AT&T Results Presentation Deck

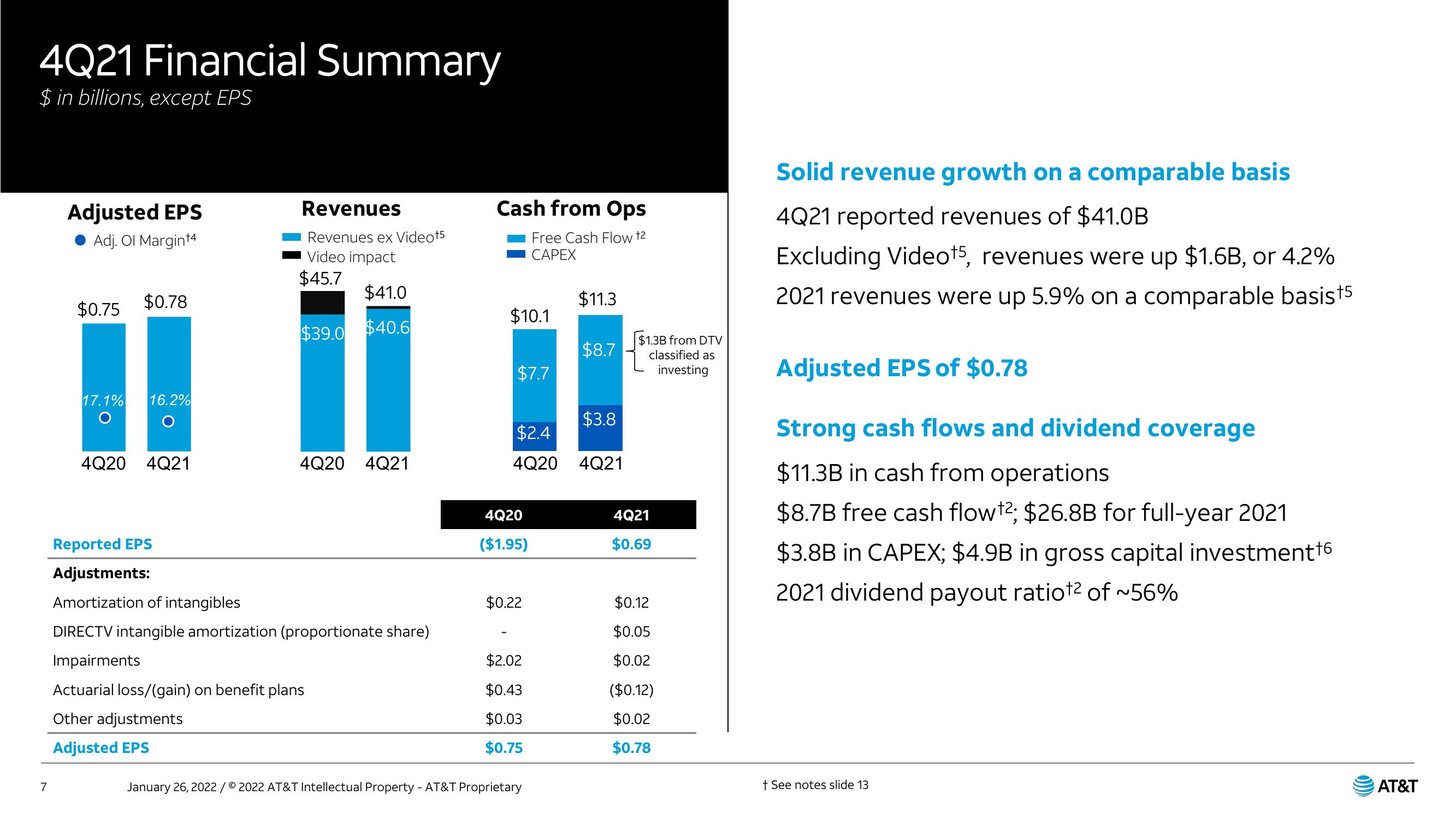

4Q21 Financial Summary

$ in billions, except EPS

7

Adjusted EPS

Adj. Ol Margint4

$0.75

$0.78

17.1% 16.2%

4Q20 4Q21

Revenues

Revenues ex Videot5

Video impact

$45.7

$41.0

$39.0 $40.6

4Q20 4Q21

Reported EPS

Adjustments:

Amortization of intangibles

DIRECTV intangible amortization (proportionate share)

Impairments

Actuarial loss/(gain) on benefit plans

Other adjustments

Adjusted EPS

Cash from Ops

Free Cash Flow ²

CAPEX

$10.1

$7.7

4Q20

($1.95)

$0.22

$2.4

4Q20 4Q21

$2.02

$0.43

$0.03

$0.75

$11.3

January 26, 2022 / © 2022 AT&T Intellectual Property - AT&T Proprietary

$8.7

$3.8

$1.3B from DTV

classified as

investing

4Q21

$0.69

$0.12

$0.05

$0.02

($0.12)

$0.02

$0.78

Solid revenue growth on a comparable basis

4Q21 reported revenues of $41.0B

Excluding Videot5, revenues were up $1.6B, or 4.2%

2021 revenues were up 5.9% on a comparable basis†5

Adjusted EPS of $0.78

Strong cash flows and dividend coverage

$11.3B in cash from operations

$8.7B free cash flow t2; $26.8B for full-year 2021

$3.8B in CAPEX; $4.9B in gross capital investment ¹6

2021 dividend payout ratiot2 of ~56%

+ See notes slide 13

AT&TView entire presentation