Clean Battery Solutions for a Better Planet

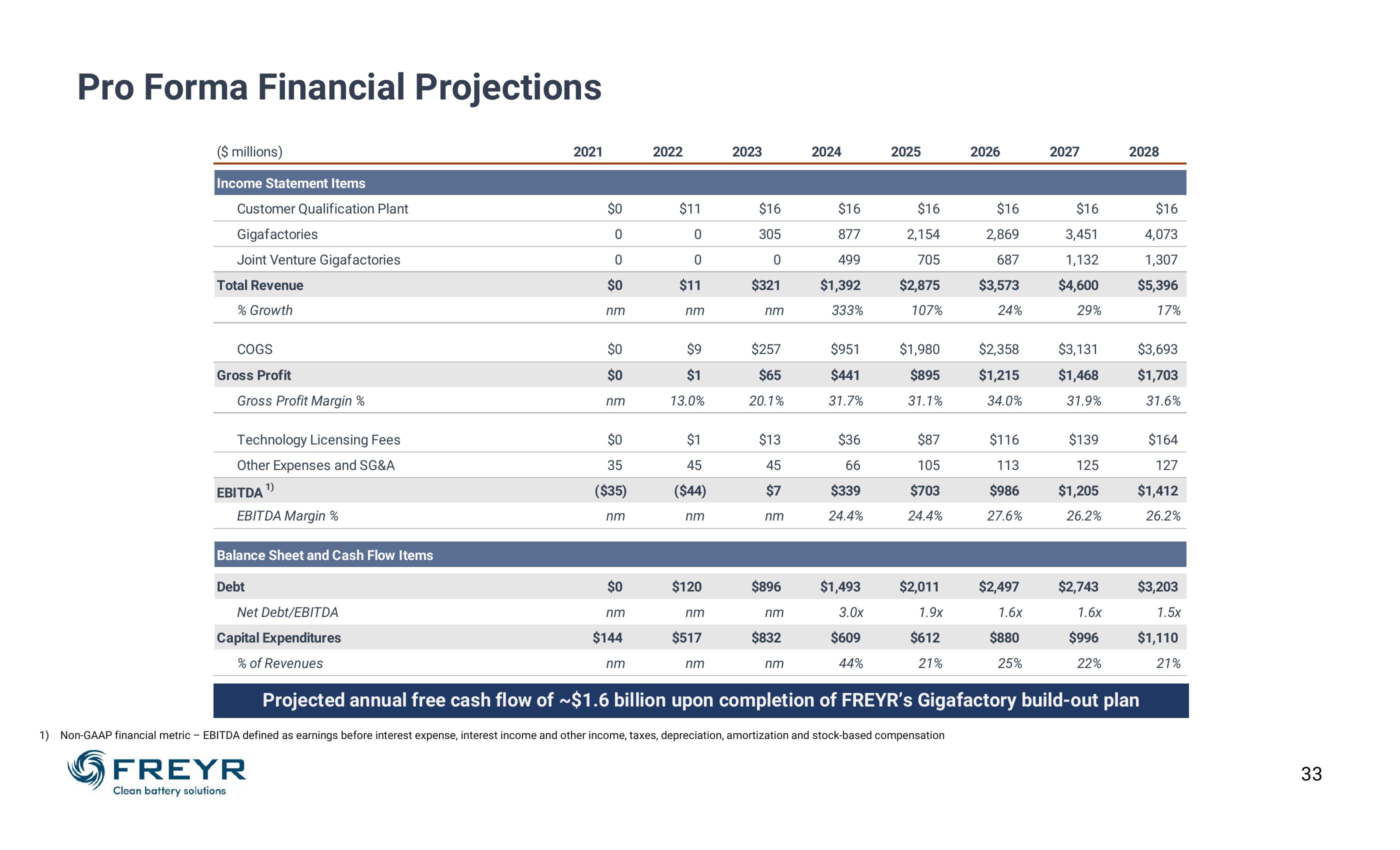

Pro Forma Financial Projections

($ millions)

Income Statement Items

Customer Qualification Plant

Gigafactories

Joint Venture Gigafactories

Total Revenue

% Growth

2021

2022

2023

2024

2025

2026

2027

2028

$0

$11

$16

$16

$16

$16

$16

$16

0

0

305

877

2,154

2,869

3,451

4,073

0

0

0

499

705

687

1,132

1,307

$0

$11

$321

$1,392

$2,875

$3,573

$4,600

$5,396

nm

nm

nm

333%

107%

24%

29%

17%

COGS

$0

$9

$257

$951

$1,980

$2,358

$3,131

$3,693

Gross Profit

$0

$1

$65

$441

$895

$1,215

$1,468

$1,703

Gross Profit Margin %

nm

13.0%

20.1%

31.7%

31.1%

34.0%

31.9%

31.6%

Technology Licensing Fees

$0

$1

$13

$36

$87

$116

$139

$164

Other Expenses and SG&A

35

45

45

66

105

113

125

127

EBITDA ¹)

($35)

($44)

$7

$339

$703

$986

$1,205

$1,412

EBITDA Margin %

nm

nm

nm

24.4%

24.4%

27.6%

26.2%

26.2%

Balance Sheet and Cash Flow Items

Debt

Net Debt/EBITDA

Capital Expenditures

% of Revenues

$0

$120

$896

nm

nm

nm

$1,493

3.0x

$2,011

$2,497

1.9x

1.6x

$2,743

1.6x

$3,203

1.5x

$144

$517

$832

$609

$612

$880

$996

$1,110

nm

nm

nm

44%

21%

25%

22%

21%

Projected annual free cash flow of ~$1.6 billion upon completion of FREYR's Gigafactory build-out plan

1) Non-GAAP financial metric - EBITDA defined as earnings before interest expense, interest income and other income, taxes, depreciation, amortization and stock-based compensation

FREYR

Clean battery solutions

33View entire presentation