Evotec Results Presentation Deck

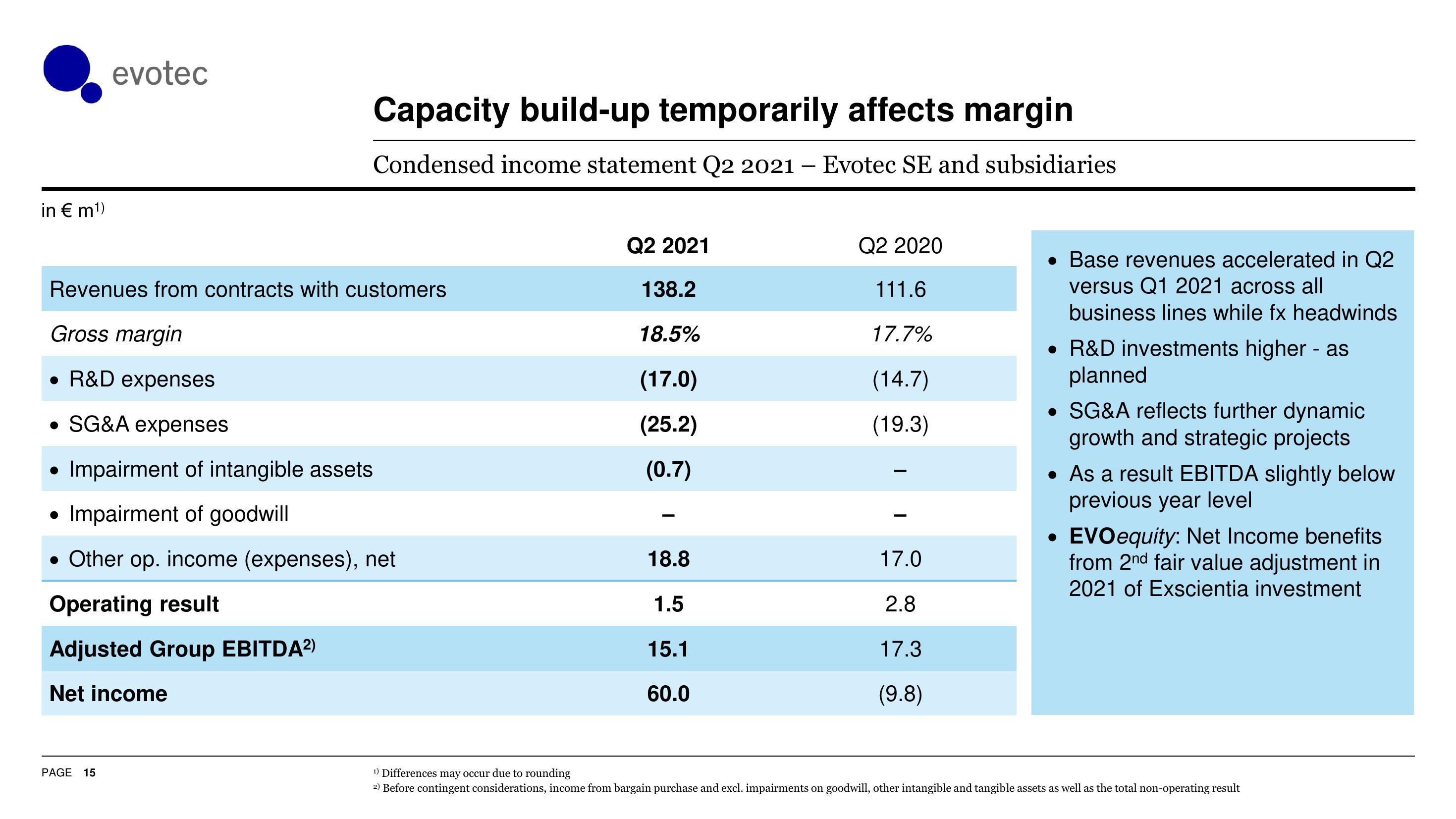

in € m¹)

evotec

Revenues from contracts with customers

Gross margin

●

R&D expenses

• SG&A expenses

Impairment of intangible assets

Impairment of goodwill

• Other op. income (expenses), net

Operating result

Adjusted Group EBITDA²)

Capacity build-up temporarily affects margin

Condensed income statement Q2 2021 - Evotec SE and subsidiaries

Net income

PAGE 15

Q2 2021

138.2

18.5%

(17.0)

(25.2)

(0.7)

18.8

1.5

15.1

60.0

Q2 2020

111.6

17.7%

(14.7)

(19.3)

17.0

2.8

17.3

(9.8)

• Base revenues accelerated in Q2

versus Q1 2021 across all

business lines while fx headwinds

• R&D investments higher - as

planned

• SG&A reflects further dynamic

growth and strategic projects

• As a result EBITDA slightly below

previous year level

EVO equity: Net Income benefits

from 2nd fair value adjustment in

2021 of Exscientia investment

¹) Differences may occur due to rounding

2) Before contingent considerations, income from bargain purchase and excl. impairments on goodwill, other intangible and tangible assets as well as the total non-operating resultView entire presentation