ads-tec Energy SPAC Presentation Deck

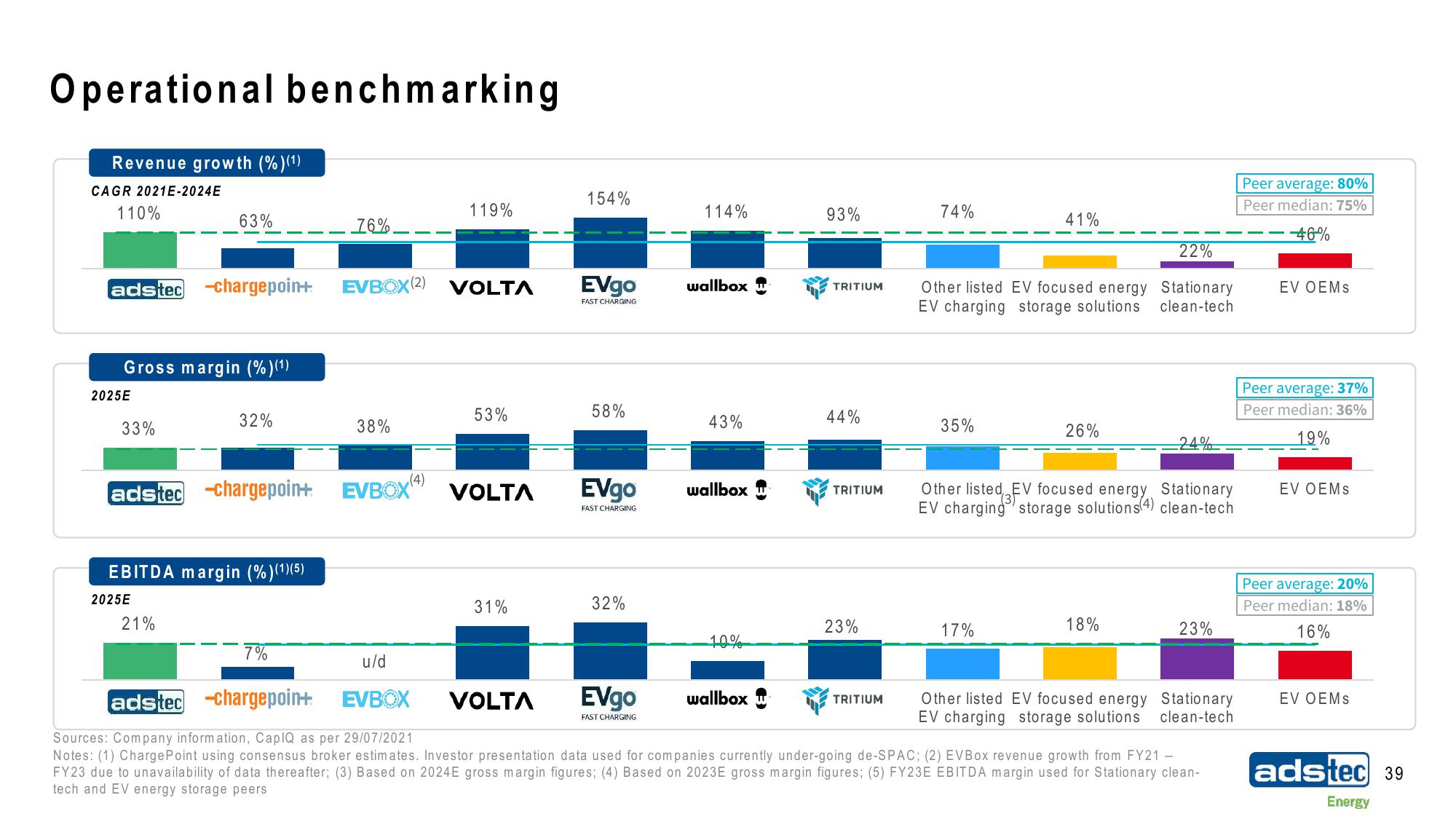

Operational benchmarking

Revenue growth (%)(¹)

CAGR 2021E-2024E

110%

adstec -chargepoin+

Gross margin (%)(1)

2025E

33%

63%

adstec -chargepoin+

2025E

32%

EBITDA margin (%)(1)(5)

21%

7%

76%

EVBOX (2)

38%

EVBOX

(4)

119%

VOLTA

53%

VOLTA

31%

154%

VOLTA

EVgo

FAST CHARGING

58%

EVgo

FAST CHARGING

32%

114%

EVgo

FAST CHARGING

wallbox

43%

wallbox

10%

93%

wallbox

TRITIUM

44%

TRITIUM

23%

74%

TRITIUM

Other listed EV focused energy

EV charging storage solutions

35%

41%

17%

26%

22%

Stationary

clean-tech

Other listed EV focused energy Stationary

EV charging storage solutions(4) clean-tech

18%

u/d

adstec -chargepoin+

EVBOX

Sources: Company information, CapIQ as per 29/07/2021

Notes: (1) ChargePoint using consensus broker estimates. Investor presentation data used for companies currently under-going de-SPAC; (2) EVBox revenue growth from FY21 -

FY23 due to unavailability of data thereafter; (3) Based on 2024E gross margin figures; (4) Based on 2023E gross margin figures; (5) FY23E EBITDA margin used for Stationary clean-

tech and EV energy storage peers

-24%

23%

Other listed EV focused energy Stationary

EV charging storage solutions clean-tech

Peer average: 80%

Peer median: 75%

-46%

EV OEMS

Peer average: 37%

Peer median: 36%

19%

EV OEMs

Peer average: 20%

Peer median: 18%

16%

EV OEMs

adstec 39

EnergyView entire presentation