Tudor, Pickering, Holt & Co Investment Banking

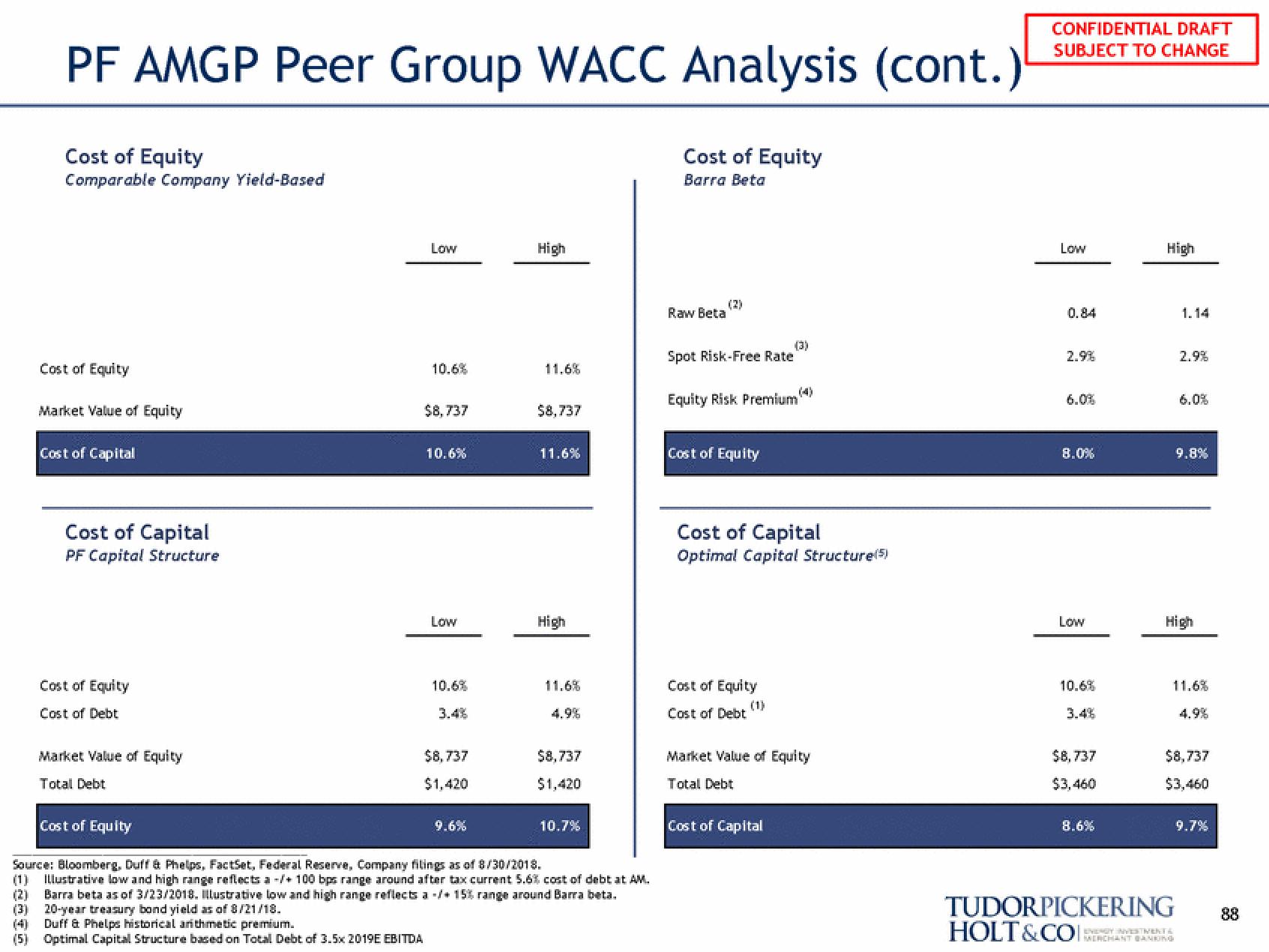

PF AMGP Peer Group WACC Analysis (cont.)

Cost of Equity

Comparable Company Yield-Based

Cost of Equity

Market Value of Equity

Cost of Capital

Cost of Capital

PF Capital Structure

Cost of Equity

Cost of Debt

Market Value of Equity

Total Debt

Cost of Equity

Low

Duff & Phelps historical arithmetic premium.

(5) Optimal Capital Structure based on Total Debt of 3.5x 2019E EBITDA

10.6%

$8,737

10.6%

Low

10.6%

3.4%

$8,737

$1,420

9.6%

High

11.6%

$8,737

11.6%

High

11.6%

4.9%

$8,737

$1,420

10.7%

Source: Bloomberg, Duff & Phelps, FactSet, Federal Reserve, Company filings as of 8/30/2018.

(1) Illustrative low and high range reflects a -/+ 100 bps range around after tax current 5.6% cost of debt at AM.

(2) Barra beta as of 3/23/2018. Illustrative low and high range reflects a -/+ 15% range around Barra beta.

(3) 20-year treasury bond yield as of 8/21/18.

Cost of Equity

Barra Beta

Raw Beta

(2)

Spot Risk-Free Rate

Equity Risk Premium

Cost of Equity

(3)

Cost of Capital

Optimal Capital Structure (5)

Cost of Equity

Cost of Debt

Market Value of Equity

Total Debt

Cost of Capital

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

Low

0.84

2.9%

6.0%

8.0%

Low

10.6%

$8,737

$3,460

8.6%

High

1.14

2.9%

6.0%

9.8%

High

11.6%

4.9%

$8,737

$3,460

9.7%

TUDORPICKERING 88

HOLT&COCHANT BANKINGView entire presentation