Apollo Global Management Investor Day Presentation Deck

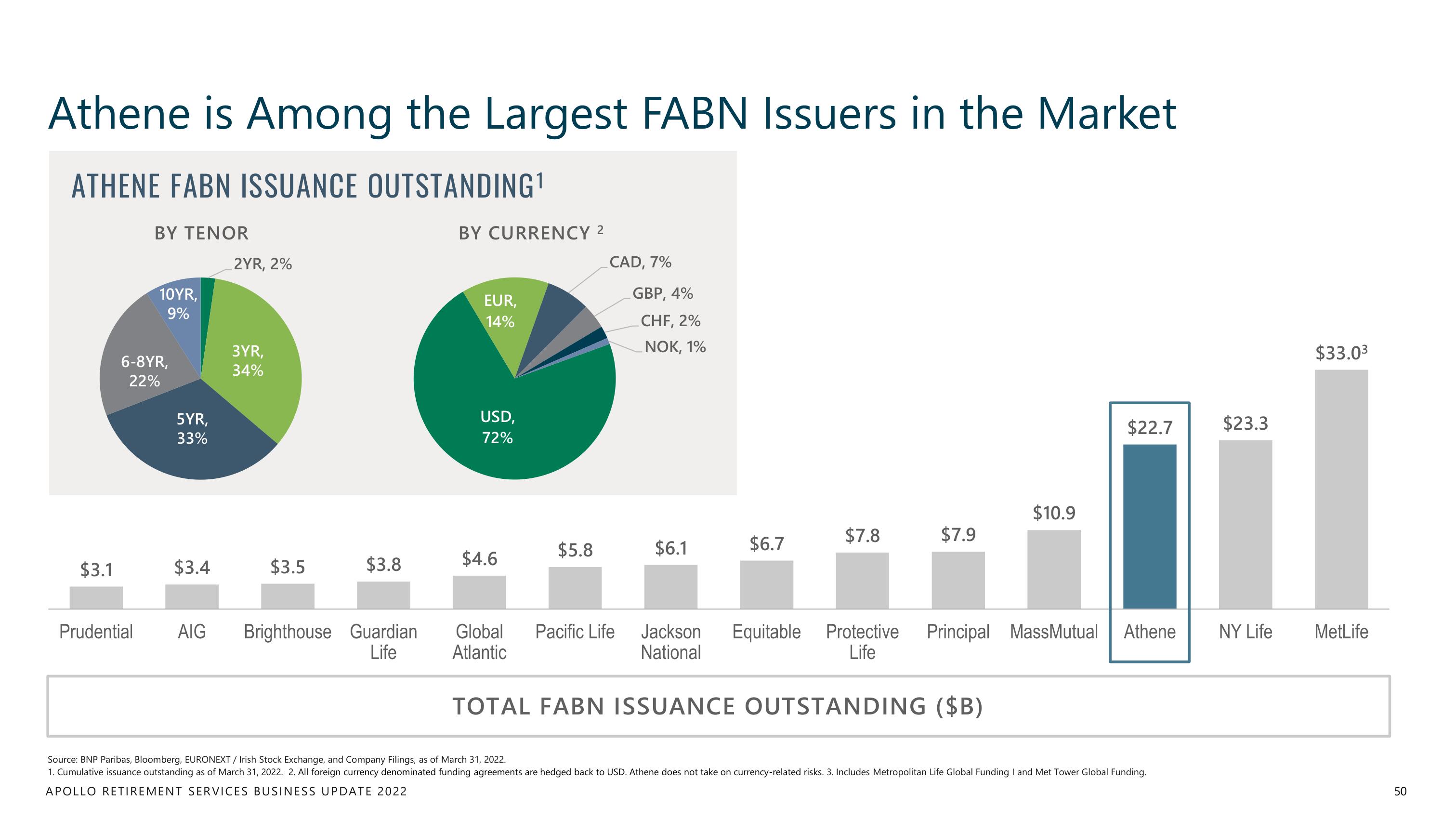

Athene is Among the Largest FABN Issuers in the Market

ATHENE FABN ISSUANCE OUTSTANDING¹

$3.1

BY TENOR

Prudential

10YR,

9%

6-8YR,

22%

5YR,

33%

$3.4

2YR, 2%

3YR,

34%

$3.5

$3.8

AIG Brighthouse Guardian

Life

BY CURRENCY 2

EUR,

14%

USD,

72%

$4.6

$5.8

CAD, 7%

GBP, 4%

CHF, 2%

NOK, 1%

$6.1

$6.7

$7.8

$7.9

$10.9

Global Pacific Life Jackson

Atlantic

National

TOTAL FABN ISSUANCE OUTSTANDING ($B)

Equitable Protective Principal MassMutual

Life

$22.7

Athene

Source: BNP Paribas, Bloomberg, EURONEXT / Irish Stock Exchange, and Company Filings, as of March 31, 2022.

1. Cumulative issuance outstanding as of March 31, 2022. 2. All foreign currency denominated funding agreements are hedged back to USD. Athene does not take on currency-related risks. 3. Includes Metropolitan Life Global Funding I and Met Tower Global Funding.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

$23.3

NY Life

$33.0³

MetLife

50View entire presentation