Sonos Results Presentation Deck

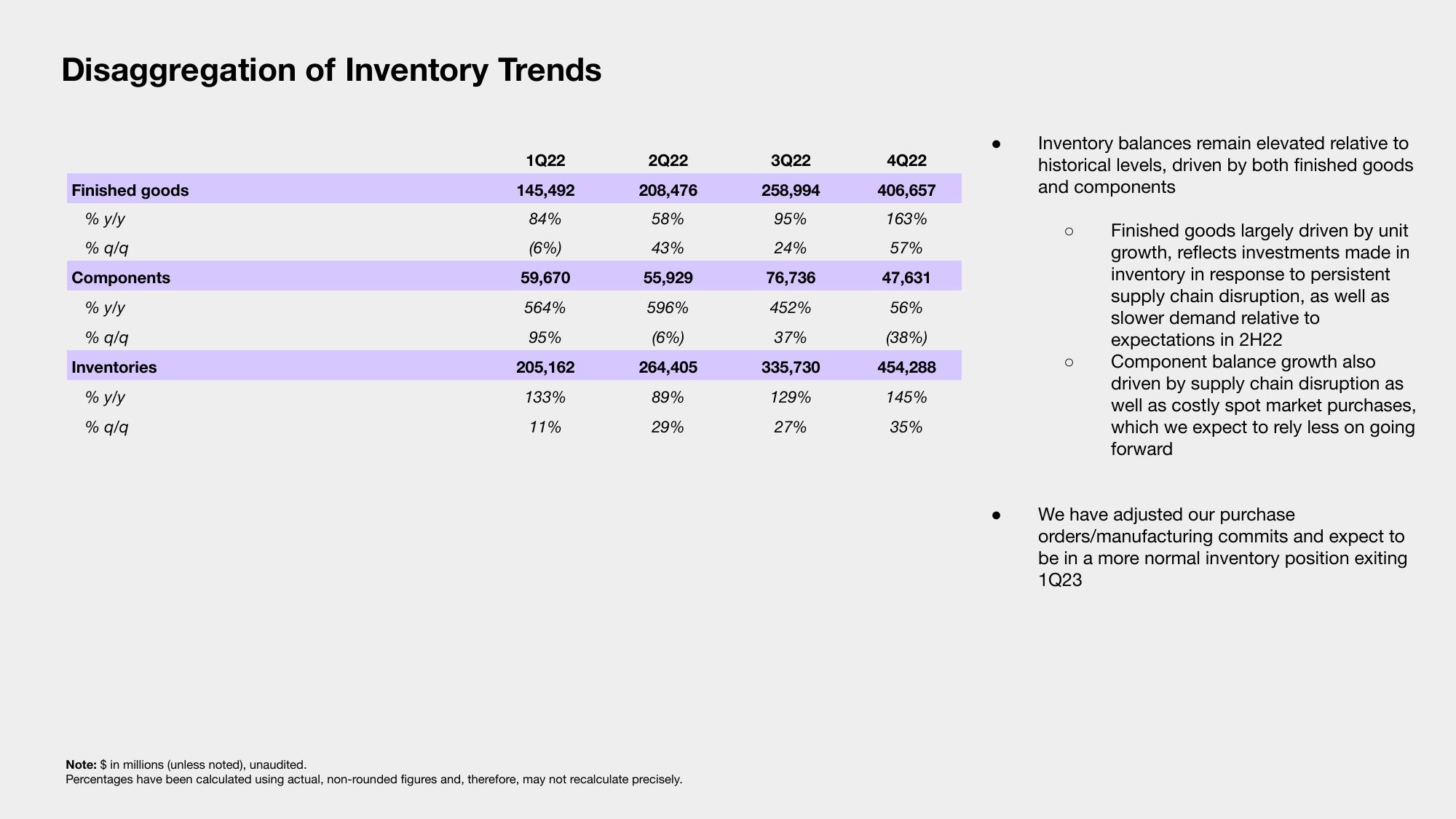

Disaggregation of Inventory Trends

Finished goods

% y/y

% q/q

Components

% y/y

% q/q

Inventories

% y/y

% q/q

1Q22

145,492

84%

(6%)

59,670

564%

95%

205,162

133%

11%

2Q22

208,476

58%

43%

55,929

596%

(6%)

264,405

89%

29%

Note: $ in millions (unless noted), unaudited.

Percentages have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely.

3Q22

258,994

95%

24%

76,736

452%

37%

335,730

129%

27%

4Q22

406,657

163%

57%

47,631

56%

(38%)

454,288

145%

35%

Inventory balances remain elevated relative to

historical levels, driven by both finished goods

and components

Finished goods largely driven by unit

growth, reflects investments made in

inventory in response to persistent

supply chain disruption, as well as

slower demand relative to

expectations in 2H22

Component balance growth also

driven by supply chain disruption as

well as costly spot market purchases,

which we expect to rely less on going

forward

We have adjusted our purchase

orders/manufacturing commits and expect to

be in a more normal inventory position exiting

1Q23View entire presentation