Vale Investor Conference Presentation Deck

2022 BofA Securities Global Metals, Mining & Steel Conference

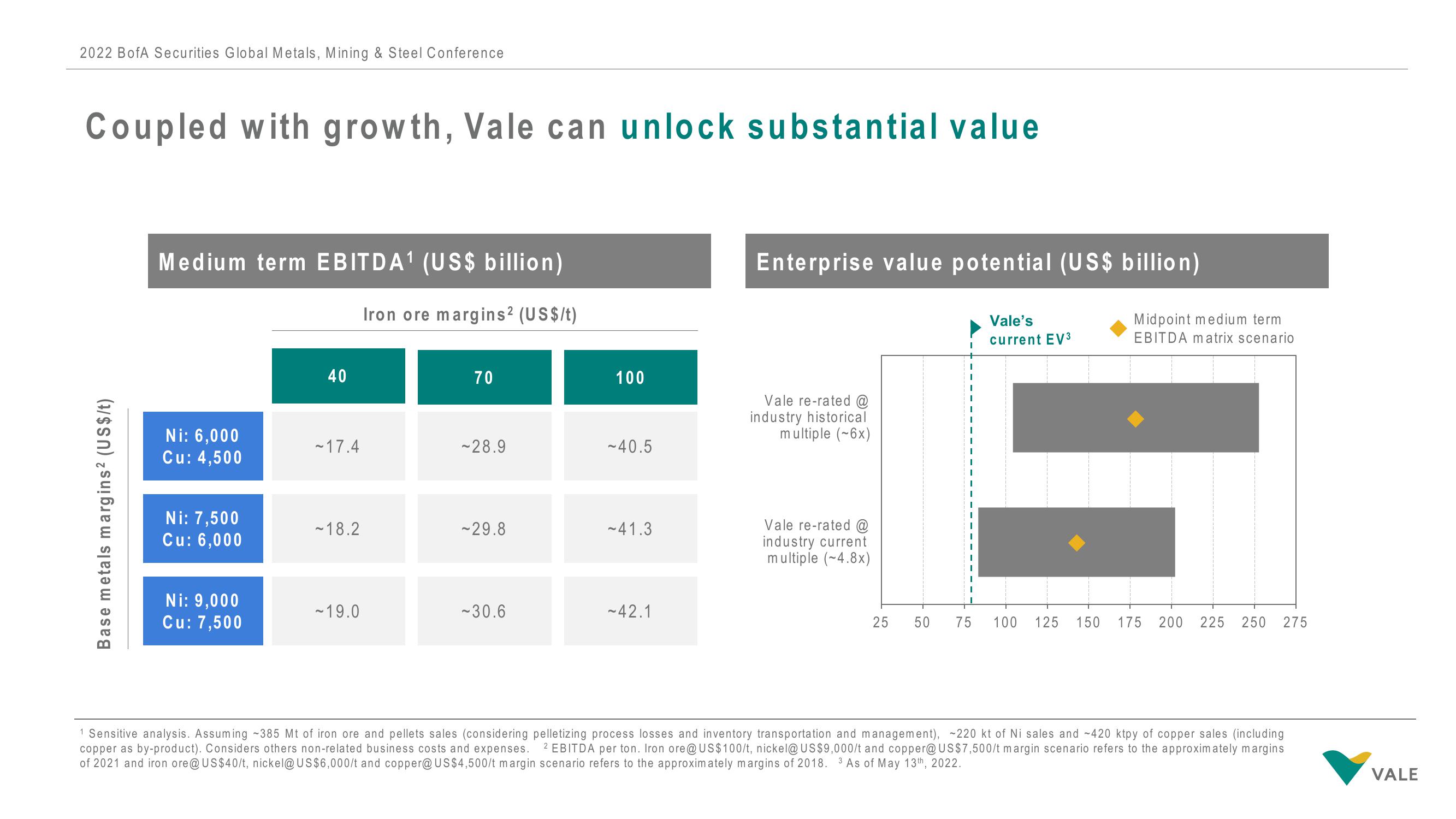

Coupled with growth, Vale can unlock substantial value

Base metals margins ² (US$/t)

Medium term EBITDA¹ (US$ billion)

Iron ore margins ² (US$/t)

Ni: 6,000

Cu: 4,500

Ni: 7,500

Cu: 6,000

Ni: 9,000

Cu: 7,500

40

~17.4

~18.2

-19.0

70

~28.9

~29.8

-30.6

100

~40.5

-41.3

~42.1

Enterprise value potential (US$ billion)

Vale's

current EV³

Vale re-rated @

industry historical

multiple (~6x)

Vale re-rated @

industry current

multiple (~4.8x)

25 50

I

75 100 125 150

Midpoint medium term

EBITDA matrix scenario

175 200 225 250 275

1 Sensitive analysis. Assuming -385 Mt of iron ore and pellets sales (considering pelletizing process losses and inventory transportation and management), ~220 kt of Ni sales and 420 ktpy of copper sales (including

copper as by-product). Considers others non-related business costs and expenses. 2 EBITDA per ton. Iron ore@US$100/t, nickel@ US$9,000/t and copper@US$7,500/t margin scenario refers to the approximately margins

of 2021 and iron ore@US$40/t, nickel@US$6,000/t and copper@ US$4,500/t margin scenario refers to the approximately margins of 2018. 3 As of May 13th, 2022.

VALEView entire presentation