IGI SPAC Presentation Deck

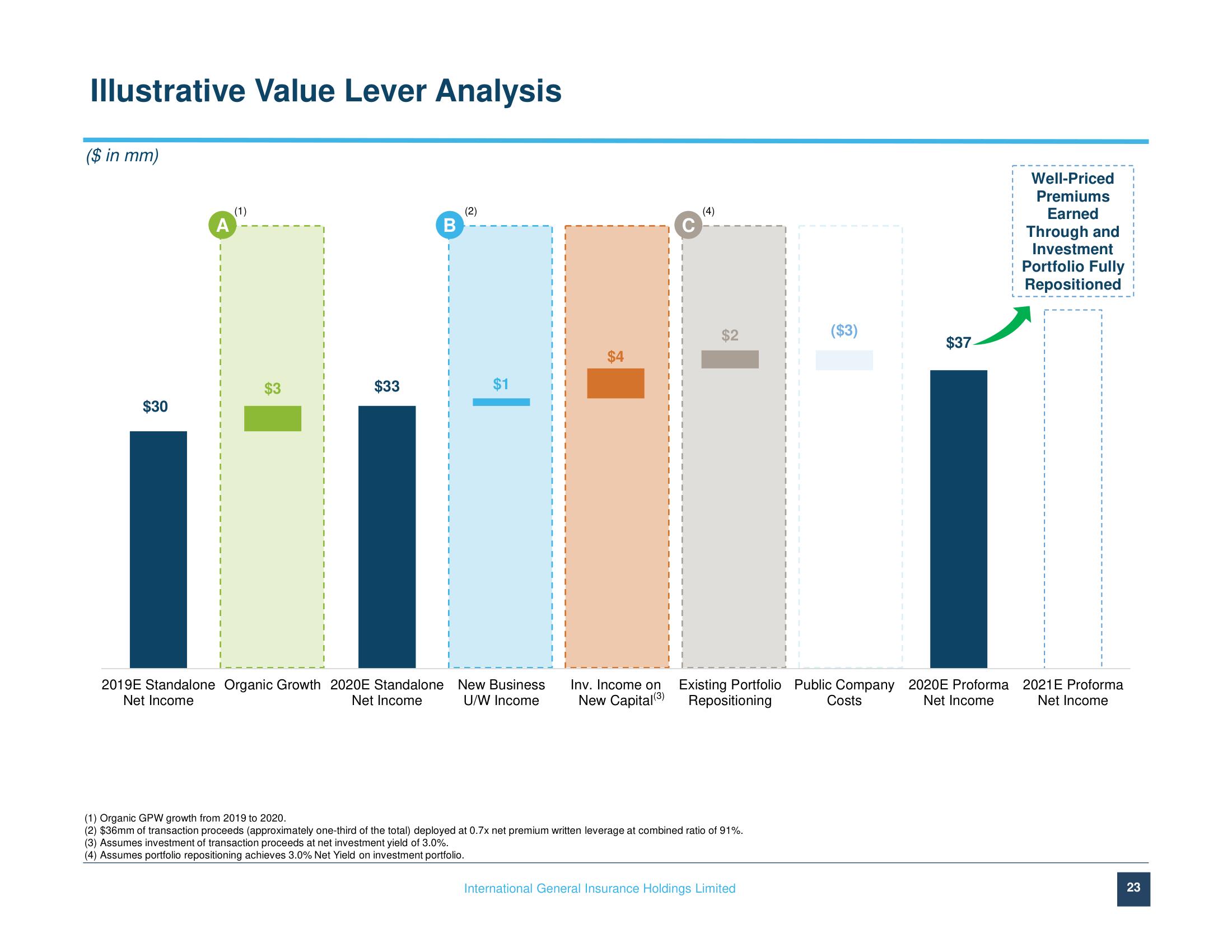

Illustrative Value Lever Analysis

($ in mm)

$30

A

(1)

I

I

I

I

1

I

I

1

I

I

I

I

I

I

I

1

I

I

I

I

I

1

I

I

I

$33

B

I

I

I

T

I

I

(2)

$1

2019E Standalone Organic Growth 2020E Standalone New Business

Net Income

Net Income

U/W Income

Inv. Income on

New Capital (3)

$2

Existing Portfolio Public Company

Repositioning

Costs

(1) Organic GPW growth from 2019 to 2020.

(2) $36mm of transaction proceeds (approximately one-third of the total) deployed at 0.7x net premium written leverage at combined ratio of 91%.

(3) Assumes investment of transaction proceeds at net investment yield of 3.0%.

(4) Assumes portfolio repositioning achieves 3.0% Net Yield on investment portfolio.

($3)

International General Insurance Holdings Limited

1

$37

2020E Proforma

Net Income

Well-Priced

Premiums

Earned

Through and

Investment

Portfolio Fully

Repositioned

2021 E Proforma

Net Income

23View entire presentation