Ocado Results Presentation Deck

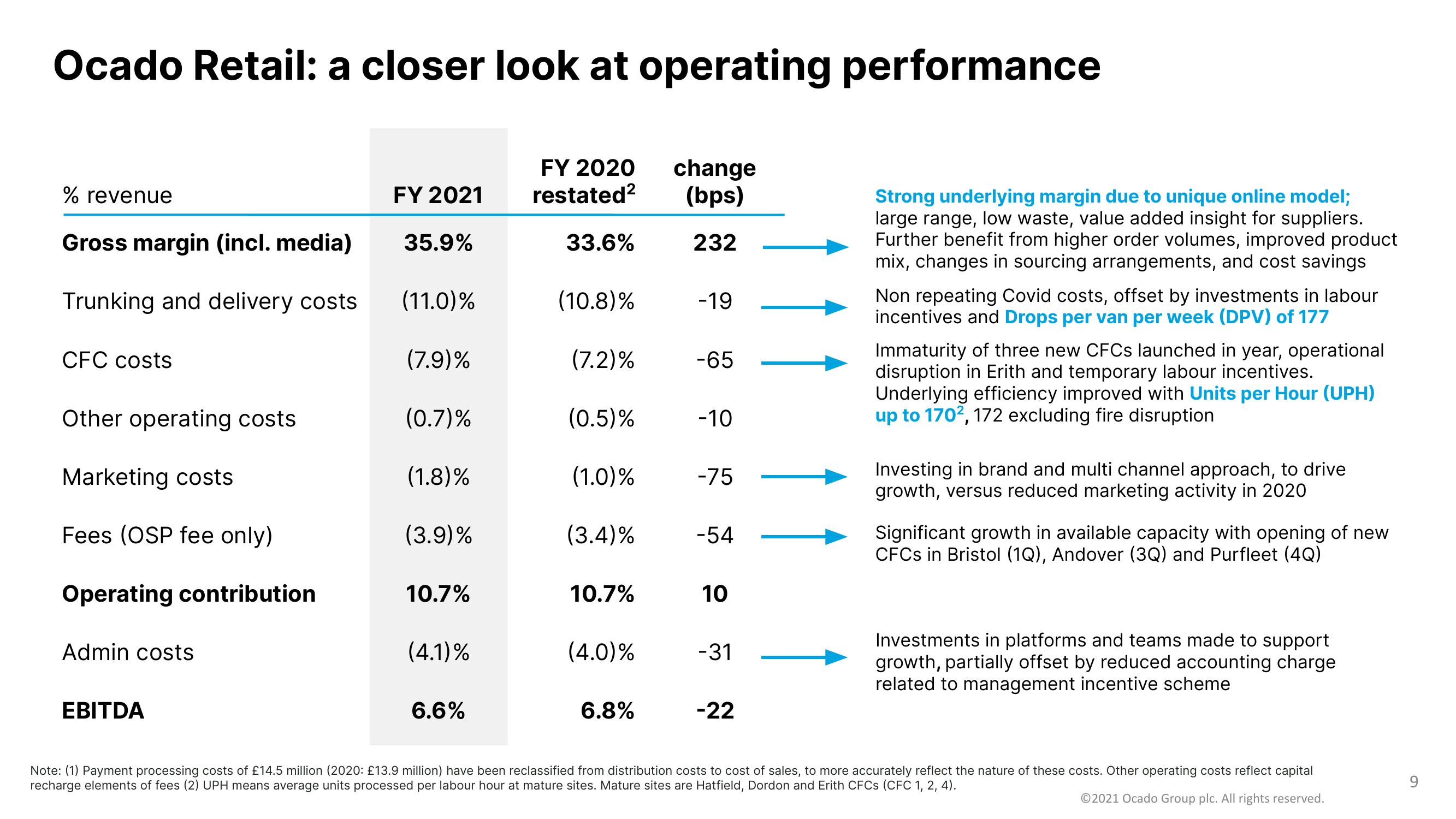

Ocado Retail: a closer look at operating performance

FY 2020 change

restated² (bps)

232

% revenue

Gross margin (incl. media)

Trunking and delivery costs

CFC costs

Other operating costs

Marketing costs

Fees (OSP fee only)

Operating contribution

Admin costs

EBITDA

FY 2021

35.9%

(11.0)%

(7.9)%

(0.7)%

(1.8)%

(3.9)%

10.7%

(4.1)%

6.6%

33.6%

(10.8)%

(7.2)%

(0.5)%

(1.0)%

(3.4)%

10.7%

(4.0)%

6.8%

-19

-65

-10

-75

-54

10

-31

-22

Strong underlying margin due to unique online model;

large range, low waste, value added insight for suppliers.

Further benefit from higher order volumes, improved product

mix, changes in sourcing arrangements, and cost savings

Non repeating Covid costs, offset by investments in labour

incentives and Drops per van per week (DPV) of 177

Immaturity of three new CFCs launched in year, operational

disruption in Erith and temporary labour incentives.

Underlying efficiency improved with Units per Hour (UPH)

up to 170², 172 excluding fire disruption

Investing in brand and multi channel approach, to drive

growth, versus reduced marketing activity in 2020

Significant growth in available capacity with opening of new

CFCs in Bristol (1Q), Andover (3Q) and Purfleet (4Q)

Investments in platforms and teams made to support

growth, partially offset by reduced accounting charge

related to management incentive scheme

Note: (1) Payment processing costs of £14.5 million (2020: £13.9 million) have been reclassified from distribution costs to cost of sales, to more accurately reflect the nature of these costs. Other operating costs reflect capital

recharge elements of fees (2) UPH means average units processed per labour hour at mature sites. Mature sites are Hatfield, Dordon and Erith CFCs (CFC 1, 2, 4).

Ⓒ2021 Ocado Group plc. All rights reserved.

9View entire presentation