Evercore Investment Banking Pitch Book

Preliminary Situation Assessment

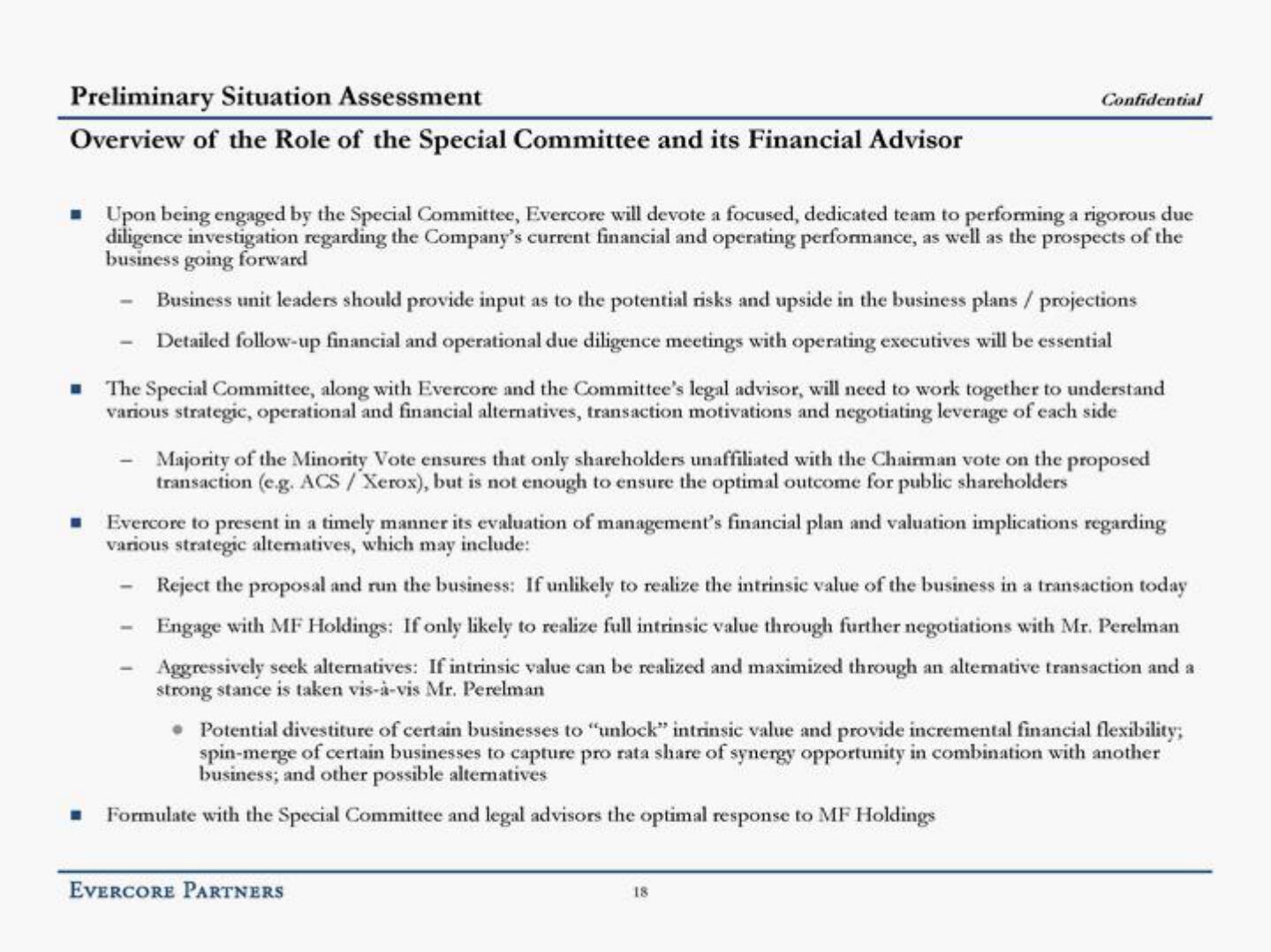

Overview of the Role of the Special Committee and its Financial Advisor

Upon being engaged by the Special Committee, Evercore will devote a focused, dedicated team to performing a rigorous due

diligence investigation regarding the Company's current financial and operating performance, as well as the prospects of the

business going forward

Business unit leaders should provide input as to the potential risks and upside in the business plans / projections

Detailed follow-up financial and operational due diligence meetings with operating executives will be essential

The Special Committee, along with Evercore and the Committee's legal advisor, will need to work together to understand

various strategic, operational and financial alternatives, transaction motivations and negotiating leverage of each side

Confidential

Majority of the Minority Vote ensures that only shareholders unaffiliated with the Chairman vote on the proposed

transaction (e.g. ACS/Xerox), but is not enough to ensure the optimal outcome for public shareholders

Evercore to present in a timely manner its evaluation of management's financial plan and valuation implications regarding

various strategic alternatives, which may include:

Reject the proposal and run the business: If unlikely to realize the intrinsic value of the business in a transaction today

Engage with MF Holdings: If only likely to realize full intrinsic value through further negotiations with Mr. Perelman

Aggressively seek alternatives: If intrinsic value can be realized and maximized through an alternative transaction and a

strong stance is taken vis-à-vis Mr. Perelman

Potential divestiture of certain businesses to "unlock" intrinsic value and provide incremental financial flexibility;

spin-merge of certain businesses to capture pro rata share of synergy opportunity in combination with another

business; and other possible alternatives

■ Formulate with the Special Committee and legal advisors the optimal response to MF Holdings

EVERCORE PARTNERS

18View entire presentation