Pershing Square Activist Presentation Deck

Appendix

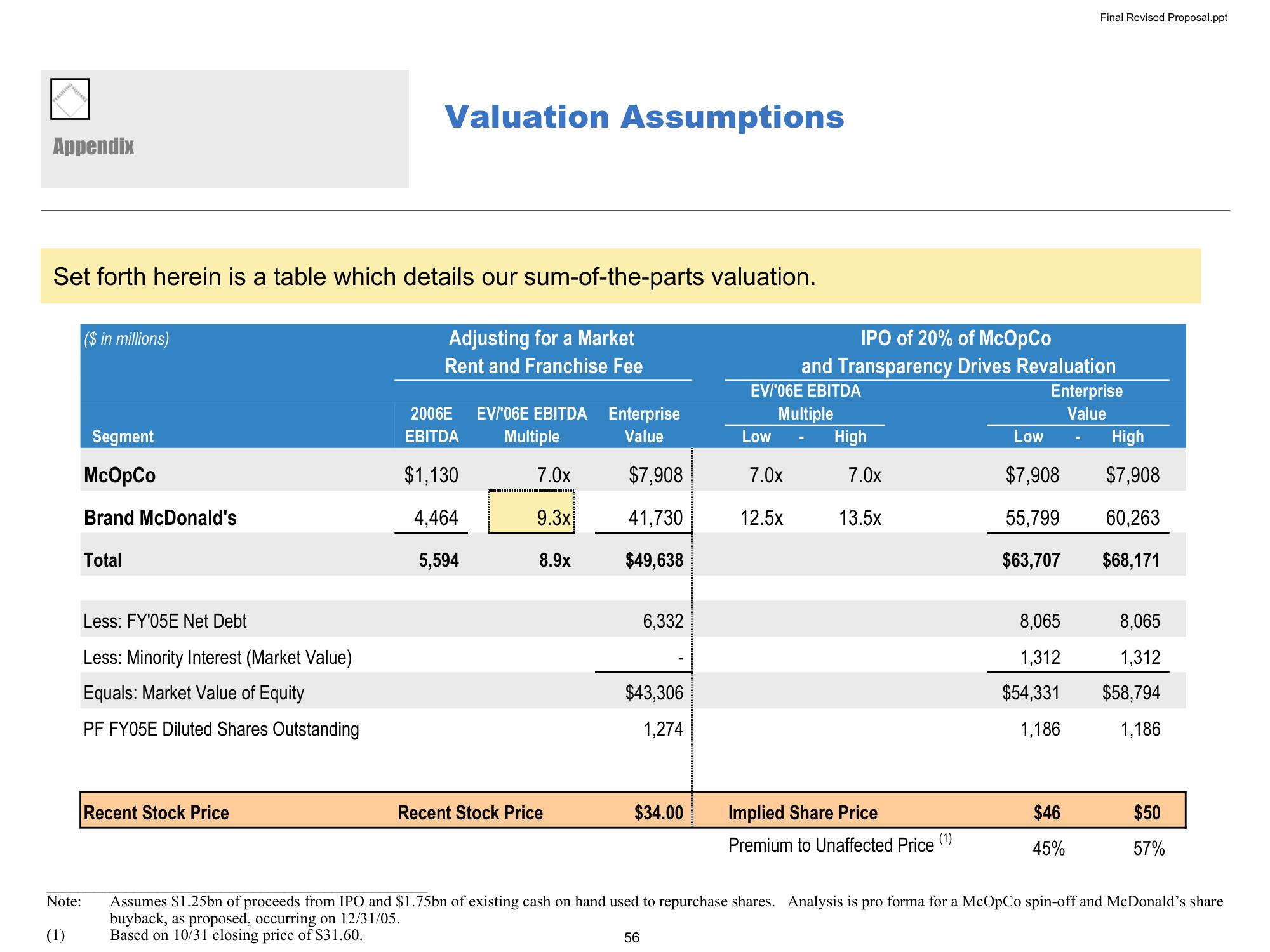

Set forth herein is a table which details our sum-of-the-parts valuation.

Note:

(1)

($ in millions)

Segment

McOpCo

Brand McDonald's

Total

Less: FY'05E Net Debt

Less: Minority Interest (Market Value)

Equals: Market Value of Equity

PF FY05E Diluted Shares Outstanding

Valuation Assumptions

Recent Stock Price

Adjusting for a Market

Rent and Franchise Fee

2006E EV/'06E EBITDA Enterprise

EBITDA

Multiple

Value

$1,130

4,464

5,594

7.0x

9.3x

8.9x

Recent Stock Price

$7,908

41,730

$49,638

6,332

$43,306

1,274

$34.00

56

EV/'06E EBITDA

Multiple

Low

7.0x

12.5x

IPO of 20% of McOpCo

and Transparency Drives Revaluation

High

7.0x

13.5x

Implied Share Price

Premium to Unaffected Price

(1)

Final Revised Proposal.ppt

Enterprise

Value

Low

High

$7,908

$7,908

55,799 60,263

$63,707

$68,171

8,065

1,312

$54,331

1,186

$46

45%

8,065

1,312

$58,794

1,186

$50

57%

Assumes $1.25bn of proceeds from IPO and $1.75bn of existing cash on hand used to repurchase shares. Analysis is pro forma for a McOpCo spin-off and McDonald's share

buyback, as proposed, occurring on 12/31/05.

Based on 10/31 closing price of $31.60.View entire presentation