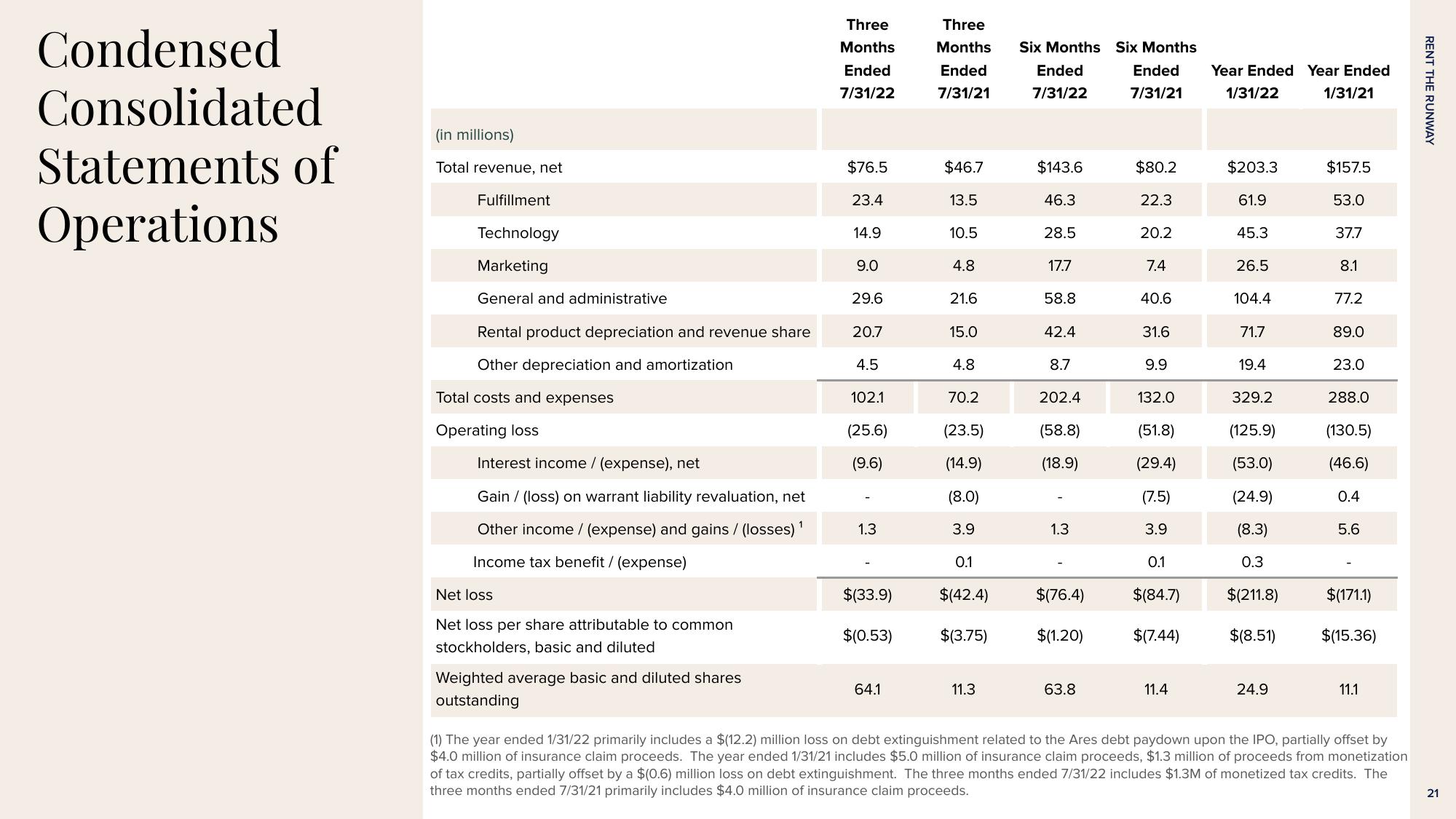

Condensed

Consolidated

Statements of

Operations

(in millions)

Total revenue, net

Fulfillment

Technology

Marketing

General and administrative

Rental product depreciation and revenue share

Other depreciation and amortization

Total costs and expenses

Operating loss

Interest income / (expense), net

1

Gain (loss) on warrant liability revaluation, net

Other income / (expense) and gains / (losses) ¹

Income tax benefit / (expense)

Net loss

Net loss per share attributable to common

stockholders, basic and diluted

Weighted average basic and diluted shares

outstanding

Three

Months

Ended

7/31/22

$76.5

23.4

14.9

9.0

29.6

20.7

4.5

102.1

(25.6)

(9.6)

1.3

$(33.9)

$(0.53)

64.1

Three

Months

Ended

7/31/21

$46.7

13.5

10.5

4.8

21.6

15.0

4.8

70.2

(23.5)

(14.9)

(8.0)

3.9

0.1

$(42.4)

$(3.75)

11.3

Six Months Six Months

Ended

7/31/22

Ended

7/31/21

$143.6

46.3

28.5

17.7

58.8

42.4

8.7

202.4

(58.8)

(18.9)

1.3

$(76.4)

$(1.20)

63.8

$80.2

22.3

20.2

7.4

40.6

31.6

9.9

132.0

(51.8)

(29.4)

(7.5)

3.9

0.1

$(84.7)

$(7.44)

11.4

Year Ended Year Ended

1/31/22 1/31/21

$203.3

61.9

45.3

26.5

104.4

71.7

19.4

329.2

(125.9)

(53.0)

(24.9)

(8.3)

0.3

$(211.8)

$(8.51)

24.9

$157.5

53.0

37.7

8.1

77.2

89.0

23.0

288.0

(130.5)

(46.6)

0.4

5.6

$(171.1)

$(15.36)

11.1

(1) The year ended 1/31/22 primarily includes a $(12.2) million loss on debt extinguishment related to the Ares debt paydown upon the IPO, partially offset by

$4.0 million of insurance claim proceeds. The year ended 1/31/21 includes $5.0 million of insurance claim proceeds, $1.3 million of proceeds from monetization

of tax credits, partially offset by a $(0.6) million loss on debt extinguishment. The three months ended 7/31/22 includes $1.3M of monetized tax credits. The

three months ended 7/31/21 primarily includes $4.0 million of insurance claim proceeds.

RENT THE RUNWAY

21View entire presentation