Deutsche Bank Results Presentation Deck

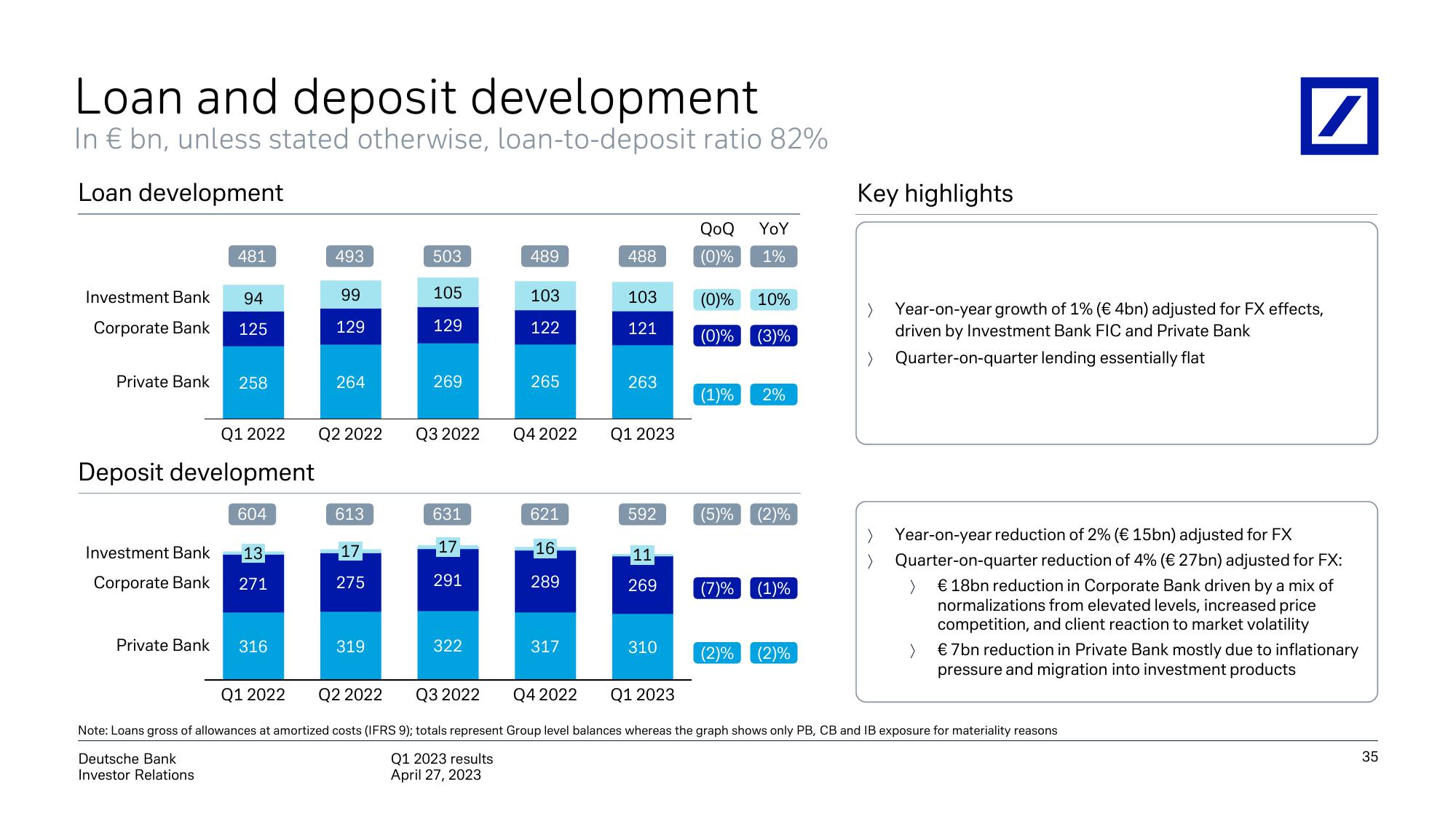

Loan and deposit development

In € bn, unless stated otherwise, loan-to-deposit ratio 82%

Loan development

481

Investment Bank 94

Corporate Bank 125

Private Bank 258

Q1 2022

Deposit development

604

Investment Bank

Corporate Bank

13,

271

Private Bank 316

493

99

129

264

Q2 2022

613

17

275

319

503

105

129

269

Q3 2022

631

17

291

322

489

103

122

265

Q4 2022

621

16

289

317

488

103

121

263

Q1 2023

592

11

269

310

YoY

QoQ

(0)% 1%

(0)%

(0)% (3)

10%

(1)% 2%

(5)% (2)%

(7)% (1)%

(2)% (2)%

Key highlights

/

Year-on-year growth of 1% (€ 4bn) adjusted for FX effects,

driven by Investment Bank FIC and Private Bank

Quarter-on-quarter lending essentially flat

Year-on-year reduction of 2% (€ 15bn) adjusted for FX

Quarter-on-quarter reduction of 4% (€ 27bn) adjusted for FX:

>

€ 18bn reduction in Corporate Bank driven by a mix of

normalizations from elevated levels, increased price

competition, and client reaction to market volatility

>

€ 7bn reduction in Private Bank mostly due to inflationary

pressure and migration into investment products

Q1 2022

Q2 2022

Q3 2022

Q4 2022 Q1 2023

Note: Loans gross of allowances at amortized costs (IFRS 9); totals represent Group level balances whereas the graph shows only PB, CB and IB exposure for materiality reasons

Deutsche Bank

Investor Relations

Q1 2023 results

April 27, 2023

35View entire presentation