Baird Investment Banking Pitch Book

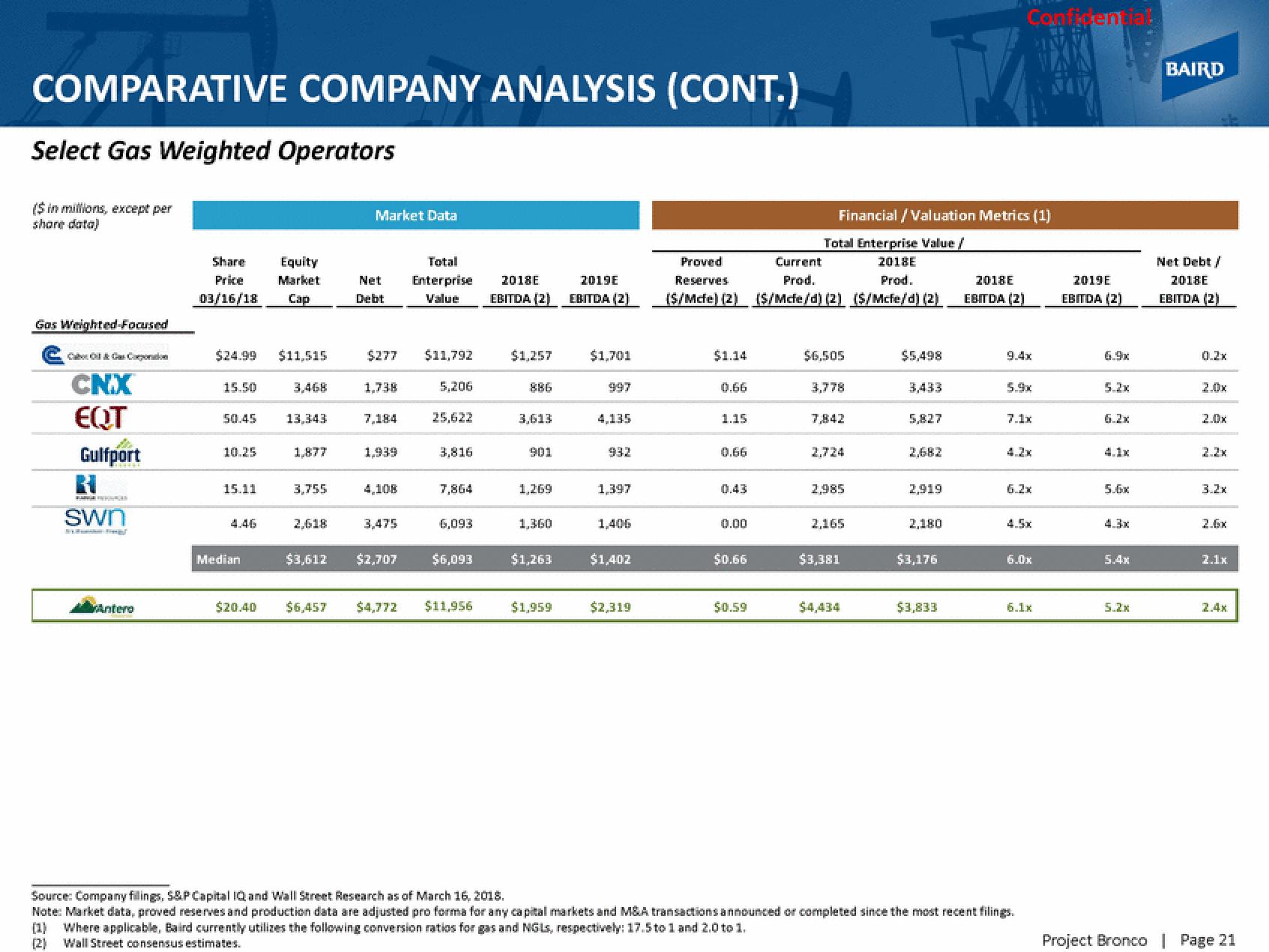

COMPARATIVE COMPANY ANALYSIS (CONT.)

Select Gas Weighted Operators

($ in millions, except per

share data)

Gas Weighted-Focused

CN.X

EQT

Gulfport

RI

BARUGA IN FONALAS

Swn

Sunt Fing!

Antero

Share

Price

03/16/18

$24.99 $11,515

15.50

50.45

10.25

15.11

Equity

Market

Cap

Median

3,468

13,343

1,877

3,755

2,618

Market Data

Net

Debt

$277

1,738

7,184

1,939

4,108

3,475

$3,612 $2,707

Total

Enterprise 2018E

Value EBITDA (2)

$11,792

5,206

25,622

3,816

7,864

6,093

$6,093

$20.40 $6,457 $4,772 $11,956

$1,257

3,613

901

1,269

1,360

$1,263

$1,959

2019E

EBITDA (2)

$1,701

997

4,135

932

1,397

1,406

$1,402

$2,319

Financial / Valuation Metrics (1)

Total Enterprise Value /

Proved

Current

2018E

Reserves

Prod.

Prod.

(S/Mcfe) (2) (S/Mcfe/d) (2) ($/Mcfe/d) (2)

$1.14

0.66

1.15

0.66

0.43

0.00

$0.66

$0.59

$6,505

3,778

7,842

2,985

2,165

$3,381

$4,434

$5,498

3,433

5,827

2,919

2,180

$3,176

$3,833

2018E

EBITDA (2)

Confidential

9.4x

5.9x

7.1x

6.2x

6.0x

6.1x

Source: Company filings, S&P Capital IQ and Wall Street Research as of March 16, 2018.

Note: Market data, proved reserves and production data are adjusted pro forma for any capital markets and M&A transactions announced or completed since the most recent filings.

(1) Where applicable, Baird currently utilizes the following conversion ratios for gas and NGLs, respectively: 17.5 to 1 and 2.0 to 1.

(2)

Wall Street consensus estimates.

2019E

EBITDA (2)

6.9x

5.2x

6.2x

5.6x

5.4x

5.2x

BAIRD

Net Debt /

2018E

EBITDA (2)

0.2x

2.0x

3.2x

2.1x

2.4x

Project Bronco | Page 21View entire presentation